Firebird Deploying on Avalanche

Firebird Finance is a one-stop DeFi platform that aims to revolutionize decentralized finance services by meeting all your DeFi needs in a single platform. Their purpose in DeFi is to provide thier users with a suite of high-performing products that are designed to bring innovation, security and high yields under a single project.

At Firebird Finance, they build user-centered products around several cores values:

- To become the ‘Ultimate DeFi Superstore’, offering the best of everything related to DeFi.

- Increase user accessibility to yield farming and decentralized markets.

- To build on-chain voting solutions for governance, giving power to their stakeholders.

- Reward stakeholders with flexible, optimized and profitable pool strategies.

- Provide our users with the safest and most profitable approach to DeFi.

Firebird’s mission for expanding onto Avalanche

What makes them different? Why use Firebird? Why another DEX?

Launching a DEX aggregator is just first step in deploying their complete ecosystem on Avalanche, and as time progresses they will add additional products and features, next gen Vaults capable of using multiple strategies to bring users even higher yield, Farms-as-a-Service, easy to create incentivised liquidity mining pools that allow other businesses maximum customization options starting from pool weight to vested and multiple rewards.

Firebird SwapV2 on Avalanche

A leading reason to expand to new chains is to find platforms like Polygon, Avalanche and others that allow them to push their Swap technology to the limits. The cheaper and more efficient the underlying smart-contract platform is, means they can also push their SwapV2 platform to the limits to get you the most optimised token swapping experience in existence.

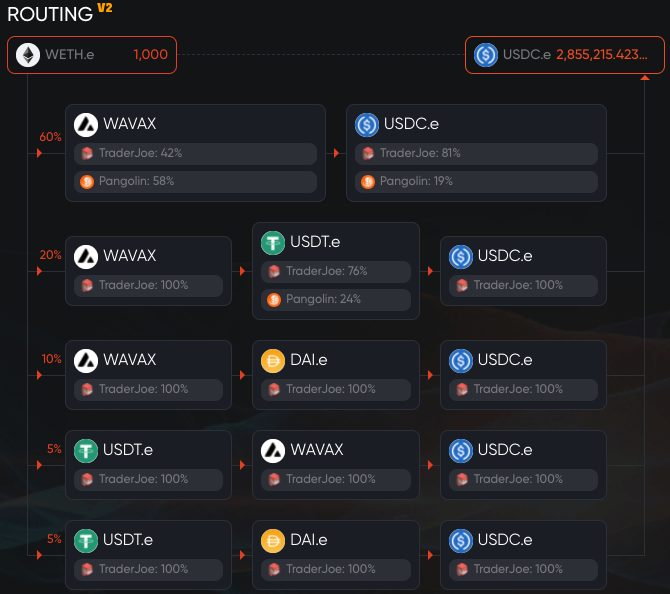

SwapV2 is the next generation of AMMs for future DeFi exchanges. SwapV2 is an AMM with integrated aggregator function, allowing users to swap any token with the best possible rate across all competitor DEXs. SwapV2 supports flexible swap fees and flexible ratio for liquidity pairs. They have focused their resources on refining their aggregating algorithm to have better slippage for users over the last few months.

They have also built their user-interface to clearly display where your funds are being routed to in real-time. While ensuring you’re getting the best value, you also control where it goes.

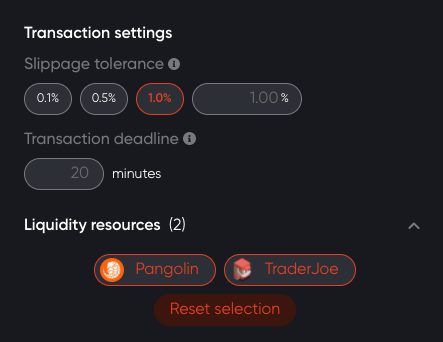

For user-experience, they have created simple buttons that give users full control over how the transaction is conducted. With a few clicks, you can customize your slippage tolerance (maximum price variation after accepting the transaction) and transaction deadline. An additional highly innovative feature is their ‘Liquidity resources’ option. This allows users the ability to customize the liquidity sources for the exchange. By default all 12 options are available (for maximum return), by clicking on a choice it will be toggled off, giving users total control of where your funds are routed through.

Future Plans

Become a true cross-chain aggregator with best possible price and fastest execution time for the next generation of DeFi.

About Firebird Finance

An innovative one-stop defi, multi-chain yield farming and decentralized exchange aggregator.

SOURCE

https://firebirdfinance.medium.com/firebird-lands-on-avalanche-5b4fb07d0e3d