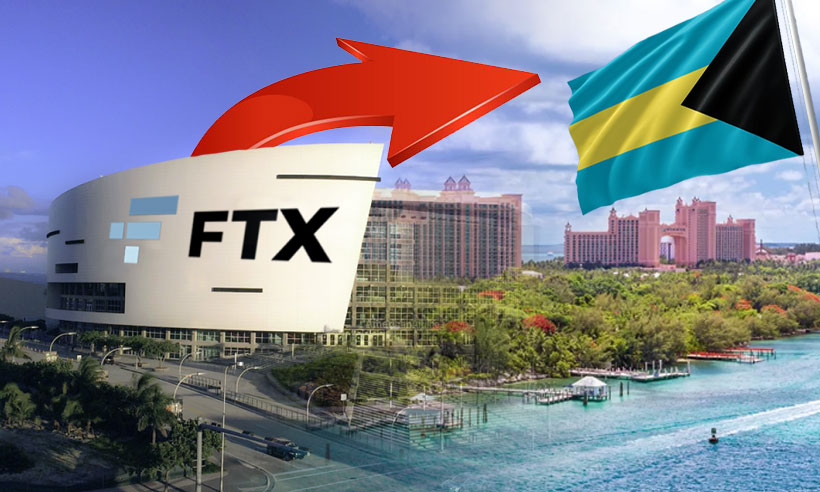

FTX Crypto Exchange HQ Moves to Bahamas

The crypto-derivatives exchange FTX officially moved its headquarters from its previous Hong Kong location to the Bahamas.

The change of headquarters location follows an announcement on Monday of the company’s Bahamian subsidiary. Earlier this week FTX Trading Ltd. filed a registration with the Securities Commission of the Bahamas as a digital assets firm. Along with the registration news, the company named Ryan Salame the CEO of FTX Digital Markets. Salame formerly served as the head of over-the-counter at Alameda Research.

As global lawmakers mull over regulations for the crypto industry, FTX chose the Bahamas because of its already implemented stance. According to comments from FTX founder Sam Bankman-Fried, the regulatory bodies of the Bahamas have a proactive stance on cryptocurrencies. This is a major reason for the switch.

Over the course of this year, FTX US continues its upward trajectory in terms of volume. According to a Tweet on September 23rd, the company is almost at 5% growth.

Regulatory Impact

Moreover, the move comes as the Chinese government issues yet another ban on digital currencies. Already this year China cracked down crypto miners across the country, which caused an exodus of crypto-related actors.

In addition countries such as Australia, Japan, and South Africa are also considering additional or more strict crypto directives. Nonetheless, FTX intends for a close relationship with regulators. Natalie Tien, an FTX spokesperson reiterated this stance in an email on Friday.

“We are committed to maintaining a close working relationship with local regulators to help promote the growth of crypto and we are further committing to providing all our clients with a safe, trustworthy and compliant exchange,” Tien said. “As jurisdictions roll out comprehensive crypto regulatory regimes, we are excited to take part. In addition to this, we are prioritizing offices in jurisdictions without travel restrictions.”

However, the exchange also has a headquarters in San Francisco, California. The regulators in the U.S are currently in the throes of new crypto industry provisions. While SEC Chairman Gary Gensler says the industry can’t survive without regulations, others within the industry reiterate financial industry equality. Exchanges and crypto-related businesses like FTX will be at the mercy of said regulators as rules fall into place.