Introducing xDollar V2 = mc²

Introducing xDollar V2, the next-generation multi-collateral chain agnostic stablecoin.

xDollar has been up and running on Polygon since early June with the goal of establishing itself as a contender in the race for a truly mobile and decentralized multi-chain stablecoin. The protocol has seen steady growth across all metrics since its inception. We also recently launched Avalanche and Arbiturm which makes xDollar a multi-chains and “multi-collaterals” system. — Captain X

Shortly, they will hit another huge milestone with the launch of xDollar V2.

This is the launch that takes them to outer space for real! The second iteration of xDollar was developed with the goal of facilitating minting and borrowing of xUSD at 0% interest-rate across multiple chains and with different types of collateral. This will bring us closer to our core vision of being a truly cross-chain, multi-collateral, and multi-chain (mc²) stablecoin. They want to make it possible for anyone, regardless of portfolio size, to borrow and transfer xUSD quickly, easily, and efficiently.

Multi-chain Multi-collateral (mc²)

To further diversify, they are innovating on top of xDollar V1 to launch a long-awaited feature — a mc² system to accept more than one crypto asset as collateral for minting xUSD.

Here are few highlights of xDollar V2

- Offer 0% interest loans

- Provide more alternatives for the user

- Leverage your current crypto portfolio

- Select a carefully curated list of strong collateral

- Create a closer peg to $1 by introducing stablecoin collateral

- Mint same xUSD for all collateral types

- Stake XDO to earn xUSD (borrowing fee) and multi-collateral(redeem fee) on each chain

Non-stable collateral

Why adding new collateral in addition to MATIC or AVAX or ETH? In short, a multi-collateral system stabilizes the xDollar platform, as it adds robustness to the protocol collateral during market downturns. A multi-collateral system also attracts users holding different crypto assets for the long term. This medium article specifies why we need multi-collaterals in detail.

Stable collateral

One issue with the Liquity-stablecoin model has been its inefficiency to create a tight enough spread around $1 via solely the arbitrage mechanism. A stablecoin using this model tends to trade at a premium to $1.

In order to strengthen the xUSD peg and further expand on collateral options for our end-users, xDollar V2 will introduce the option to collateralize your stablecoin like USDC and DAI for xUSD. For a small X% fee you’ll be able to mint or sell xUSD using other stablecoins (DAI, USDC, etc). In the near future, the inclusion of new stablecoin collateral types can be decided by the XDO holders via DAO governance.

This will create a tighter and more stable spread, minimizing the volatility and peg xUSD closer to $1. This is crucial during times of market volatility when the price of other collateral such as Matic or ETH fluctuates heavily, in particular, reduces the risk of users from repaying xUSD to save risky troves. It will also make it easier to onboard more users who have stablecoins in their portfolio but don’t want exposure to other volatile assets.

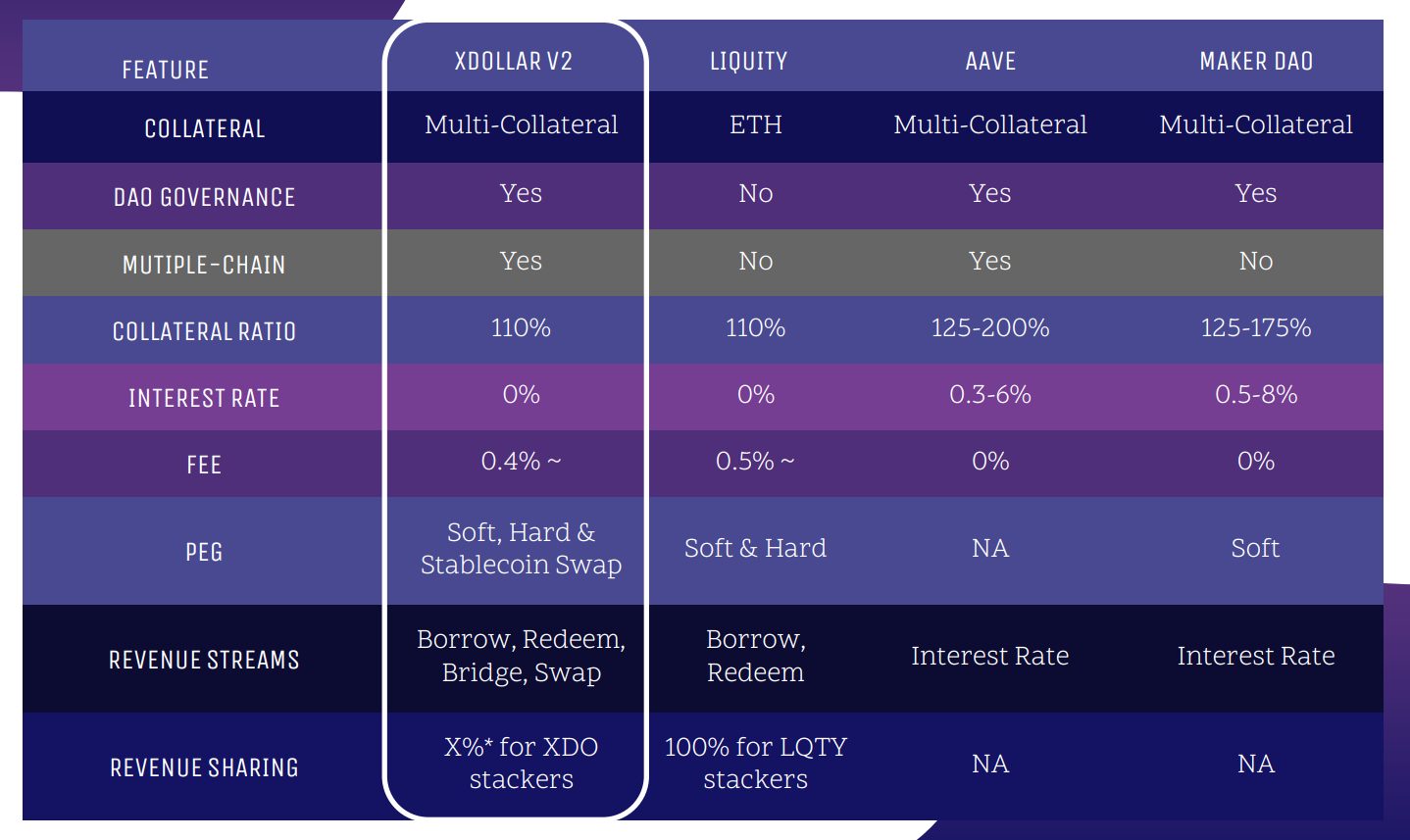

xDollar V2 versus competitors:

Summary

Right now, all smart contracts of xDollar V2 are undergoing a thorough audit review by CertiK, a truly trusted audit service in the space. The xDollar V2 frontend is expected to launch in Early Q4 2021 following by the release of our first whitepaper detailing xDollar V2.

What’s next on their space mission?

Even with their recent multi-chain expansion and the upcoming V2 launch, they haven’t done yet on their space mission. The next space missions which are under the pipeline are multi-chain ecosystem development, DAO governance, and a new P2P product launch with SX Network.

“We are clear about xDollar’s vision to become the next-generation multi-collateral chain agnostic stablecoin. Ultimately, we are on a space mission to make DeFI accessible to 1 billion users by 2030.” — Captain X.

About xDollar

xDollar is an interest-free lending platform that users can borrow non-custodial stablecoin, xUSD against MATIC collateral on Polygon, AVAX collateral on Avalanche, and ETH collateral on Arbitrum with a minimum collateral ratio of only 110%. The platform implements a systematic liquidation mechanism (xUSD pool) and fair platform revenue fee distribution (XDO pool). xDollar’s vision is to become the next-generation multi-collateral chain agnostic stablecoin.

xDollar has been up and running on Polygon and Avalanche since early June with the goal of establishing itself as a contender in the race for a truly mobile and decentralized multi-chain stablecoin.

SOURCE:

https://xdollarfi.medium.com/houston-we-have-a-liftoff-introducing-xdollar-v2-mc%C2%B2-60a920452b78