Banker Joe Lending Strategies on Snowball

Snowball now supports compounding and folding strategies for Banker Joe’s new lending services.

The following tokens can be deposited into Snowball for Banker Joe to maximize your returns: ETH.e, wBTC.e, LINK.e, USDC.e DAI.e, and USDT.e.

Deposit your tokens into Snowball here.

Snowball’s Strategy

Snowball’s strategies for Banker Joe go beyond compounding. They have developed new strategies that work with lending called folding strategies.

Here’s how they work:

Deposit your tokens on Snowball.

Snowball automatically lends them out on Banker Joe for you.

Snowball then uses the tokens it supplies as collateral to borrow more of the same tokens.

The new borrowed tokens are lent out again to maximize the deposited amount. This process is repeated up to a level that is deemed “safe.”

The rewards received from Banker Joe (JOE and soon AVAX) are sold for more of the underlying tokens deposited. This causes your initial deposit to grow.

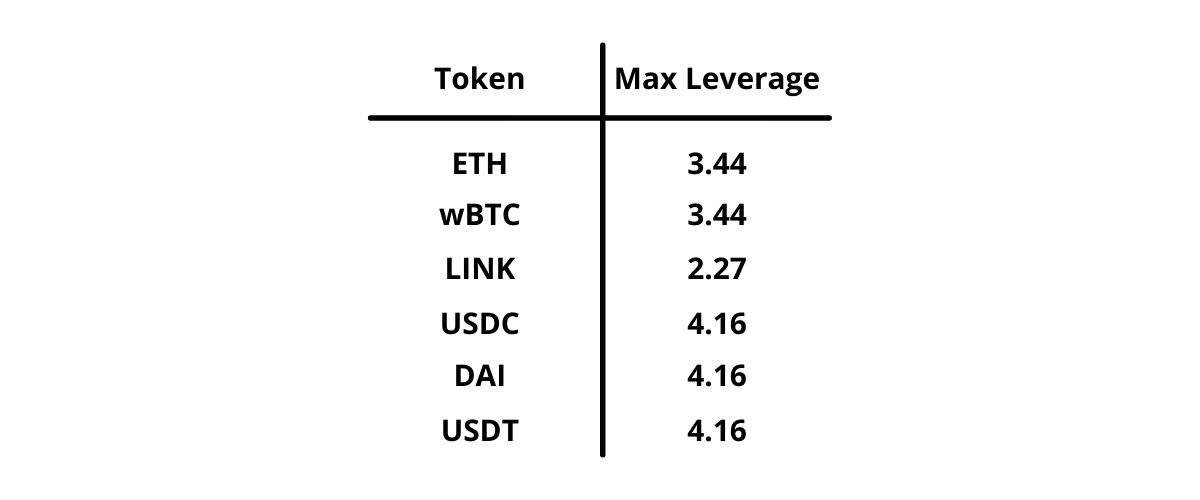

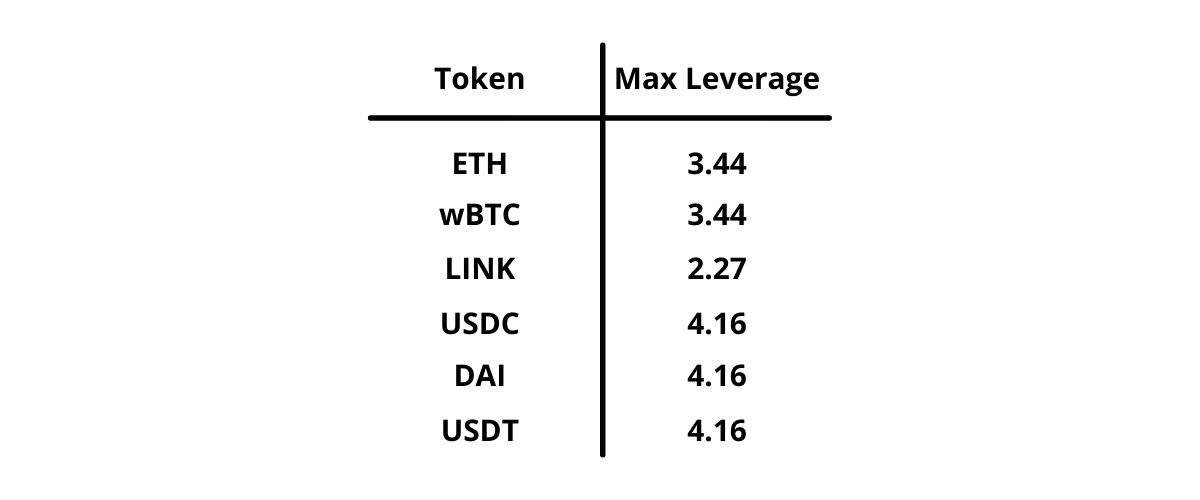

Based on Banker Joe’s collateral factors, they created strategies that borrow up to a maximum level. This level is different for each token and can be seen below

What is Banker Joe?

Banker Joe is a new lending protocol built on Trader Joe. It works similar to protocols like Aave and Benqi, which have also launched on Avalanche.

Banker Joe allows depositors to lend out assets to borrowers and provides incentives for people deposited. These incentives are compounded in Snowball’s strategies and currently include JOE rewards. In the future, Banker Joe will also reward depositors with AVAX rewards from Avalanche Rush.

About Snowball

Snowball is an auto-compounder for liquidity rewards and an automated market maker (AMM) for stable assets. It was the first auto-compounder launched on Avalanche and it prides itself on being entirely community run. If you’d like to be a part of Snowball, join the conversation in Discord or Telegram. Stay up to date on our Twitter.

SOURCE

https://medium.com/snowball-finance/banker-joe-lending-strategies-on-snowball-b4b577dab568