Yield Yak x OrcaDAO Partnership, Introducing ibTokens

Yield Yak and OrcaDAO have joined to form an innovative partnership to further unlock the most out of DeFi users’ assets, via use of Interest Bearing Tokens (ibTokens) as collateral.

For the first time ever, Yakheads will be able to utilize their deposited assets on Yield Yak as collateral on OrcaDAO. Deposit your YRT (Yak Receipt Token) on avai.finance Vaults and borrow the AVAI stablecoin for a 0% loan. The best thing is, your deposited assets on YY will continue to auto-compound in the background.

This new integration opens up a plethora of options for current Yield Yak users, and unlocks millions of dollars of assets’ lending potential for holding YRT. Once you take out a leveraged position (i.e. loan against your Yield Yak farming tokens), you are able to mint AVAI, OrcaDAO’s Avalanche-native stablecoin. The AVAI stablecoin is pegged to the USD (1 AVAI = 1 USD). This can be used throughout the Avalanche ecosystem for various needs.

An end user can only borrow up to a certain amount, however, based on the USD value of their collateral. A minimum collateral percentage is implemented, with a default value of 150% for AVAX, 125% for wETH, and 100% for USDC, meaning a user must have at least 100% collateral backing their loan. As an example, a user can borrow 100 AVAI, worth $100 USD, if they have $150 USD worth of collateral deposited.

This integration introduces a new yield optimizing strategies for Yield Yak users that are unavailable anywhere else on Avalanche.

“This integration is a huge step forward for Yield Yak: it allows users with unmatched yield earning opportunities in the Avalanche defi ecosystem. We’re thrilled to work with OrcaDAO and be Avalanche’s first platform to leverage auto-compounding yield bearing tokens as collateral.”

— Dylan Coady from Yield Yak

How does this work?

How to Deposit

As a first time user, you will need to begin by setting up a vault. There is a minor Avalanche network transaction fee involved in setting up a vault. This is a one time setup cost. Here are the steps:

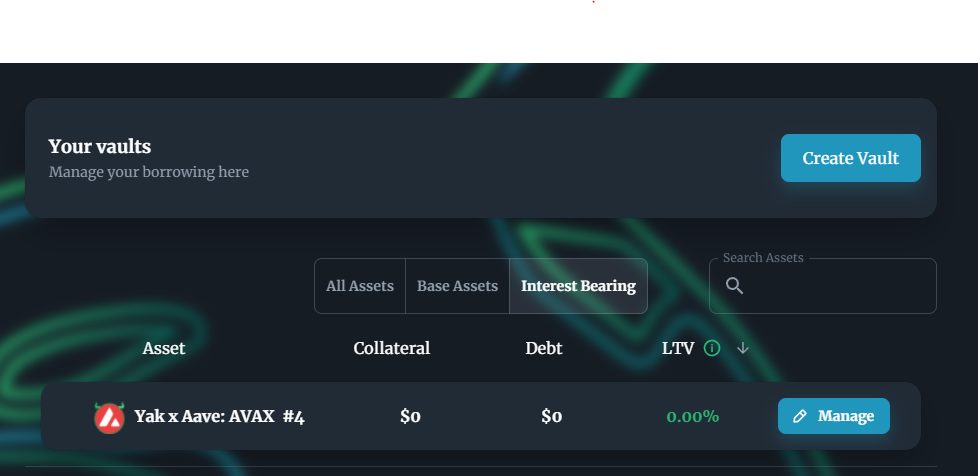

- To create the Vault, navigate to Your Vaults, and click the Blue Create Vault button (top right corner). Click ‘create vault’ next to the asset you want to deposit.

- Once your vault is created, Click Manage to access the actions that can be taken within.

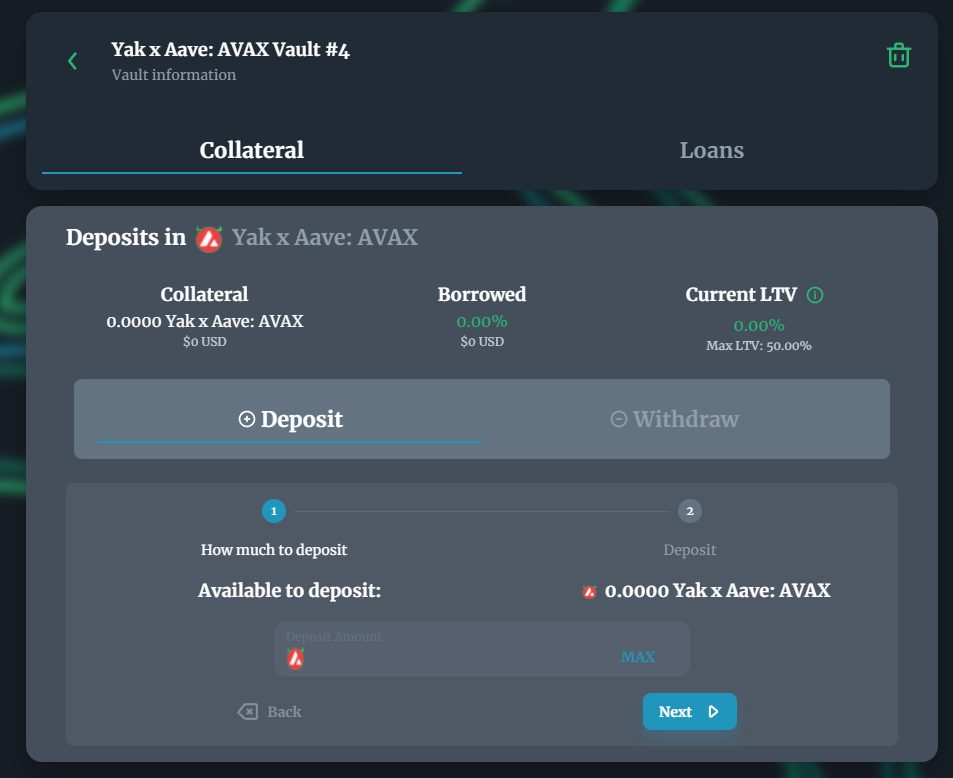

3. To Deposit into the Vault, Ensure the Deposit tab is selected, and scroll to the bottom, where you can enter your collateral amount to be entered into the Vault.

4. Select amount and hit deposit.

How to Borrow

Once the deposit process above is complete, the Borrow function is straightforward:

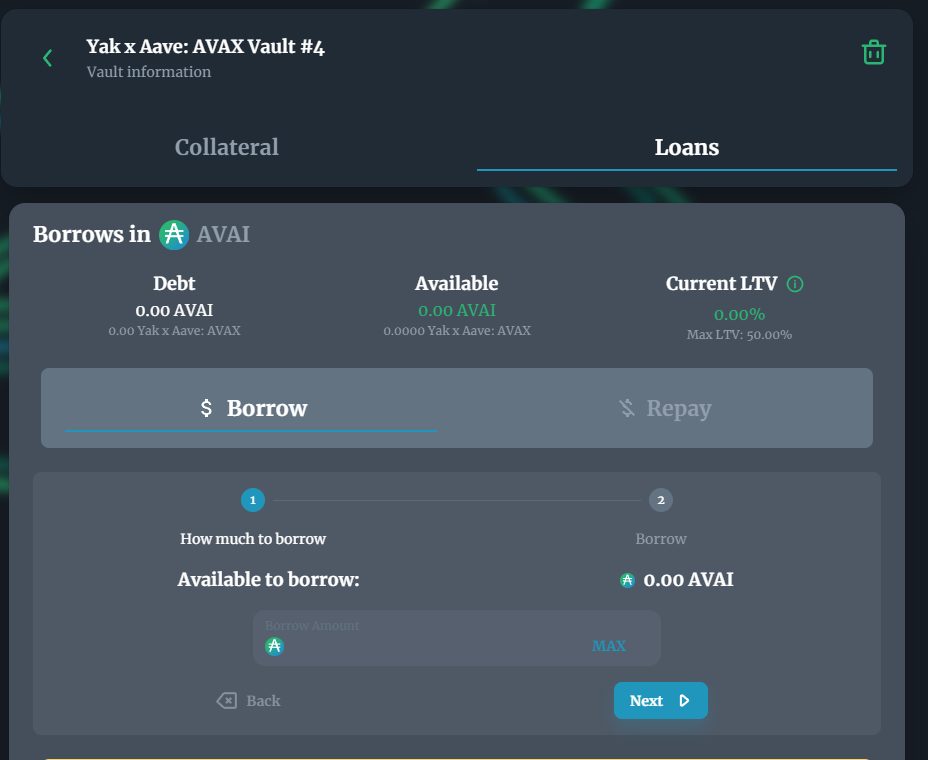

- First, select Loans at the top of page, the page will default to the Borrow tab. Enter the amount of AVAI you would like to borrow and select Next.

- The next page will calculate the LTV that this will put on the vault, as well as confirming the amount to be added as debt.

3. The wallet will ask you to confirm once more (similar wallet screenshot to above). Once that has been confirmed, you will be met with confirmation in the bottom right of the screen.

4. Finally, you will see your wallet balance update for AVAI at the top of the page. The transaction has been completed, and you can now use this AVAI liquidity as desired.

Once you have borrowed AVAI, how should you manage your new liquidity?

For anyone new to lending and borrowing, our previous article on the subject is a good summary of how lending works, to manage your newly unlocked leverage from YY, and manage your own risk tolerances.

It is well worth the few minutes to read and review, while you plan your next steps.

What’s the plan for rollout?

To start, they have integrated Yield Yak’s AAVE AVAX auto compounding strategy with a 10 million AVAI debt ceiling. They will be adding more very soon and will adjust the debt ceiling if it is reached.

Following this offering, they will quickly be adding additional banks for AAVE, as well as QI & JOE banks, and a bit further on Liquidity Pool’s (LP’s) will be integrated in as well.

Altogether this will unlock a majority of Yield Yak’s TVL to be available to be borrowed against, an exciting time for both Yakheads and Orca Whales. Stay tuned as development progresses and new YY tokens are added in!

About Yield Yak

Yield Yak is an easy-to-use tool to earn more yield from defi farming on the Avalanche network.

Web | Twitter | Docs | Telegram | Discord

About OrcaDAO

OrcaDAO is an Avalanche native protocol designed to offer and optimize a Stablecoin (AVAI), and Ownership/Governance token (ORCA) pair that allow for lending using crypto collateral at 0% interest. The protocol centers around the production, maintenance, and sustained equilibrium of AVAI around a stable value, used by the DeFi community for a multitude of use cases — such as loaning/borrowing and yield farming — with a high level of confidence.

Twitter | Discord | Website | Telegram

SOURCE

https://medium.com/@OrcaDAO/yield-yak-orcadao-partnership-introducing-ibtokens-b09540d50360