How to maximize yield on your xJOE using MOR

What is MOR?

MOR is a decentralized and overcollateralized stablecoin running on Avalanche and BSC (with more to come). It allows users to deposit collaterals that earn yield (like xJOE) and borrow MOR at very favourable rates; in the case of xJOE it is a self-repaying collateral, meaning the user gets paid 8% per year on their debt to borrow MOR.

MOR is always overcollateralized, this means that for every MOR in circulation there is at least $1 worth of assets backing it. This model is inherited from DAI (MOR is a fork of DAI that implements the use of yielding collaterals).

Strategy 1: Maximum yield with no leverage

TLDR:

- Deposit xJOE

- Borrow MOR

- Stake MOR to farm WHEAT

- Unstake some MOR and repay part of your debt if the price of JOE goes down to avoid liquidation

- Borrow more MOR and stake it on WHEAT if the price of JOE goes up to maximize yield

Detailed breakdown:

1-Depositing xJOE and borrowing MOR

In order to do this you’ll need to go to xJOE’s borrow page on MOR.

Once you are there you can input how much xJOE you want to deposit and how much MOR you want to borrow alongside it.

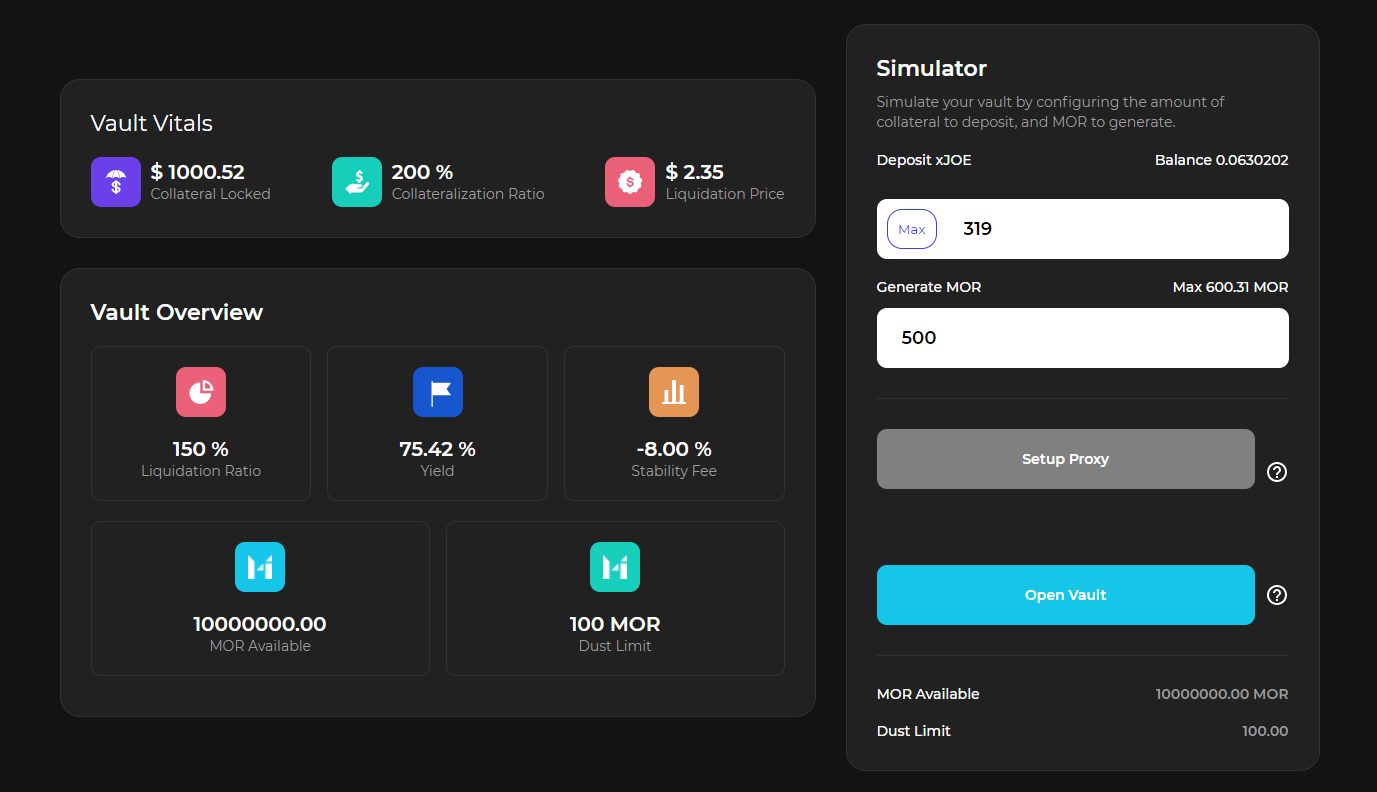

Glossary:

Collateral Locked: USD amount of the xJOE you’d be depositing as collateral

Collateralization Ratio: How many USD worth of collateral for each MOR borrowed (1000$ in collateral and 500 MOR debt = 200% Collateralization Ratio).

Liquidation Price: Estimated price that xJOE would need to go to in order for your position to be liquidated (remember that xJOE is worth more than JOE)

Liquidation Ratio: Minimum Collateralization Ratio for your position, if it goes below this % your position would be at risk of liquidation.

Yield: Annualized Percentage Yield (APY) on your collateral, if the Yield is 75.42% it means your collateral balance would grow by that amount in a 1 year timeframe assuming no changes. For xJOE this yield is calculated based on JOE returns (xJOE APY + xJOE farming APY).

Stability Fee: This is your interest rate/borrow rate. If it’s negative it means you are getting paid to borrow. A stability fee of -8% translates to having your debt drop by 8% per year (from 1000 MOR to 920 MOR for example).

MOR Available: How much MOR can be borrowed with this collateral before the debt ceiling is hit.

Dust Limit: Minimum amount of MOR you can borrow (if you borrow less than 100 MOR the transaction will fail).

What steps to follow:

Once you have inputted how much xJOE you want to deposit as collateral and how much MOR you want to borrow with it there are three transactions to sign:

1-Setup Proxy (This will create a proxy contract that you’ll use every time you interact with any MOR vault)

2-Enable Collateral (Also known as “approve spending”)

3-Open Vault (Opens the vault with the collateral and borrow numbers you input)

Once you have an open vault you can manage them from the MOR Dashboard. It’ll show the same parameters as in the borrow page to monitor your vault’s health. From there you can deposit/withdraw xJOE, mint/borrow MOR to leverage up or repay some or all of your outstanding debt to improve the collateralization ratio.

Now that you have MOR in your wallet from opening the vault you can stake it in WHEAT. You will start farming WHEAT (Avalanche) by doing this.

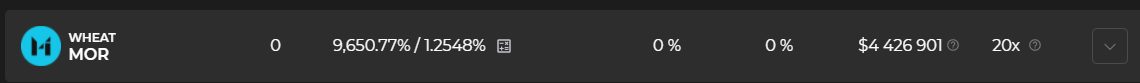

Current APY for staking MOR is 9,650% (1.2548% per day).

Whenever the price of JOE goes up so does your collateralization ratio, that means that you can borrow/mint more MOR and stake it in WHEAT for larger rewards.

Whenever the price of JOE goes down so does your collateralization ratio, in order to bring it back up to reduce your liquidation risk, you can unstake some of the MOR you have staked in WHEAT and repay your debt with it.

With this strategy you are effectively unleveraged because you have plenty of MOR staked to repay your debt at any given time.

Your net yield/returns is composed of four parts:

JOE’s price performance

Yield on your deposited collateral (In this example you’d have 75.42% more JOE in 1 year assuming no changes)

Amount of debt self repaid by negative stability fees (In this example your debt goes down by 8% per year, if you borrowed 500 MOR then you’d only owe 460 MOR in one year, that 40 MOR difference is extra profit)

WHEAT rewards farmed from staking your MOR

At the time of this writing you can earn thousands of % in APY on your xJOE using this strategy.

Strategy 2: Leveraging up on xJOE

The second strategy is to build a leverage position on xJOE, in order to do this you need to convert the borrowed MOR to xJOE. There are two possible routes for this:

Route 1:

1-Swap MOR to USDC.e in the swap page (no slippage).

2-Swap USDC.e to JOE through TraderJoe.

3-Stake your JOE to convert it to xJOE.

4-Deposit the xJOE into your MOR Vault through the Dashboard.

5-After depositing the xJOE your collateralization ratio would go up allowing you to borrow more MOR and repeat the process until your desired leverage is reached.

Route 2:

1-Swap MOR to JOE through Trader Joe directly (it’ll route through MOR/AVAX and AVAX/JOE).

2-Stake your JOE to convert it to xJOE.

3-Deposit the xJOE into your MOR Vault through the Dashboard.

4-After depositing the xJOE your collateralization ratio would go up allowing you to borrow more MOR and repeat the process until your desired leverage is reached.

Your net yield/returns is composed of three parts:

- JOE’s price performance (you have more exposure to it compared to Strategy

- Yield on your deposited collateral (you earn the yield on all the xJOE deposited, that includes the xJOE you acquired and deposited from borrowed MOR)

- Negative Stability Fees yield more in this strategy since the more leverage you take on the larger your debt balance is, meaning you profit more from the negative rates.

Conclusion

There are many strategies that can be run by using MOR + WHEAT. This article shows the two most simple strategies that can be executed with xJOE but the possibilities for strategy creation are virtually infinite.

About Trader Joe

Trader Joe is a one-stop trading platform on Avalanche. It launched first as a DEX and now soon combining DeFi lending to offer leveraged trading.

SOURCE

https://growthdefi.medium.com/how-to-maximize-yield-on-your-xjoe-using-mor-d8fdf67137b8