Trader Joe is integrated into the Cook DeFi Index platform

Cook Finance are proud to share that they integrated Trader Joe, one of the largest DEXes on Avalanche, into the Cook platform. Through this integration, Cook was able to launch the first ever DeFi Index platform on Avalanche.

In this article a high level overview of the integration and explain how the Trader Joe integration was completed with the Cook platform. Also you’ll learn how each index on the Cook platform on the Avalanche chain is created with the assistance of the Trader Joe DEX.

For those of you interested in how indexes work in the world of DeFi, this is a great way to learn more about the inner workings.

Platform Integration

As the Cook team was working on building out the platform on the Avalanche chain, the team recognized the need to source the underlying tokens that are essential for any index on the platform. It was quite apparent that Trader Joe offered not only a highly liquid marketplace through which to source the underlying tokens for the Cook indexes but also a protocol that is widely used by many people every single day.

Token Sourcing

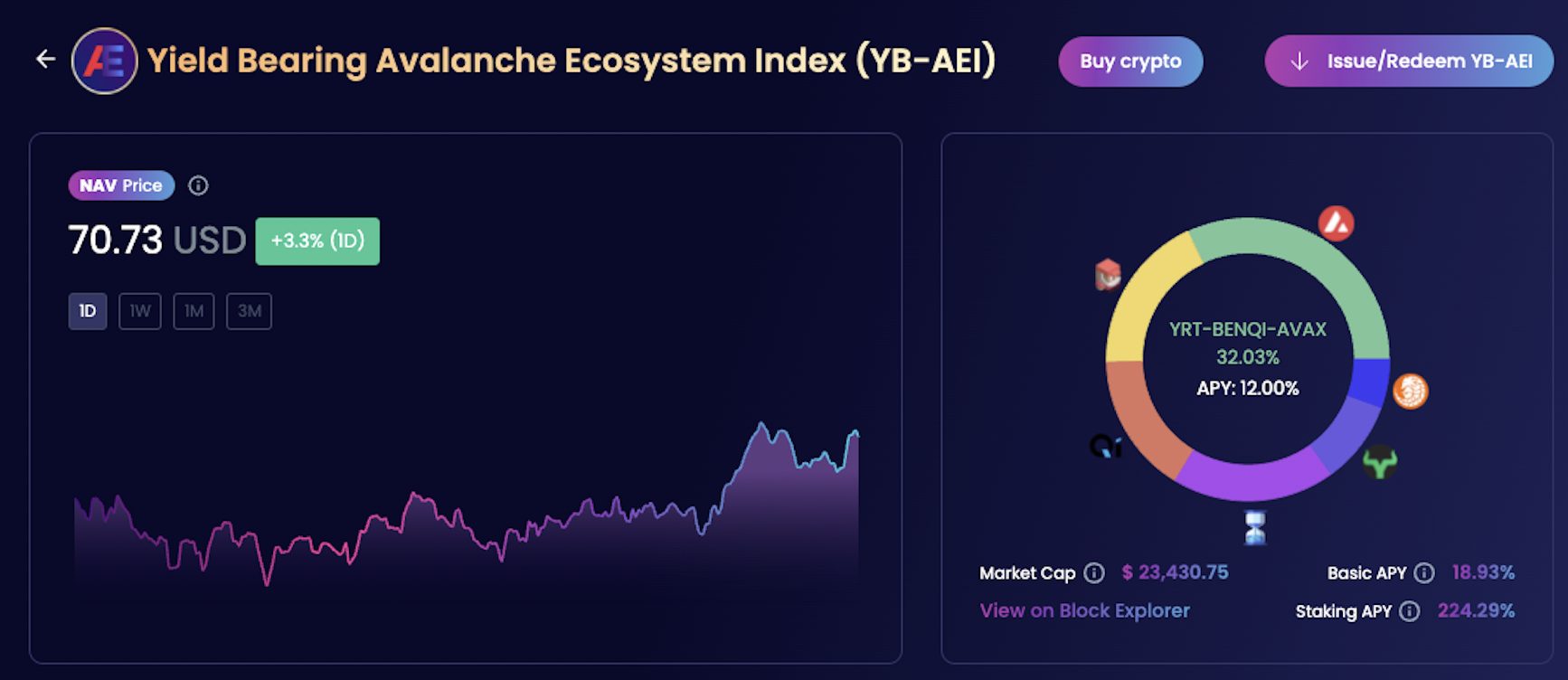

Once the integration with Trader Joe was completed, the ability to get an Avalanche Index by automatically sourcing the underlying tokens through Trader Joe was ready. To explain how this process works, they can take the example of the YB-AEI Index that comprises some of the most popular projects within the Avalanche ecosystem.

Smart Contract

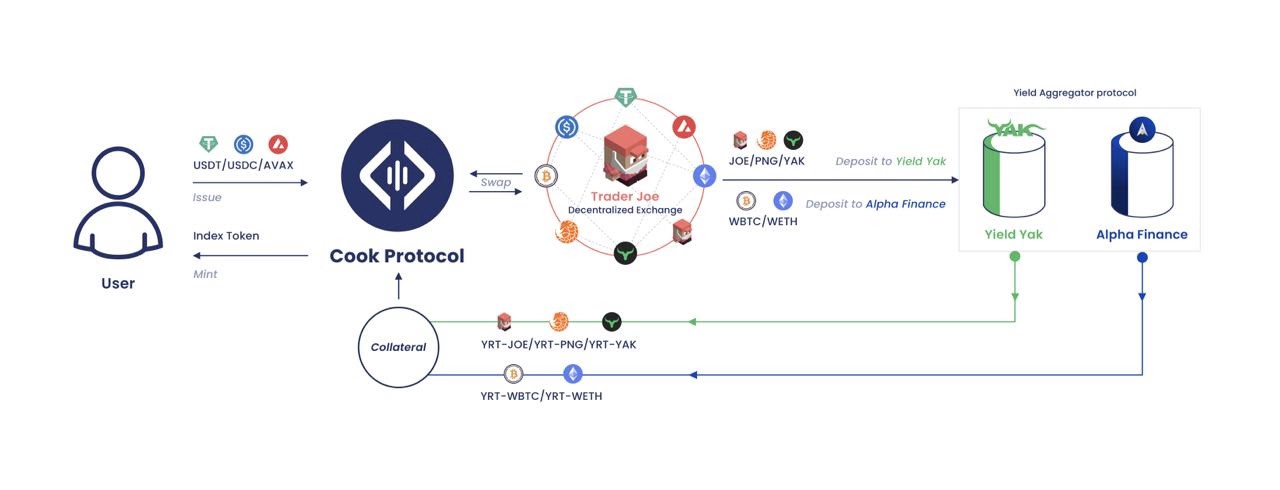

When a user issues an index token with a single token such as AVAX, USDT, USDC or DAI, the Cook smart contract automatically swaps for and encumbers all the underlying tokens into the index token. This process diversifies individual price risks and removes all the complexity of constructing a portfolio of tokens such as the YB-AEI Index.

With this integration with Trader Joe to source the underlying tokens of the Avalanche Indexes, Cook is able to offer a streamlined user experience. This fluidity enabled by Trader Joe, combined with the “Issue with Single Token” feature on the Avalanche chain, makes the Cook platform the fastest DeFi Index platform ever created.

About Cook Finance

Cook Finance is a transparent and flexible DeFi Index platform. This two sided platform is suited to a diverse range of users to make it easy to select from a menu of indexes across multiple chains. At the same time on the other side of the platform, index creators can utilize tools to create virtually any imaginable strategy and easily offer it up to the Cook community.

About Trader Joe

Trader Joe is a one-stop trading platform on Avalanche. It will launch first with regular trading and later with lending, which combine together to offer leveraged trading.