Introducing “Elixir” — The Alchemix Algorithmic Market Operator

When Alchemix was originally launched, it never anticipated its peg stability module, the Transmuter, to exceed 9 figures in value, with both the alUSD and alETH transmuters holding over $100m in value each. To take advantage of this, Alchemix began deploying these reserves in Yearn and passed the extra yield from these deposits to DAI and ETH depositors in Alchemix. This enabled them to have a killer feature — boosted yield, which at times, doubled the amount of interest paid to Alchemix depositors.

Recently, it dawned on the Alchemix team that these DAI and ETH reserves could be more-intelligently deployed in order to better benefit the Alchemix ecosystem. Instead of these assets passively making money elsewhere in DeFi, it makes much more sense to use these funds actively in the market to earn the protocol income and to better manage its pegs.

Introducing the Alchemix Elixir

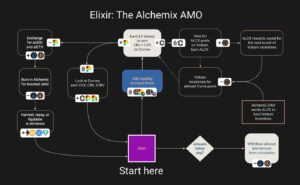

The Alchemix Elixir is a contract inspired by FRAX’s Algorithmic Market Operator (AMO). Their AMO allows them to expand and contract the supply of FRAX in LP pools, with FRAX3CRV LP being the most predominant. They mint and deposit FRAX when the token price is above their peg, withdraw and burn FRAX when the token price is below their peg. They also farm with the LP in Convex, earning the protocol income in the process.

Through its own automations the Alchemix Elixir would take a similar approach to market operations, with the exception that we cannot mint alUSD into the LP pools.

See below for a diagram that shows how funds flow through the market.

The Elixir will be jump-started by migrating the v1 Transmuter TVL to it. This process will be completed over the course of 6 weeks so we can ensure a safe transition of funds. From there, all additional funds going to the Elixir will come from debt repayments in Alchemix. Once the funds are deposited into Elixir, the contract will supply liquidity in our primary curve pools — alUSD3CRV LP for alUSD, and alETH LP for alETH. Since the Alchemix protocol will be continually depositing DAI, USDC, USDT, and ETH into Elixir, it deepens liquidity and helps to maintain the peg.

The next function of Elixir is to generate revenue and build long term liquidity for the protocol. Elixir will do this by making a Convex flywheel strategy. Alchemix has been accumulating CVX tokens via Olympus Pro for several months, now holding ~250k CVX.

The Elixir is a significant upgrade to Alchemix peg stability module. The concentrated management of its protocol controlled value aligns it more closely to its interests.

ABOUT Alchemix Finance

Alchemix Finance is a future-yield-backed synthetic asset platform and community DAO. The platform gives you advances on your yield farming via a synthetic token that represents a fungible claim on any underlying collateral in the Alchemix protocol. The DAO will focus on funding projects that will help the Alchemix ecosystem grow, as well as the greater Ethereum community.

RESOURCES

Medium