Introducing IntentX’s Tokenomics

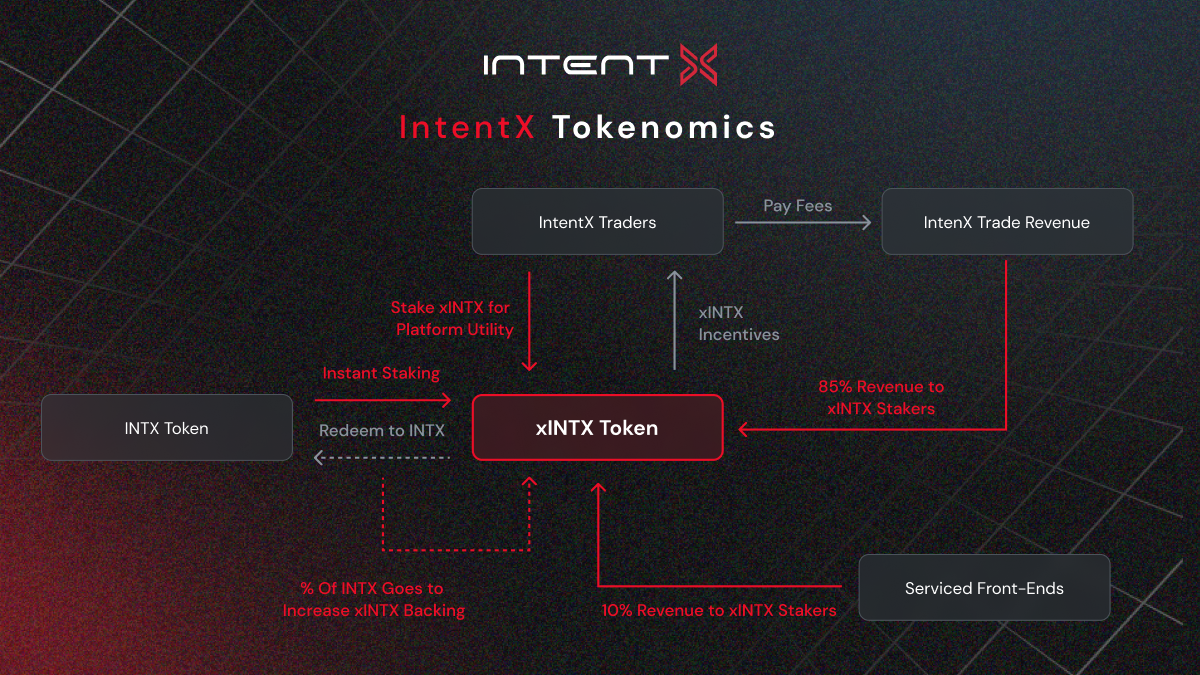

Introducing IntentX’s tokenomics, an important part of every project. In the overly incentivized landscape of DeFi, IntentX’s tokenomics distinguish themselves with a thoughtfully crafted approach that ensures sustainability while rewarding active participation.

This article offers an in-depth look at the tokenomics of IntentX, exploring the principles, mechanisms, and strategic initiatives embedded in its design, all collaborating to maximize value capture.

Introduction to $INTX

$INTX, the utility token of IntentX, serves as the backbone of the platform, designed to capture value and align stakeholders’ interests. It is a non-inflationary token with a maximum supply capped at 100,000,000 tokens.

The Role of $INTX in the IntentX Ecosystem

Being non-inflationary, $INTX is designed to be valuable and scarce, ensuring its status as a highly sought-after asset within and beyond the IntentX ecosystem. This strategic design positions $INTX as a crucial means of earning “real yield” and accessing various services and features on the platform.

Understanding $xINTX

xINTX is the embodiment of $INTX in a staked format, serving as the primary value catalyst for stakeholders within IntentX. Those possessing xINTX receive a proportional slice of all fees accrued by the IntentX platform. Furthermore, this incentive is augmented based on the duration of staking. Thereby fostering alignment between the protocol and its long-term stakeholders.

Notably, IntentX has recently announced its “Serviced Front-End” program. With three live partners (Thena, Core, BeFi), xINTX stakers will also receive a portion of revenues generated by all serviced front ends in perpetuity.

Staking $INTX to receive xINTX is a straightforward process, similar to any other staking contract.

Goals and Benefits of xINTX Staking

- Distribute 85% of revenues

IntentX stakeholders ($xINTX Stakers). - Reward long-term stakers

Without forcing them to lock their tokens for varying periods. - Safeguard stakeholders

From the potential adverse effects of short-term trading habits. - Governance voting rights

(Implemented in the future) to decide on critical token and staking-related mechanisms.

Loyalty Reward Boosts

Based on how long tokens are staked as $xINTX, users will receive a boost to their revenue over time:

- The Loyalty Stake Duration

A period of 16 weeks where revenue boosts are increased linearly over the maturity of your staked position up to 2.5x. - Maximum Boost

The 2.5x value means that if you stake your tokens for the full loyalty duration (16 weeks), the rewards you earn can be multiplied by up to 2.5 times.

Leveraging the significant value accrual from the IntentX DEX and its serviced front-ends, xINTX stakers are rewarded with sustainable real yield. The xINTX dynamic mechanisms are meticulously designed to align incentives and create a growth-oriented environment for stakeholders.