The Rome Terminal Launches with Service for the KyberDMM

An exciting time for the protocol, the Rome Terminal team is excited to announce an agreement for native integration with one of DeFi’s most advanced market services: KyberDMM.

An overview of the KyberDMM

Pushing the boundaries of traditional decentralized exchanges, the KyberDMM is powered by Amplified Liquidity Pools which offer capital efficiencies of nearly 10,000% over traditional AMMs. The market operates similar to traditional decentralized exchanges in that any trader can freely deposit two assets into a pool and receive an LP token representing their proportional ownership of that pairing. KyberDMM improves this process by introducing Programmable Price Curves. This improvement to the well-known simple constant-product function exponentiates efficiency across the pool spread and slippage potential.

In conjunction with an improvement in efficiency, KyberDMM has additionally produced a dynamic LP fee model. The model algorithmically reduces fees based upon changing market conditions. As market volatility increases so do the DMM fees. To incentivize efficiency, the fees drop in parallel to market activities therefore establishing a healthy fee equilibrium.

Integration into the Rome Terminal

An overarching goal for the Rome Terminal is to supply DeFi traders with a seamless portfolio management experience. A necessary requirement in achieving this target is to subsequently provide the community with top-quality DeFi services. Rome Blockchain Labs has found that the KyberDMM meets this need by a large margin. Through a combination of dependable reputation and impressive technical capability the Rome Terminal is proud to directly partner with Kyber Network in this endeavor.

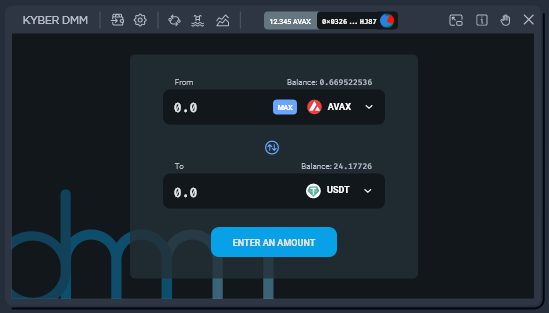

The KyberDMM’s native widget will be integrated into the Rome Terminal as shown above. From this interface, users may execute transactions directly through the smart contract. The widget lets traders select the asset and direction of the trade as well as establish their preferred execution settings via the gear icon. Individuals who want to add or remove liquidity from a pool may select the Liquidity button. In this view they have a breakdown of each pool on Kyber sorted by pair and then by amplification factor. An iframe of the exchange is currently in the service and will be replaced with this widget shortly.

Traders are able to add in charts and transaction tables for assets on the Avalanche Network. These display real time analytics of all token pairs on the KyberDMM. From these analytics widgets, click on the Exchange icon and you can open directly to the KyberDMM for immediate DEX interaction. All of the above mentioned widgets are expandable and can be rearranged on the Rome Terminal dashboard. In addition, KyberDMM assets can be added to the preferred tokens section which gives a real-time USD price price feed.

Moving forward

Rome Blockchain Labs is grateful to the Kyber Network team for their professionalism and willingness to partner with an up and coming project in the Rome Terminal. Both services understand the importance of quality technology being implemented across the most impactful blockchain networks. In order for decentralized finance to establish itself in the consciousness of the average person, there must be a healthy blend of technical quality, community involvement, and uncompromising integrity. It is our intention to develop these facets, and more, following the continual improvement of the Rome Terminal.

About Kyber Network

Kyber Network aims to deliver a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources (e.g. KyberDMM) to provide the best token rates to takers such as Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can contribute or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere.

Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

About the Rome Terminal

The Rome Terminal is the worlds first multi-blockchain DeFi management interface. Through the use of a customizable dashboard, traders are able to create a layout of charts, tables, exchanges, and other natively integrated services. Every top-quality protocol for use in one convenient place.