Trader Joe Officially Announces the Integration of Chainlink Price Feeds for Banker Joe

The Trader Joe team is thrilled to announce the launch of Banker Joe, a new lending and borrowing platform powered by Chainlink Price Feeds. Now, users can leverage Banker Joe to earn interest on their assets by loaning them to others via non-custodial pools, or by depositing their own assets as collateral to borrow more assets. Banker Joe references Chainlink decentralized price oracles to determine a user’s borrowing capacity during loan issuance and check loans for under-collateralization during liquidations.

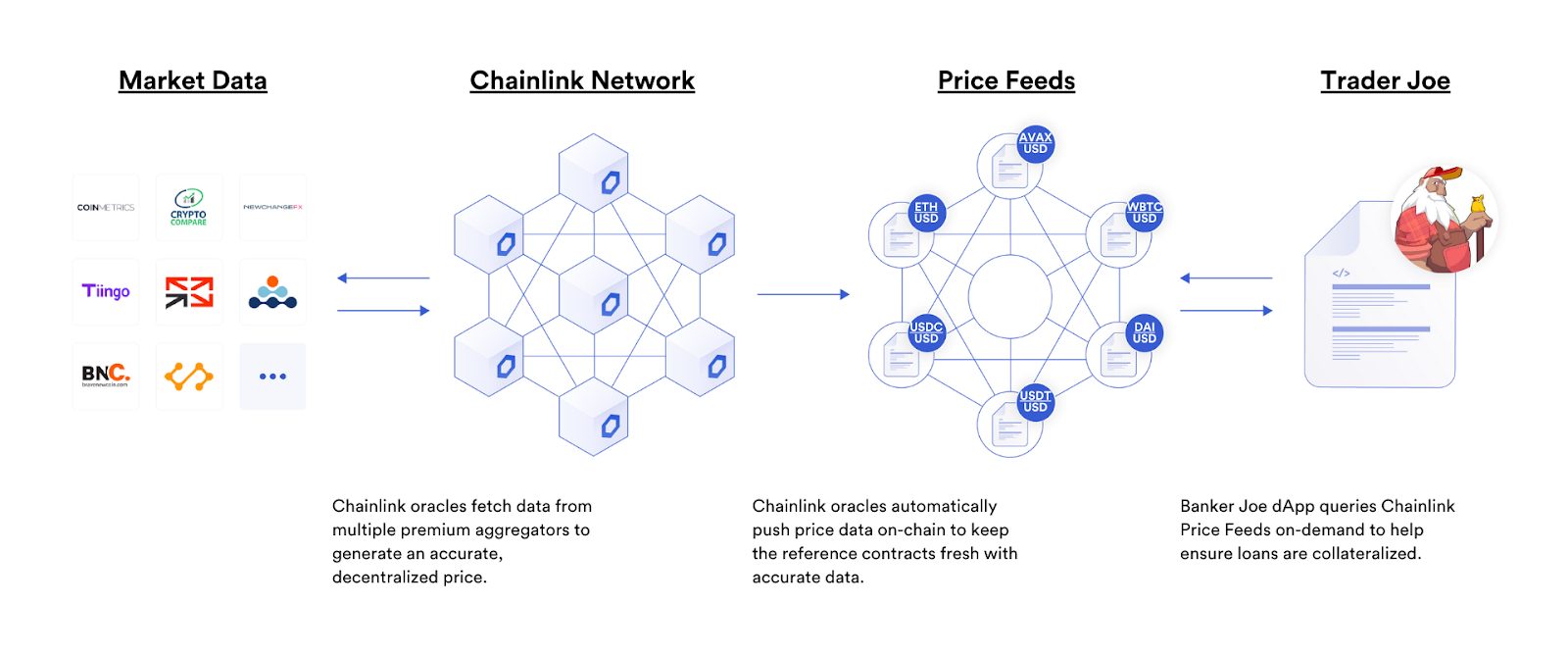

Trader Joe’s initial integration supports multiple Chainlink Price Feeds: AVAX/USD, ETH/USD, WBTC/USD, LINK/USD, USDT/USD, USDC/USD, and DAI/USD. Importantly, our integration with Chainlink can easily expand Price Feed support for more assets in the future.

They decided to integrate Chainlink because it is the most time-tested and reliable decentralized oracle network in the blockchain industry, already helping secure tens of billions of dollars for leading DeFi applications across various blockchains. Chainlink Price Feeds have proven over an extensive period of time to provide high-quality data and robust infrastructure, consistently updating accurately and securely during periods of extreme market volatility and network congestion. Ultimately, Chainlink Price Feeds help ensure that each transaction on Banker Joe that relies on asset prices will reflect real-time, global markets.

Banker Joe is a crucial component of the overall vision to turn Trader Joe into a one-stop trading platform on Avalanche. Banker Joe’s lending functionality combined with our DEX enables non-custodial leverage trading. For instance, users can deposit collateral and borrow assets from Banker Joe to effectively make long or short positions. However, borrowing doesn’t come without risk, as users can be liquidated when their ‘borrow limit’ reaches 100%, resulting in the liquidators seizing 8% of the user’s collateral.

Accurate price feeds are critical to ensuring that loans are issued, closed, and liquidated at fair market prices. This is extremely important not only for reducing slippage but for avoiding inaccurate liquidations due to faulty oracle functions. After exploring various price oracle solutions, we decided to go with Chainlink because of its strong track record of reliability, saving many protocols from unexpected events like flash crashes, exchange downtime, or data manipulation via flash loans.

Some of the notable optimizations of Chainlink Price Feeds include:

- High-Quality Data — Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that is aggregated from hundreds of exchanges, weighted by volume, and cleaned from outliers and suspicious volumes.

- Secure Node Operators — Chainlink Price Feeds are secured by independent, Sybil-resistant oracle nodes run by leading blockchain DevOps teams and traditional enterprises with a strong track record for reliability.

- Decentralized Network — Chainlink Price Feeds are decentralized at the data source, oracle node, and oracle network levels, generating strong protections against downtime and tampering by either the data provider or the oracle network.

Transparency — Chainlink provides a robust reputation framework and set of on-chain monitoring tools that allow users to independently verify the historical performance of node operators and oracle networks, as well as check the real-time prices being offered.

About Chainlink

Chainlink is the industry standard for building, accessing, and selling oracle services needed to power hybrid smart contracts on any blockchain. Chainlink oracle networks provide smart contracts with a way to reliably connect to any external API and leverage secure off-chain computations for enabling feature-rich applications. Chainlink currently secures tens of billions of dollars across DeFi, insurance, gaming, and other major industries, and offers global enterprises and leading data providers a universal gateway to all blockchains.

About Trader Joe

Trader Joe is a one-stop-shop decentralized trading platform native to the Avalanche blockchain. Trader Joe builds fast, securely and aims to serve the community at the frontier of DeFi. The long-term vision of the team is to make Trader Joe an R&D-focused platform for new DeFi primitives not yet seen on any blockchain.

SOURCE