Trava: The Next-Generation of Lending Protocols | Navigation Guide

INTRODUCTION

While existing approaches provide only one or a few lending pools with their own parameters such as borrowing/lending interest rate, liquidity rate, collateral ratio, or a limited list of exchangeable cryptocurrencies, TRAVA has another innovative approach.

“SmartLiquidity” would like to present Trava, that offers a flexible mechanism in which users can create and manage their own lending pools to start a lending business. TRAVA is deployed on the Binance Smart Chain and allows for lending with BSC tokens first; they then enable cross-chain lending with various tokens on Ethereum and other blockchain networks.

OVERVIEW OF TRAVA FINANCE

TRAVA.FINANCE is deployed on the Binance Smart Chain and allows for lending with BSC tokens first; we then enable cross-chain lending with various tokens on Ethereum and other blockchain networks.

The pool owners, who are an additional role to lenders and borrowers, can receive more earnings by devising a good lending strategy for their pools.

Moreover, to reduce risks and stimulate lending and borrowing, TRAVA.FINANCE performs cross-chain data analysis on multiple blockchain networks to (i) recommend optimal pool parameters for pool owners and (ii) detect unusual transactions in their pools. The lending marketplace model of TRAVA.FINANCE will increase crypto liquidity and promote the growth of the DeFi ecosystem.

TRAVA FEATURES

There are six salient features of TRAVA, including:

🔹1. Crypto lending marketplace

TRAVA creates a marketplace in which anyone confident in their abundant capital and profound knowledge of finance is free to create and manage their own lending pools. This multiple-pool model allows pool owners and their pool members to flexibly adapt their investment strategies to the volatility of the crypto market and earn more profits.

🔹2. Data analysis

To reduce lending risks, TRAVA performs statistical data analysis based on the cross-chain knowledge graph and other data sources. TRAVA recommends the optimal parameters for pool owners to create and maintain their own pools (e.g., borrowing-lending interest rate, collateral ratio, liquidation threshold, a minimum credit score of borrowers). TRAVA also assists them in detecting and alerting unusual transactions in their pools.

🔹3. Credit score evaluation

Though being an effective tool in lending, credit score has never been used in existing decentralized lending platforms. As a pioneer, TRAVA uses the cross-chain knowledge graph to evaluate credit scores for users and their digital assets. The pool owners thus can

- Reduce the lending risks by defining a credit-score threshold for borrowers participating in the lending pool;

- Stimulate borrowing by defining a high collateral ratio for borrowers with high credit scores.

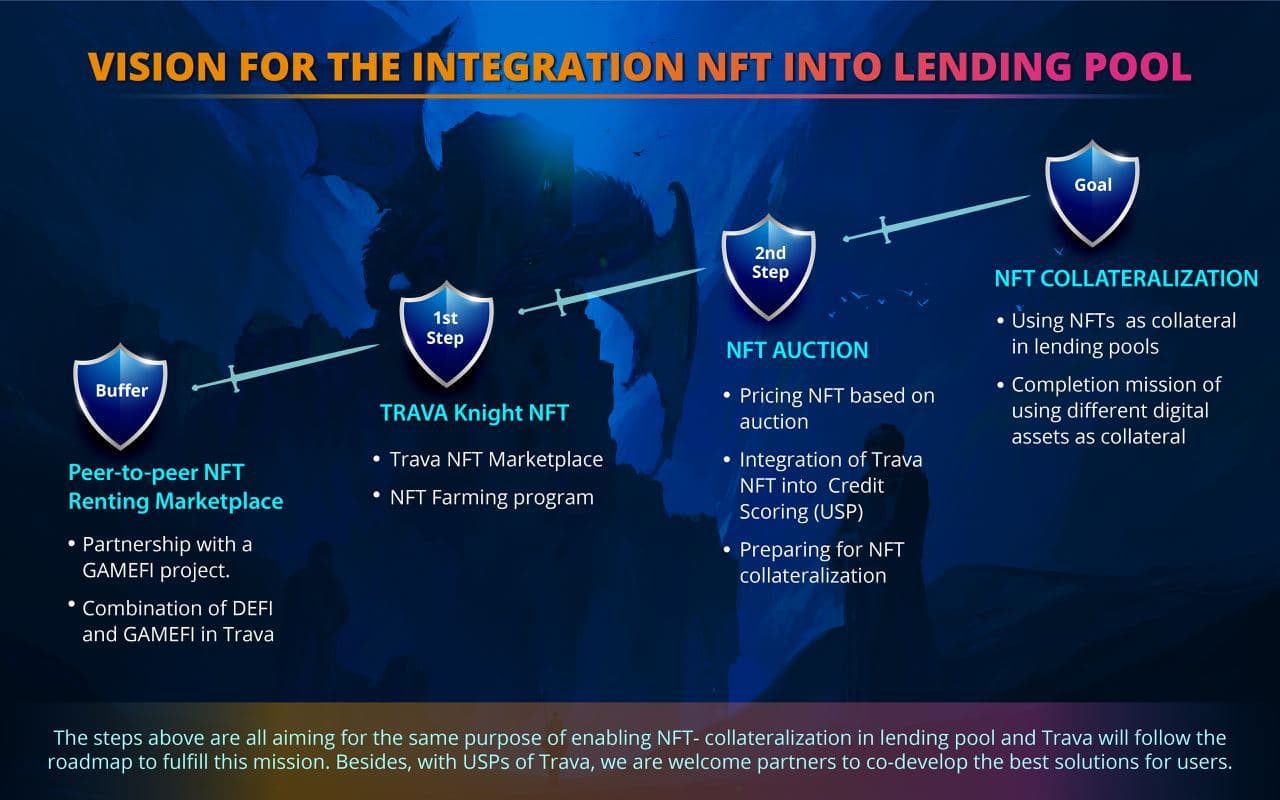

🔹4. NFT, stock tokens, and other digital assets as collaterals

To increase the liquidity of such special assets as NFT, stock tokens, or smart contracts, TRAVA allows users to use all of these asset types as collaterals. Before that, the special digital assets must be priced through auctions. The auction winners are involved in the lending contract. They can either possess the digital asset at a low price or earn a considerable profit from the contract.

🔹5. Cross-chain identification and cross-chain lending

TRAVA uses the cross-chain identification protocol to identify all wallet addresses of the same users on different networks. After that, users can use up all of their cryptos as collateral for a huge loan in a single transaction. This facilitates their borrowing operations and saves them transaction fees. Cross-chain identification also helps them to increase their credit scores.

🔹6. Semantic knowledge graph

TRAVA is built upon the semantic cross-chain knowledge graph. The graph is a distributed ledger that holds the data collected from multiple blockchain networks in the form of entities and their interconnections. The graph allows TRAVA to efficiently search for useful information:

- The amount and value of assets exchanged between two wallet addresses;

- The provenance of an NFT;

- Aggregated assets of the same user on multiple networks, etc.

TRAVA PARTNERS

Trava was also successfully audited by Certik and Hacken.

TRAVA ROADMAP

Q4 – 2021

🔸Launching Knowledge Graph (Beta)

🔸Launching NFT Auction

🔸Launching Cross-Chain Protocol (Beta)

Q1 – 2022

🔸Launching TestNet for On-chain Knowledge Graph

🔸Launching Credit Score

🔸Launching Cross-Chain Protocol

Q2 – 2022

🔸Launching MainNet for On-chain Knowledge Graph

🔸Enabling DAO Functionalities

🔸Improve Features and Tools (insurance for loan/collaterals)

TRAVA KNIGHT NFT

Trava.Finance launched #KnightNFT for enabling NFT-collateralization. By opening the NFT marketplace for everyone and facilitating collateralization, we can see more activity in the future & benefits. This will enable Trava.Finance to progress towards achieving their goals and introducing more NFT utilities in their lending pool.

The launch of Trava Knight NFT also helps them to increase TRAVA utility in system, as all the trading on Marketplace will be in $TRAVA. Thus, $TRAVA holders will receive a lot of benefits gained from the launch of Trava Knight NFT.

Trava NFT Marketplace

Trava NFT Marketplace allows NFT owners to list and sell their NFTs. At the first stage, they will start to run the “TRAVA ARMOURY CHESTS ‘’ product, which allows users to buy and uncover mystery chests. Based on the Epic of Trava Knights, the item in those chests will be randomly 1 out of 4 parts of a knight’s armor, including: Helmet, Armor, Shield, and Weapon. These parts will be classified into 5 rarities from lowest to highest: Copper, Silver, Gold, Diamond, and Crystal. One chest will contain one item of random rarity. Users can assemble a special Collection NFT to farm in NFT vault after collecting 4 full parts of Helmet, Armor, Shield, and Weapon.

NFTs Farming Program will be launched several hours after the “TRAVA ARMOURY CHESTS” sales program initialization. By collecting NFT collections, users will be able to earn great yields from NFTs farming program.

Benefits for Knight NFT Holders

Users can create their own Knight NFTs by collecting 4 and then join Farming Program. Their farming program offers Knight NFT holders several vaults for each rarity with a great APY of minimum 3-digit. The rarer the NFT, the higher APY.

If you are ever so unlucky, they also offer users a “Trade-up” mechanism, which allows users to upgrade their NFT rarity by owning multiple items with the same rarity. Furthermore, users can list their Knight NFTs on Marketplace for sales so others can collect NFTs for their “Trade-up”. Not only that, they will provide users with a Buyback mechanism for NFT Holders to have more options to sell their NFTs.

Last but not least, the longer Knight NFT holders stake in the vaults, the more preferential treats they will get in the lending pool in the future. Loyal Knight NFT holders will have enormous benefits when they finish NFT-collateralization.

TRAVA SOCIALS

Website I Telegram I Announcement I Twitter I Medium I Reddit I Github I Discord I LinkedIn I Youtube

FRIENDLY REMINDER:

We deliver these news articles based on our own thorough research. We want to preserve some important information regarding the project that is presented in our column. We value our readers’ opinion and appreciate your valued respect to us. The article above is not financial advice and as we always say “Invest at your own risk and only invest what you can afford to lose”.