Introducing Cega, The Decentralized Exotic Derivatives Protocol

Cega is building the next evolution in decentralized finance derivatives.

Cega are the first protocol focused purely on exotic derivatives, a class of options products that combine basic options (e.g. call/put) with advanced options characteristics to create packaged offerings for investors which generate superior yield, provide downside protection, and express infinite views of the financial market. Their first exotic product offering is the fixed coupon note (explained below) but there are many more to come!

Cega’s First Exotic Product: Fixed-Coupon Note (FCN)

Product Structure

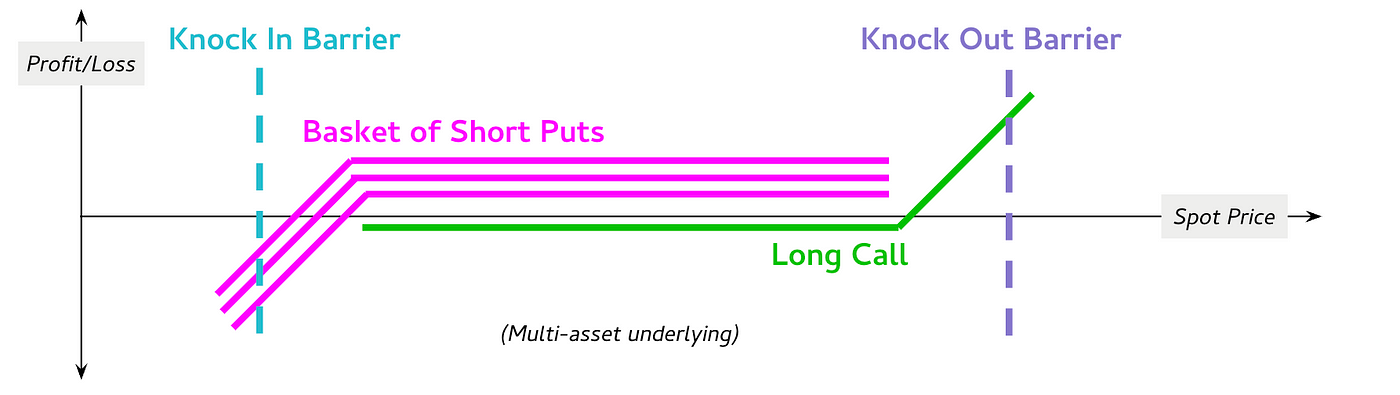

The fixed coupon note (FCN) is a packaged exotic derivative offering comprised of:

- 2 or 3 Short Puts to generate yield for investors

- 1 Long Call to incentivize Knock-Out events

- Knock-In (KI) Barrier to provide downside protection against market downturns

- Knock-Out (KO) Barrier to improve investor liquidity and increase compounding of yield when markets rally

The payout of Cega’s FCN offering is illustrated below:

Benefits for Investors

- Superior Yield, Fixed — Users will be paid a high fixed daily yield (~40% to 200%+ APY) that is promised upfront when they stake their capital

- Downside Protection — Users are safer investing in FCNs than in basic options strategies because FCNs provide protection against market downturns. Unless one of the crypto assets underlying the fixed coupon note falls more than 50% and knocks in, the capital staked by users stays safe

- Compounded Returns — At the end of the term of the note (e.g. 3 months) or when the structure knocks out, the initial capital staked + yield accrued will be reinvested into a new another structure, thus compounding returns

Benefits for Market Makers

Market makers who are willing to provide liquidity for the other-side positions of these products benefit from:

- Discounted Hedge — KI Barriers allow for discounted protection of a basket of underlying cryptos in a market markers portfolio

- Proprietary Gains — Hedging these structures will allow for proprietary gains due to the delta and vega positions

How It Works

Users connect their wallet in the Cega web app and stake on their platform through a simple 1-click UI/UX to make exotic derivatives simple for anyone. Yields will start being paid to users automatically and will perpetually reinvest (both principal and yield) to compound returns on investment. Users can unstake at any time.

Governance

They want their community of investors, traders, quants, and statisticians to influence how the protocol grows. This means they want to develop the following capabilities for the community through decentralized governance:

- Vote on future product offerings — we want the $CEGA token holders to influence the baskets that we create, as well as the risk tolerance

- Impact on the statistical models — we want the community to learn about more exotic derivatives and influence the pricing capabilities that Cega offers

- Education — we want the defi community to understand options trading in the most realistic way. Cega’s early community will consist of experts and fans of the defi derivatives field, and we look to onboard users further into understanding ways to flexibly represent views of the market using derivative instruments

Website ♦ Twitter ♦ Discord ♦ Whitepaper ♦ Medium

⏩ SOURCE