UPFI is Integrating Chainlink Price Feeds on Solana

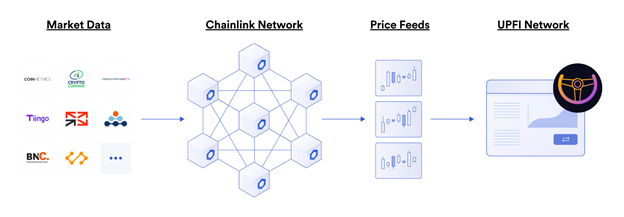

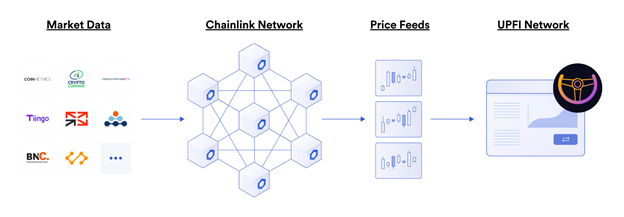

UPFI Network is integrating the industry-leading Chainlink Price Feeds on Solana as its oracle solution to help maintain the peg of its partially collateralized and partially algorithmically stabilized stablecoin called UPFI.

The initial integration involves the use of the Chainlink USDC/USD Price Feed, which is referenced during all mints and redemptions.

UPFI Network selected Chainlink because it’s the most time-tested decentralized oracle network in the industry, with Chainlink Price Feeds already helping secure tens of billions of dollars in value across DeFi.

UPFI is a partially collateralized and partially algorithmically stabilized token soft-pegged to the U.S. Dollar. The protocol’s goal is to keep the UPFI token price stable. Two tokens are used as collateral: USDC and the UPFI share token (UPS). When a user mints UPFI by depositing USDC and UPS, the USDC is locked in the protocol, and the deposited UPS is burnt. When a user redeems UPFI for the underlying collateral, the user gets their deposited USDC back, and the protocol mints UPS. This dual-collateral design along with the redemption mechanism helps to keep the price of UPFI stable.

For their smart contracts to accurately calculate in real-time the price of collateral during minting and redemptions, we needed an oracle solution that can fetch highly precise USDC/USD exchange rates and deliver them on-chain securely and reliably. This price oracle is critical to maintaining both the peg and protocol solvency.

Chainlink Price Feeds are open-source, decentralized data feeds that have been battle-hardened in production and already used by many of the leading applications in the decentralized finance ecosystem. By integrating Chainlink Price Feeds, the calculation of collateral during minting and redemption becomes more secure and tamper-proof while still maintaining frequent response times and high accuracy.

Some of the most notable considerations around Chainlink Price Feeds that make it ideal over other alternatives include:

💥 High-Quality Data — Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that are aggregated from hundreds of exchanges, weighted by volume, and cleaned from outliers and suspicious volumes. Chainlink’s data aggregation model generates accurate global market prices that are resistant to API/exchange downtime, flash crash outliers, and data manipulation attacks.

💥 Low Deviation Updates — Chainlink Price Feeds running on Solana can perform low deviation price updates at minimal costs, resulting in precise price data that consistently reflects current market conditions.

💥 Robust Infrastructure — Chainlink Price Feeds utilize decentralized networks of professional node operators run by leading blockchain DevOps teams and traditional enterprises with a strong track record of uptime during market volatility.

💥 Transparent Monitoring — Chainlink provides a robust reputation framework and set of on-chain monitoring tools that allow users to independently verify the historical and real-time performance of price feeds.

“We’re excited to strengthen the infrastructure of UPFI Network with Chainlink, bringing stronger security and manipulation-resistance guarantees to our stablecoin along with finely tuned and accurate price updates for better stability,” stated Harry Nguyen, Founder of UPFI Network. “We look forward to deepening the integration with the industry-leading oracle solution with a potential collaboration on a UPS/USD Chainlink Price Feed in the future.”

About Chainlink

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

Solutions ♦ Docs ♦ Twitter ♦ Discord ♦ Reddit ♦ YouTube ♦ Telegram ♦ GitHub

About UPFI Network

UPFI is the first stablecoin protocol which design principles to create a highly scalable, non-custodial, extremely stable, fractional-algorithmic, and pure on-chain financials on Solana. It supports next-generation payment networks on the blockchain.

UPFI aims to replace fixed-supply digital assets by bridging the gap between digital currencies and real-world applications with transaction costs of almost zero.

Twitter ♦ Discord ♦ Facebook ♦ Telegram ♦ Medium ♦ Docs

⏩ SOURCE