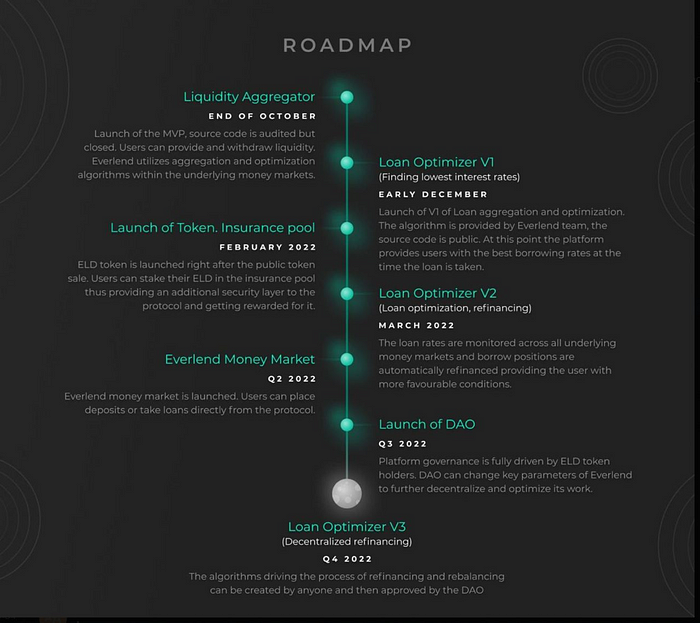

Everlend Development Roadmap

Everlend released its recent adjustments on its roadmap to the community. Their goal is to integrate with all major money markets and become the go-to Meta lending protocol on Solana.

⭐️ Liquidity Aggregator (End of October / Beginning of November)

Their team is pushing very hard to release the MVP of their Liquidity Aggregator by End of October / Beginning of November. Users will be able to deposit their funds, provide and withdraw liquidity and Everlend will utilize aggregation and optimization algorithms to achieve the highest possible yield.

⭐️ Loan Optimizer V1 (Early December)

The next step is the launch of V1 of Loan Optimizer, which provides Everlend users with the best borrowing rates at the time the loan is taken. This feature is still very unique to the DeFi space and is expected to attract many traders and investors pursuing the lowest interest rate. Loan interest rate and liquidity yield will also be decoupled, which means the loan can be taken out on money market A while the funds will provide liquidity on money market B to always ensure our users the best performance for their funds.

⭐️ ELD token launch and insurance pool (February 2022)

An important milestone will be the launch of their governance token ELD, which will happen shortly after their public sale. They haven’t yet determined all the details of the procedures of the public sale, but they are already working closely with their legal team to sort out any legal hurdles and to fully comply with regulatory frameworks in various jurisdictions. After the TGE users will now have the possibility to stake their ELD into the insurance pool and receive rewards for providing an additional security layer for the protocol. On average 10% of all the fees will go to the insurance pool users. ELD token holders are also entitled to submit and vote on governance proposals.

⭐️ Loan Optimizer V2 (March 2022)

The second version of Loan Optimizer will enhance the refinancing feature. Refinancing means loan optimization. The loan rates are now monitored across all underlying money markets and borrow positions will be automatically refinanced and moved between protocols to ensure the user pays the lowest interest on the market.

⭐️ Everlend Money Market (Q2 2022)

The original mission was to build a decentralized cross-chain money market for the Solana ecosystem. This hasn’t changed and we expect it to materialize by Q2 of 2022. Everlend will enable users to place deposits and/or take out loans directly from our lending protocol. Our money market will be scored and assessed by our aggregator like any other money market that is integrated with our protocol. It will also mark the start of the Loss Protection System, which aims to protect lenders from the risk of borrowers defaulting.

⭐️ Launch of DAO (Q3 2022)

Another milestone will be the launch of the DAO. The team plans to fully transform Everlend Finance into a DAO in Q3 2022. The platform governance will now be fully driven by ELD token holders. Via the internal voting system, the DAO can change key parameters such as interest rate curve, collateralization ratio, liquidation threshold, optimal utilization ratio, and rеserve factor of Everlend to further decentralize and optimize its work.

⭐️ Loan Optimizer V3 (Q4 2022)

Finally, with version 3 of Loan Optimizer, the algorithms that are driving the process of refinancing and rebalancing can be created by anyone and then be approved by the DAO. This is another huge step towards decentralization and the utilization of the DAO.

About Everlend