Solvent Protocol Secures $1.8 million in Private Funding Round, Launches its Governance Token

Solvent Protocol, the first-ever liquidity platform for NFTs on Solana, has closed its private funding round, raising $1.8 million.

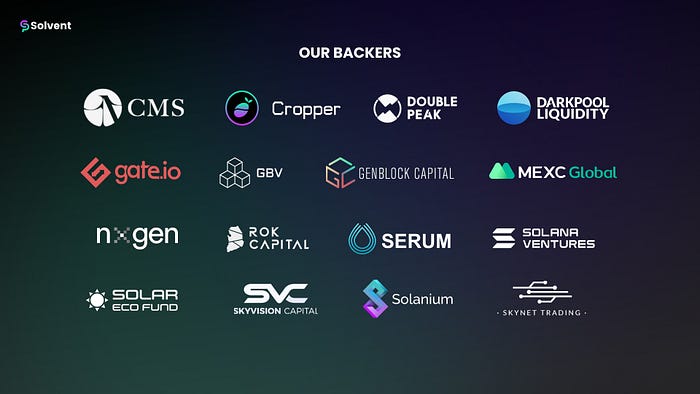

Participants in the funding round include CMS, Solana Ventures, and GBV Capital, with notable angel investors, like the co-founder of Magic Eden, Zhuoxun Yin, Solend Protocol’s co-founder 0xRooter. Other notable investors include NFT Whales such as SOLBigBrain of Big Brain VC and Arnold Poernomo of Masterchef Indonesia; as well as NoJob from NoJobCapital and Marcus Maute of BridgeTower Capital.

Funding will be used to continue developing the Solvent Protocol platform, as well as expanding the team, and providing liquidity to pools on the platform. Other investors in the private funding round included Project Serum, Genblock Capital, ROK Capital, SkyVision Capital, NxGen Ventures, Solar Eco Fund, Double Peak Ventures, Solanium Ventures, Cropper Finance, Gate.io, MEXC Global, Skynet trading, and Darkpool Liquidity.

Solvent’s Institutional Backers

The funding announcement comes just as Solvent Protocol launches its governance token $SVT, which can be used to vote on proposals related to Solvent Protocol. $SVT will also be used for token staking, with benefits for liquidity providers such as reduced minting fees and portions of open market buybacks.

Solvent Protocol aims to make buying, selling, and trading NFTs easier, allowing traders to instantly liquidate their holdings across NFT projects and get exposure to the success of these NFT projects at fractions of the costs.

Already, Solvent has launched the first-ever NFT-backed index funds on Solana and, in one month of operation, has facilitated instant liquidity to over 200 NFT assets across 5 NFT projects. Supported NFT projects on Solvent now include Catalina Whale Mixer, Degenerate Ape Academy, and Galactic Geckos, among others, with many more to come. Solvent Protocol currently has a TVL in excess of $400,000 across its NFT droplet liquidity pools.

In 2021, the NFT market hit $22 billion, as more people turn to NFTs as a viable option for investment. With the difficulty of trading and staking NFTs, Solvent Protocol has devised a solution where NFTs can be deposited in exchange for droplets, which can be staked and traded, and behave exactly the same as fungible tokens.

Solvent Protocol is currently preparing its Initial Dex Offering (IDO) on Solanium, which will take place from January 7th — 11th.

Furthermore, Solvent Protocol is preparing an Initial Exchange Offering (IEO) on Gate.io, which will take place from January 10th — 11th. The capital raised from this IDO will go towards expanding the team and providing liquidity to pools for Solvent’s droplet tokens.

⏩ SOURCE