Cropper Introduces SafetyVest – Fertilizer’s New ROI Protection Feature for Vested IDOs

Cropper Finance, a decentralized platform on the Solana blockchain, has introduced its SafetyVest – Fertilizer’s New ROI Protection Feature for Vested IDOs.

Vest assured with SafetyVest

All Vested IDOs on Cropper’s IDO Launchpad Fertilizer will now be protected with the SafetyVest guarantee. The decision to implement this feature was made by the Cropper Team in order to ensure that they were providing the fairest opportunities and platform integrity to both investors and the projects that they launch.

Now with SafetyVest, your original IDO investment is protected by Cropper on Cropper’s Fertilizer IDO Launchpad. Here’s how:

- If the project’s Token Price is below Pre-Sale on any Vested Unlock Day within the Vesting Schedule, IDO Sale participants will be refunded their original investment by Cropper in USDC of equal value to the Pre-Sale price for that unlock.

- If the project’s Token Price is below the Pre-Sale value for 2 consecutive Vested Unlock Days (e.g. Month 2, Month 3), participants will be reimbursed their remaining investment amount in USDC by Cropper for all remaining Unlocks and the vesting schedule will be terminated.

How does SafetyVest work?

They will demonstrate an example of SafetyVest in practice with Winerz IDO $WZN as an example.

Sale Type: Vested | 50% at TGE, 2 months linear vesting (25% monthly)

Token Price: 0.02 USDC

Here’s 3 examples to demonstrate how SafetyVest works

Here’s what a Successful / Normal Vested IDO breakdown would look like with SafetyVest

So, if you had purchased $100 USDC of $WZN at 0.02 USDC during the IDO, you would be able to claim 5000 WZN in total. First, 50% at the TGE on April 14th, 2022 (2500 WZN) and then 25% the next 2 months following (e.g. May 15th: 1250 WZN, June 15th: 1250 WZN)

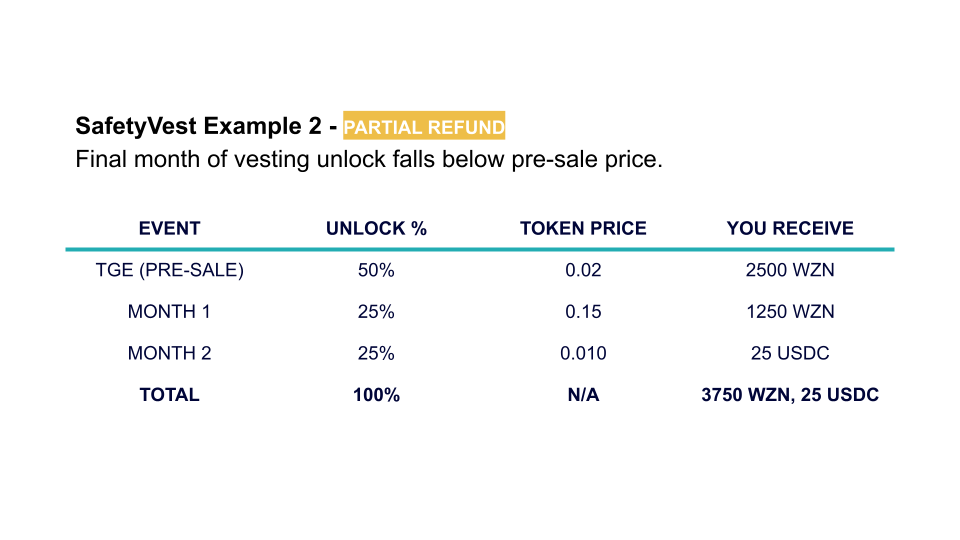

Here’s what a Partially Refunded Vested IDO breakdown would look like with SafetyVest

Now, with SafetyVest, if on May 15th WZN’s price had fallen below $0.02 USDC to $0.015 USDC, you would be reimbursed for that month’s unlock based on the original investment.

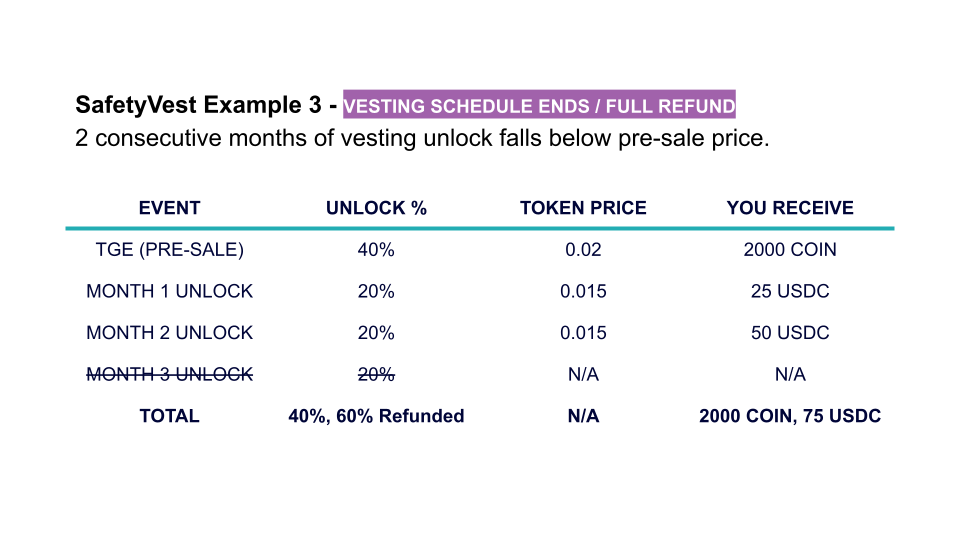

Here’s an example of if the Vesting Unlock was below the pre-sale price for 2 consecutive months with SafetyVest

However, if the Vesting Unlock period was longer than 2 months (e.g. 3 months, and the Token failed to meet or surpass its Pre-Sale price for 2 consecutive months, the vesting schedule would be terminated and all remaining unlocks would be reimbursed to the investors.

How SafetyVest helps Projects & Investors

Vested sales are a great tool for projects launching with a clear development plan and that are hungry for long-term success. They help projects bring early stability and prevent predatory pumps and dumps. This empowers projects to hit the ground running and ensure that they have the opportunity to launch and prove their utility to users and investors without having the rug pulled out from under them.

Likewise, Vested IDOs for retail investors are often met with more skepticism than Fully Unlocked IDOs. This is because, without the proper control mechanisms, a few select projects in the past have abused the Vested IDO structure, or not fulfilled their responsibilities as a functional protocol, and therefore left investors with pennies on the dollar at unlocking months after the IDO.

SafetyVest guarantee solves both of these pain points for both projects and investors. It allows the ambitious and carefully selected projects Cropper launches on Fertilizer to utilize vested IDOs within their launch strategy, while also protecting Cropper Investors from any FUD associated with Vested IDOs.

Their first SafetyVest IDO starts today with Winerz, a play-to-earn gaming technology that enables competitive 1v1 play of traditional head-to-head games powered by a token economy on Solana.

About CropperFinance

Cropper is an automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum decentralized exchange (DEX) to enable lightning-fast trades, shared liquidity, and new features for earning yield.

⏩ SOURCE