InsurAce.io and Port Finance Long-Term Strategic Collaboration

InsurAce.io is delighted to confirm their official partnership with Port Finance, the first non-custodial liquidity protocol on Solana.

InsurAce.io confirms that they have agreed on a long-term partnership with Port Finance. Port Finance is a lending protocol that aims to provide an entire suite of fixed income products including variable-rate lending, fixed-rate lending, and interest rate swaps.

Since launching, Port Finance has been incredibly diligent in its approach to security. After heavily implementing safety through a variety of security audits and bug bounty programs, they have taken a further step to protect users by confirming their partnership with InsurAce.io.

Users are now able to protect their assets on Port Finance by purchasing smart contract insurance from just 0.25% per month via InsureAce.io app — Buy now.

“We’ve been following Port Finance closely since their launch and we’ve been particularly impressed by their approach to security and the safety of their users. Being able to list them on our dApp is just the start of what we believe to be an exciting partnership.” Oliver Xie, Founder, InsurAce.io

About Port Finance

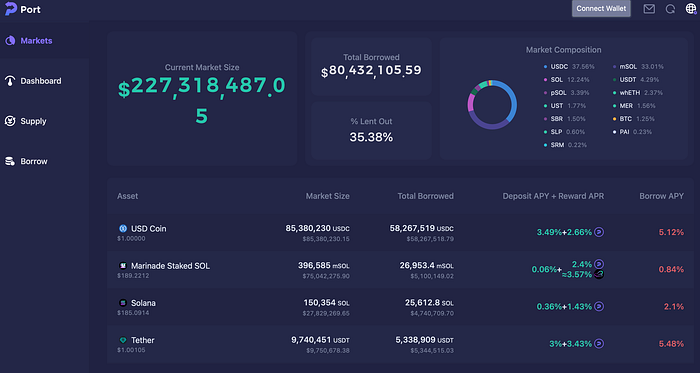

Port Finance is a money market protocol based on Solana. Port Finance leverages the speed of Solana blockchain to provide innovative lending and interest rate derivative products.

Port Finance provides a basic lending protocol that allows users to take leverage. They offer fixed rate lending to ensure transparency for their users while also creating interest rate swap markets between fixed and floating rates for users to speculate or hedge on interest rate risk.

They are a close-knit team of engineers with previous experience at the likes of Facebook, Google and Microsoft.

Website | Twitter | Telegram | Discord

About InsurAce.io

InsurAce.io is a decentralized multi-chain insurance protocol, to empower the risk protection infrastructure for the DeFi community. InsurAce.io offers portfolio-based insurance products with optimized pricing models to substantially lower the cost; launches insurance investment functions with flexible underwriting mining programs to create sustainable returns for the participants, and provides coverage for cross-chain DeFi projects to benefit the whole ecosystem.

At the time of writing, InsurAce.io has provided coverage to 87+ protocols, safeguarding over $170M DeFi assets on 12+ public chains.

InsurAce.io is backed by DeFiance Capital, Parafi Capital, Alameda Research, Hashkey group, Huobi DeFiLabs, Hashed, IOSG, Signum Capital, LongHash Ventures, and a dozen of other top funds.

Website | Twitter | Telegram | LinkedIn | Announcements | Medium

⏩ SOURCE