Switchboard Integration with Snowflake

Switchboard, a multi-chain, permissionless oracle protocol, announced its integration with Snowflake, the most secure & feature-rich multisig platform on Solana.

This integration of Switchboard with Snowflake will to allow users to manage their data feeds via a secure Multisig.

Introduction

The Switchboard protocol allows you to customize data feeds without requiring permission. Their approach has always been developer-first, allowing developers to build feeds using the Publisher app’s low-code interface and manage them all in the same app.

There will be protocols that require a similar set of data feeds as their ecosystem protocols grow and scale alongside Switchboard. Consider a group of DeFi protocols; they are most likely integrating with similar crypto assets and, as a result, require a similar set of price feeds to plug into their protocols.

A multi-signature (Multisig) wallet solution will be able to enable teams and developers to co-own data feeds in a secure manner.

Multisig Solutions for Creating and Managing Data Feeds

They integrated with Multisig solutions on Solana after receiving requests from primarily DeFi protocols to bring this feature to its users. Switchboard users can now use Multisigs to create, fund, and manage data feeds with third parties.

What exactly is a Multisig?

A multi-signature wallet enables a group of users to approve a transaction before it is carried out. Before a transaction, such as a payment or withdrawal, can be executed, many individuals and teams prefer that multiple parties sign off on it. This provides greater security by distributing responsibility for your digital assets to multiple parties and avoiding a single point of failure in the event of a compromised individual or wallet.

Multiple users can be required to manage any on-chain transaction, such as signing a payment transaction, purchasing an NFT, withdrawing from a wallet, or updating the settings and funding of a data feed in Switchboard’s use case.

How does Multisig interact with Switchboard?

Users can integrate their data feeds with a Multisig wallet when creating a data feed. To do so, they will need to:

- Create a feed using a Multisig wallet and have its authority appear immediately under the Multisig wallet’s address;

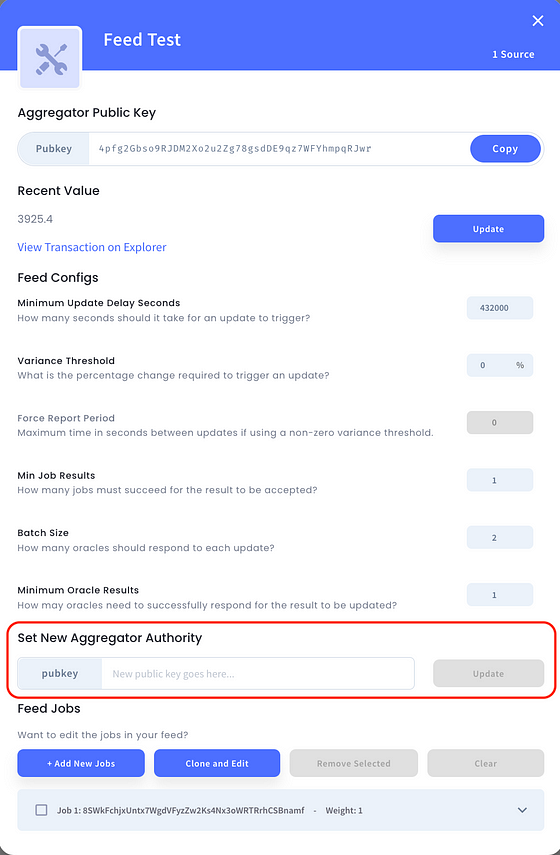

- Create a feed natively in Switchboard’s Publisher and transfer its authority to a Multisig wallet address (as shown in image).

This integration enables multiple Multisig users to gain ownership of the data feed and execute transactions responsibly, such as funding the lease of the feed or updating feed configurations.

Advantages of Using Switchboard with a Multisig Solution

Using the previous example, a group of DeFi protocol developers can create a Multisig wallet to manage a collection of price feeds required by their protocols. They can save money by sharing feeds instead of funding them individually. The fees shares by more parties, they can choose the best feed security by increasing the number of jobResults and oracleResults for each feed.

The integration improves developer operations on the protocol side, but the end users benefit greatly as well. Knowing that the protocols are using a set of price feeds controlled by a Multisig wallet adds an extra layer of security because responsibility and cross-checking are increased.

Switchboard users can use Multisig applications to create, manage, and fund data feeds that benefit not only the protocol but also their end users.

About Switchboard

Switchboard is a community-driven, decentralized oracle network built on Solana that allows anyone to publish on-chain data for smart contract developers to reliably build upon.

About Snowflake

Snowflake Safe — the most secure & feature-rich multisig platform on Solana. A multi-signature wallet allows a group of users to approve a transaction before executed. Many individuals and teams desire to have multiple parties sign off on a transaction, such as payments or withdrawals before its executed. This allows for more robust security, as it spreads the responsibility of your digital assets to multiple parties, and avoids a single point of failure in the case of a compromised individual or wallet.

SOURCE

https://switchboardxyz.medium.com/building-managing-data-feeds-through-multisig-soltuions-afb1ace6eb06