Defi News

What is DeFi?

DeFi, or decentralized finance, is one of the biggest things in the blockchain and crypto industry right now. And it’s easy to see why: DeFi provides a variety of financial services that use blockchain technology to cut out middlemen and reduce costs.

How does DeFi work?

Decentralized finance is a new approach to the financial industry and banking. It uses blockchain technology, or what some people call cryptocurrency, and applications called dApps. In this system, transactions are recorded on a blockchain or a ledger of transactions. The secure ledger creates a record that cannot be altered or hacked by third parties and allows multiple users to verify the transactions through consensus.

The chain is a structure that links together the blocks of information it holds. Each block in the chain can hold a certain amount of data and contains an encrypted hash link to the previous block. The data contained in each block cannot be changed or altered, because once a block is completed it cannot be changed and the following blocks are all dependent on its information. This technology provides secure transactions through these permanent links and breaks down data to a manageable size by breaking it into pieces.

Pros of DeFi

The DeFi movement aims at introducing various benefits for customers and investors. Some of the notable advantages of DeFi would include the destruction of negotiators alongside centralized control. With these, one gains more transparency and control, whilst obtaining a decentralized network wherein all entities are granted access to financial services.

DeFi, which is also referred to as decentralized finance and dApp development, is the abstract of blockchain technology, a concept that has developed over time to address issues such as the lack of trust between users. DeFi would allow the creation of decentralized platforms that are designed to help in creating investment opportunities on a sustainable basis.

🔹Convenience

🔹 Security

🔹Autonomy

🔹 Profitability

Cons of Decentralized Finance

While the benefits of DeFi are many, it is important to get a neutral opinion about its cons and drawbacks as well. The majority of problems associated with today’s DeFi projects are generally linked to blockchain and other related technologies. Blockchain’s scalability issues have caused headwinds for the implementation of smart contracts in specific industries like supply chain management. On the other hand, blockchain’s security concerns have also dissuaded many investors from supporting DeFi startups

🔹Limited integration

🔹Poor user experience

🔹Lack of oversight

🔹Volatility and risk

The Future of DeFi

Decentralized finance is growing at a rapid pace with no signs of slowing down. But while the technology behind this innovation is truly fascinating, there are still many aspects lacking when it comes to a complete ecosystem. Current laws were crafted based on the idea of separate financial jurisdictions, each with its own set of laws and rules.

As demand for DeFi grows, concerns arise over who is responsible for investigating financial crimes that occur across borders. Who would enforce the regulations, and how would they enforce them? Other concerns include system stability, energy requirements, carbon footprint and hardware failures.

QuickSwap is introducing the first phase in our governance vote about whether or not we should do a token split to make $QUICK — our native governance and utility token — more appealing...

Injective Protocol is thrilled to announced that Injective PRO V2 went live! The upgrade includes a major user interface overhaul and backend optimizations that ultimately create the best...

PancakeSwap we’re proud to announce a new Syrup Pool with Biswap. Biswap is the 1st DEX on the BNB chain with a 3-type referral program and attractive trading fees. The Syrup Pool: Stake...

The Covid Doge community, the Covid Doge team will launch a session of “MX DeFi” to enable mining on COVIDDOGE tokens from March 11 to March 13. Throughout the campaign, users...

Fountain Protocol is pleased to announce our partnership with GemKeeper Finance which is a community-focused AMM & DeFi Platform built on Oasis. Through this strategic...

The mission of MachineFi is simple: connecting the real world to Web3. MachineFi brings verifiable, trusted data from the physical world onto the blockchain to power an entire economy for...

Lead Wallet is excited to announce a strategic partnership with NEXTYPE, an open, cross-chain integrated application system built on Games, NFT and DeFi for NEXT GENERATION. Lead Wallet...

The Gadget War team will launch a session of “MX DeFi” to enable mining on GWAR tokens from March 11 to March 13. Throughout the campaign, users can stake MX and GWAR to earn...

How Fantom Liquid Staking by Ankr works Ankr Earn allows users to stake more flexibly with Fantom Liquid Staking. During the staking process, FTM is delegated to several validator nodes...

Cronos Stable Swap (“CROSS”) is pleased to announce a strategic partnership with Autofarm by integrating CROSS’ unrivalled low-slippage stableswap capabilities into Autofarm’s...

Symbiosis is ready for beta mainnet launch. This is after a long period of testing, continuous development, and tons of hard work. SYMBIOSIS SIGNIFICANTLY UPDATE ITS WEB APP The swap...

Universe Finance is moving step by step to achieve our roadmap. Today, They are happy to announce that two new products — leveraged vaults and lending vaults— are available on Universe...

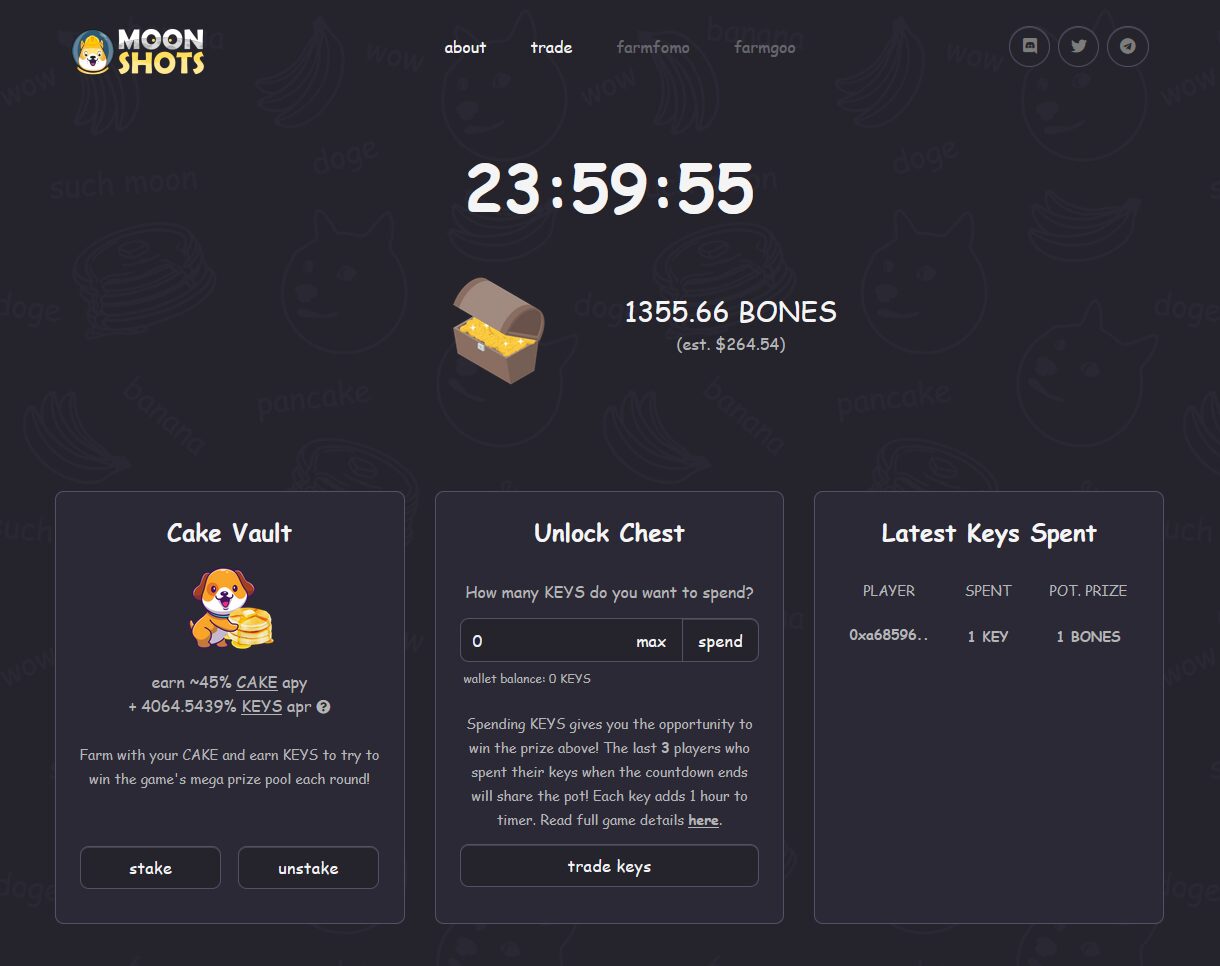

FarmFomo is a mash-up of the “no-loss lottery” concept mixed with a classic “Fomo3D” jackpot game which rewards players for buying the last key before the timer runs out, unlocking...

Genius Yield partnership that will strengthen their ecosystem. Genius Yield are proud to announce that they have signed another Memorandum of Understanding with MinSwap, the first multi-pool...

Following the successful Pioneer Program Season 1 with its winners are still a crucial part of the KardiaChain Ecosystem, the platform return with the Pioneer Program Season 2 with even more...

NAOS Galaxy Alpha Lending Pool is coming! Investors must complete a one-time KYC through Securitize to be whitelisted. Complete KYC earlier than later, as it takes some time to get...

Understanding the rewards The tetuQi strategy is based on QI locking and 90% of the rewards earned by the strategy are wrapped to tetuQi tokens and distributed to tetuQi holders while 10%...

Loans. From making that big purchase to committing oneself to both short and long-term investments, having to take out a loan becomes inevitable at some point in our lives. And loans can...