Alpha Finance Announces New Liquidity Mining Period for Alpha Homora V1 and V2 (Ethereum + BSC)

Announcing the new liquidity mining period for Alpha Homora – both on Ethereum (V1 and V2) and BSC (v1).

For those who haven’t migrated from Alpha Homora V1 to V2 on Ethereum, be sure to migrate since leveraged yield farming on Alpha Homora V2 can get you ~2x the ALPHA rewards!

Alpha Homora V1 and V2 on Ethereum: New Liquidity Mining Period

The new liquidity mining period is from June 23rd, 8am UTC – July 5th, 8am UTC.

During this period on Alpha Homora V1 and V2 on Ethereum:

- 6,000,000 ALPHA will be distributed between June 23rd and July 5th to the following eligible users:

15% to stablecoin lenders on Alpha Homora V2 (USDT, USDC, DAI):

- Eligible users will receive ALPHA rewards proportionately to the value of stablecoins they lend vs. the total value of stablecoins lent on Alpha Homora V2.

7% to ETH lenders on Alpha Homora V2:

- Eligible users will receive ALPHA rewards proportionately to the value of ETH they lend vs. the total value of ETH lent on Alpha Homora V2.

78% to Alpha Homora V1 and V2 users who open leveraged positions of more than 1x (including leveraged yield farming and leveraged liquidity providing positions):

- Eligible users will receive ALPHA rewards proportionately to the value of assets they borrow vs. the total value of assets borrowed on Alpha Homora V1 and V2.

- The value of ETH borrowed on Alpha Homora V2 will be treated as 2x the actual borrow value. This means leveraged yield farming on Alpha Homora V2 can get you ~2x the ALPHA rewards.

- For users who already have leveraged positions of at least 1x open, there’s no need to close and re-open a new position to collect these ALPHA rewards.

ALPHA rewards will be available to claim:

- By June 30th for the latest period (ended June 23rd)

- By July 12th for the new period (ending July 5th)

Users on Alpha Homora V1 are encouraged to migrate to V2

- On V2, farmers can borrow multiple assets/stablecoins in one position. This allows them to borrow the asset with a lower borrow APY and also spreads the borrow demand across multiple assets, thereby increasing the yield.

- Leveraged yield farming on V2 offers ~2x the ALPHA rewards.

- Lenders of ETH also earn a higher lending interest rate on V2 as compared to V1.

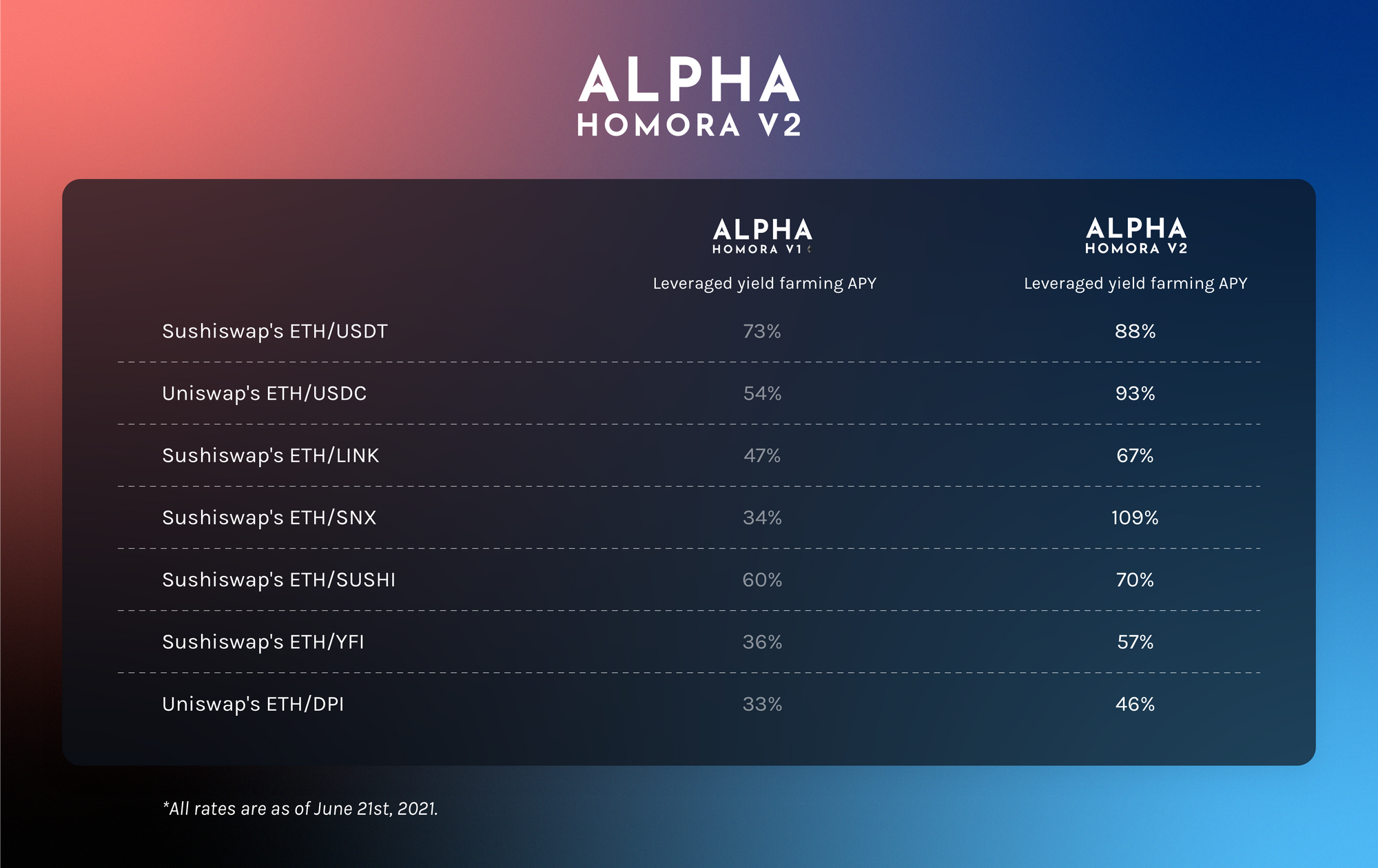

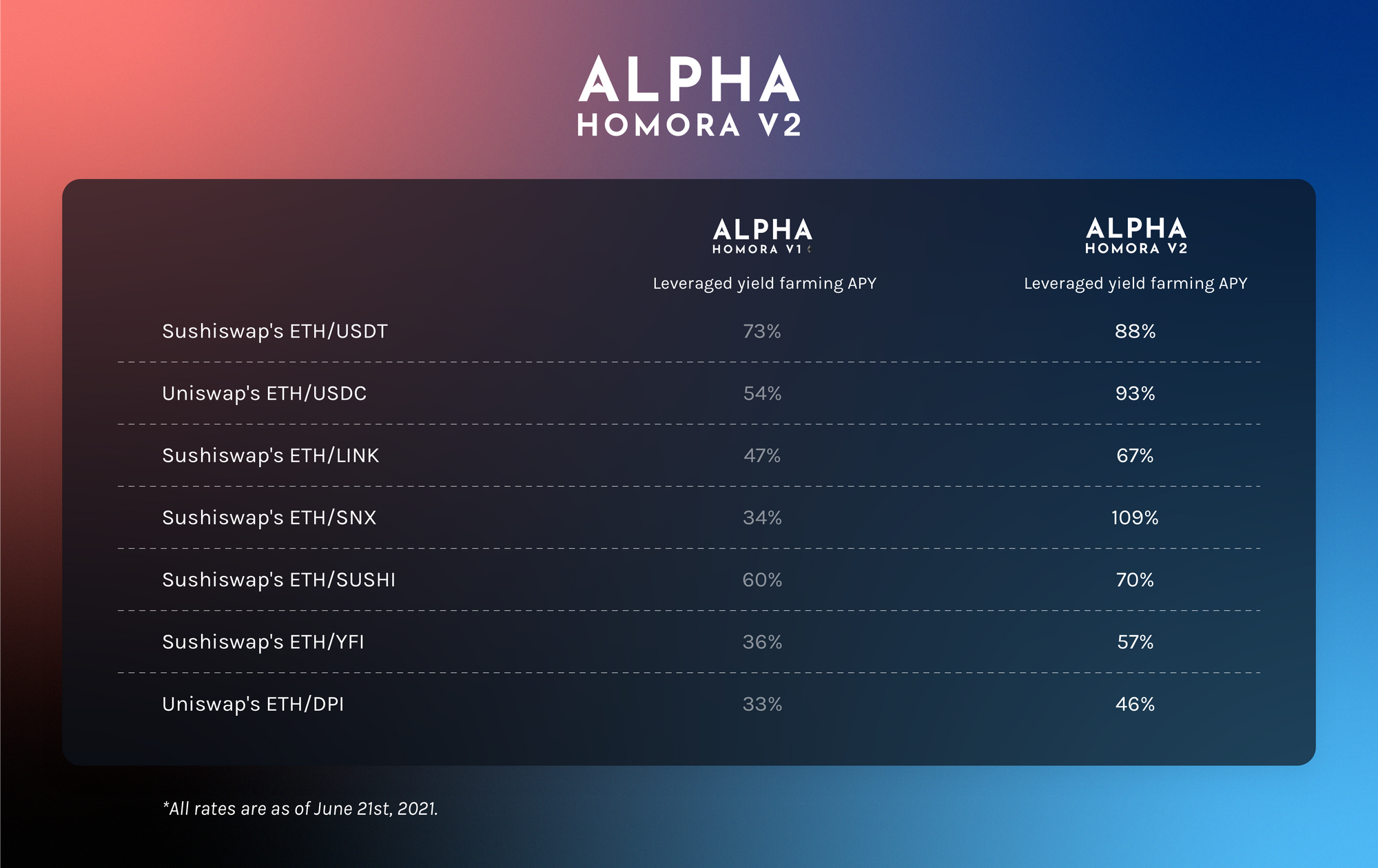

Here’s a quick comparison between the APY on some of the pools in V2 and V1:

Alpha Homora V1 BSC: Next Liquidity Mining Period

The new liquidity mining period will be from June 23rd, 8am UTC – July 5th, 8am UTC.

During this liquidity mining period on Alpha Homora V1 BSC:

- 320,000 ALPHA will be distributed between June 23rd and July 5th to borrowers (or yield farmers who open leveraged positions of more than 1x).

ALPHA rewards will be available to claim:

- By June 30th for the latest period (ended June 23rd)

- By July 12th for the new period (ending July 5th)

About Alpha Finance Lab

Alpha Finance Lab is a DeFi Lab and on a mission to build an ecosystem of DeFi products (the Alpha ecosystem), consisting of innovative building blocks that capture unaddressed demand in key pillars of the financial system. These building blocks will interoperate, creating the Alpha ecosystem that will be an innovative and more capital efficient way to banking in DeFi.

📰 INFO