PERI Finance (PERI) Token dApp Staking Details

Benefits of Stakeholders

One of the exciting new features PERI added in their recent update is PERI.pool, a staking program for PERI holders. PERI Finance locked staking rewards for 9,000,000 PERI, which is 45% for total supply and 76,924 PERIs are weekly distributed to the PERI stakeholders.

This article will explain details of the PERI dApp staking structure.

Staking Details

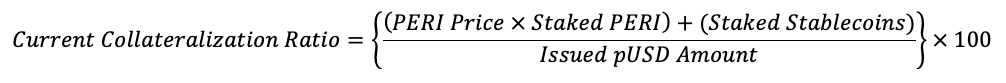

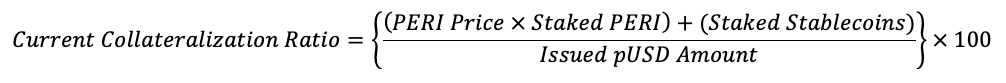

Current Collateralization Ratio(C-ratio)

If you stake PERI in the dApp, you can mint pUSD by 1pUSD : 4 USDC ratios, which means if you want to mint 1pUSD, you have to have at least 4 times bigger valued asset compared to 1pUSD.

Let’s say the price of PERI is currently at $4, and you want to mint 1pUSD. You just need 1 PERI to mint 1pUSD because this fits on ratio of 1pUSD : 4USDC ($4/$4 valued PERI = 1PERI).

We called this as ‘Collateralization ratio(C-ratio)’.

According to this formula, when price of PERI drops, the collateralization ratio drops under the 400% because your value of PERI decreased.

(Ratio is based on pUSD to USDC, so if PERI prices decreases, you need to put more PERI to cover the amount of loss)

This is the reason for your collateralization ratio is often drops.

Ex) The price of PERI drops from $4 to $2, (always 1pUSD = $4)

PERI price $4 = 1pUSD : 1PERI (C-ratio = 400%)

↓

PERI price $2 = 1pUSD : 2PERI (C-ratio = 200%)

↓

Burn half of minted pUSD

Reseversly, when your price of PERI goes up, you have more chance to mint pUSD. as the formula are based on PUSD to USDC, you currently have more valued asset to claim it.

Ex) The price of PERI raises from $4 to $8, (always 1pUSD = $4)

PERI price $4 = 1pUSD : 1PERI (C-ratio = 400%)

↓

PERI price $8 = 1pUSD : 0.5PERI (C-ratio = 800%)

↓

Can mint additional pUSD by staking PERI

Target Collateralization Ratio (fixed)

Users are only available to claim their staking reward at collateralization ratio of 400%. This is called ‘Target collateralization ratio’.

Liquidation Ratio (fixed)

If user’s collateralization ratio is under 150%, system can liquidate your staked tokens. So you should check current c-ratio regularly.

Why PERI dApp is on Polygon?

With the Polygon network, users can staking dApp with low gas-fee, high-speed transaction.

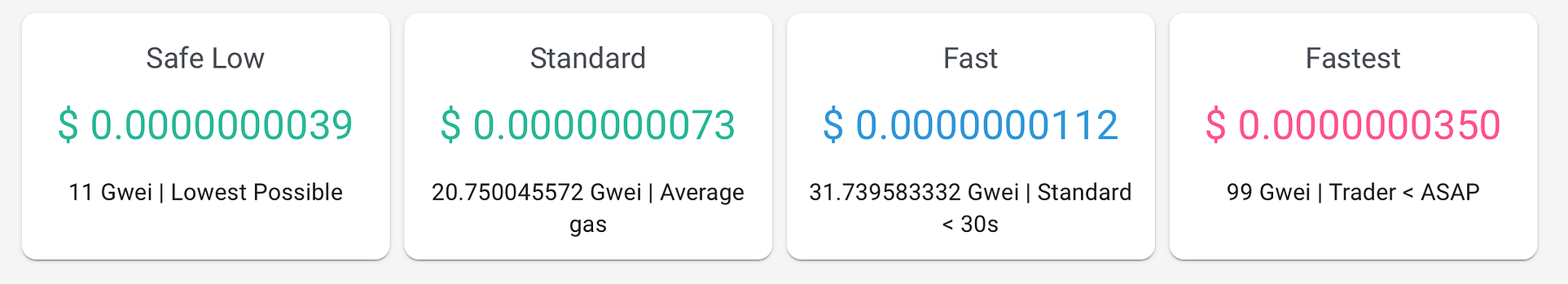

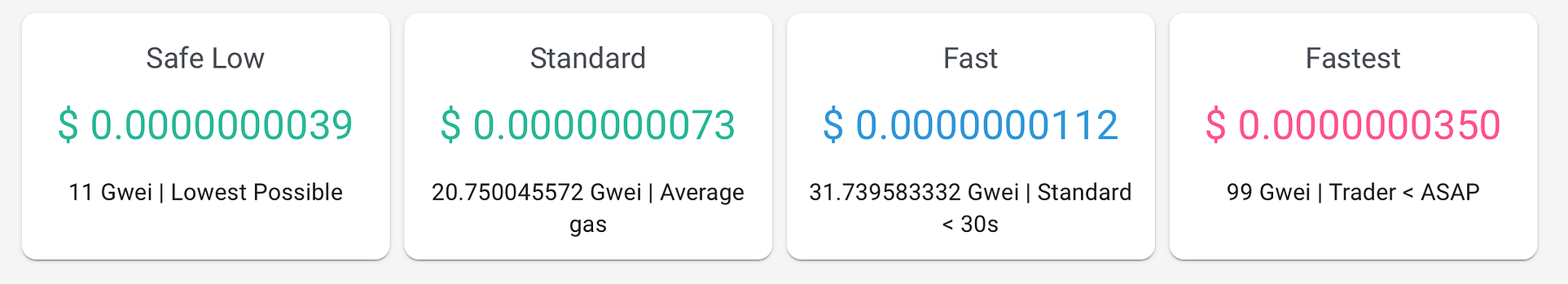

When you see ‘network fees’ on the staking dApp, sometimes that price is surge to 200~300 gwei, so users think it is absurdly high.

But as you see this spreadsheet above, paying gas fee by MATIC is millions of times smaller than paying gas with ETH. And here’s details of Gwei digit:

10⁹ Gwei = 1 MATIC

20 Gwei = 0.00000002 MATIC

Although the network gas fee seems very high, you only need to pay 0.0000002 MATIC(current Matic price is less than one USDT). This shows that gas fee in polygon network is extremely cheaper than that of Ethereum.

About PERI Finance

PERI Finance is an innovative synthetics issuance and derivatives market that utilizes blockchain technology to supercharge trades through its protocol.

📰 INFO

https://medium.com/perifinance/peri-finance-dapp-details-about-peri-staking-93a61ea0e89c