BiFi Launches Native BTC Lending on DeFi

TL;DR

- The world’s first native BTC lending on DeFi — connecting Bitcoin and Ethereum networks

- To lend or borrow BTC with ERC20 assets on BiFi, users only need real BTC from their Bitcoin wallet

- BIFROST ensures the security of BiFi with cryptographic proofs and our own multichain technology

- BIFROST aims to accelerate the use of BTC currently stagnant at 1% on Ethereum, increase the adoption of DeFi, and connect the whole fragmented blockchain ecosystem

- 👉 Start BTC Lending on BiFi

- 👉 BTC Lending Guide

Introduction

For the last few years, a myriad of blockchain networks has been brought out to the world to address the problem of scalability. Each network compete with each other to attract users with its own unique advantages, and it is natural that they interact with and move their capital to networks that give them the best experience.

DeFi is a global ecosystem that must scale to support more financial activity. The current systems, however, have further fragmented the DeFi ecosystem and diversified assets, resulting in a financial economy that does not scale.

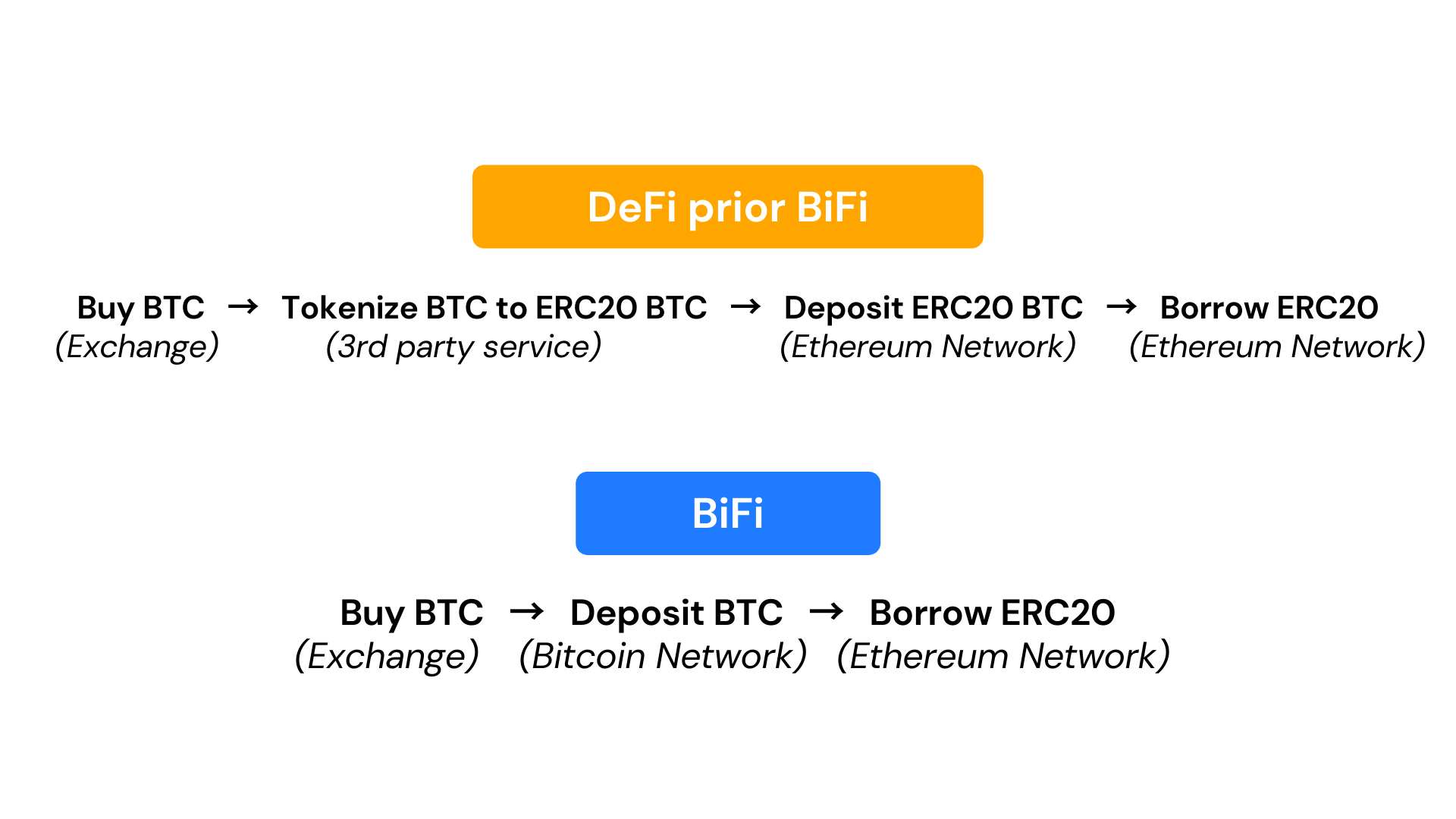

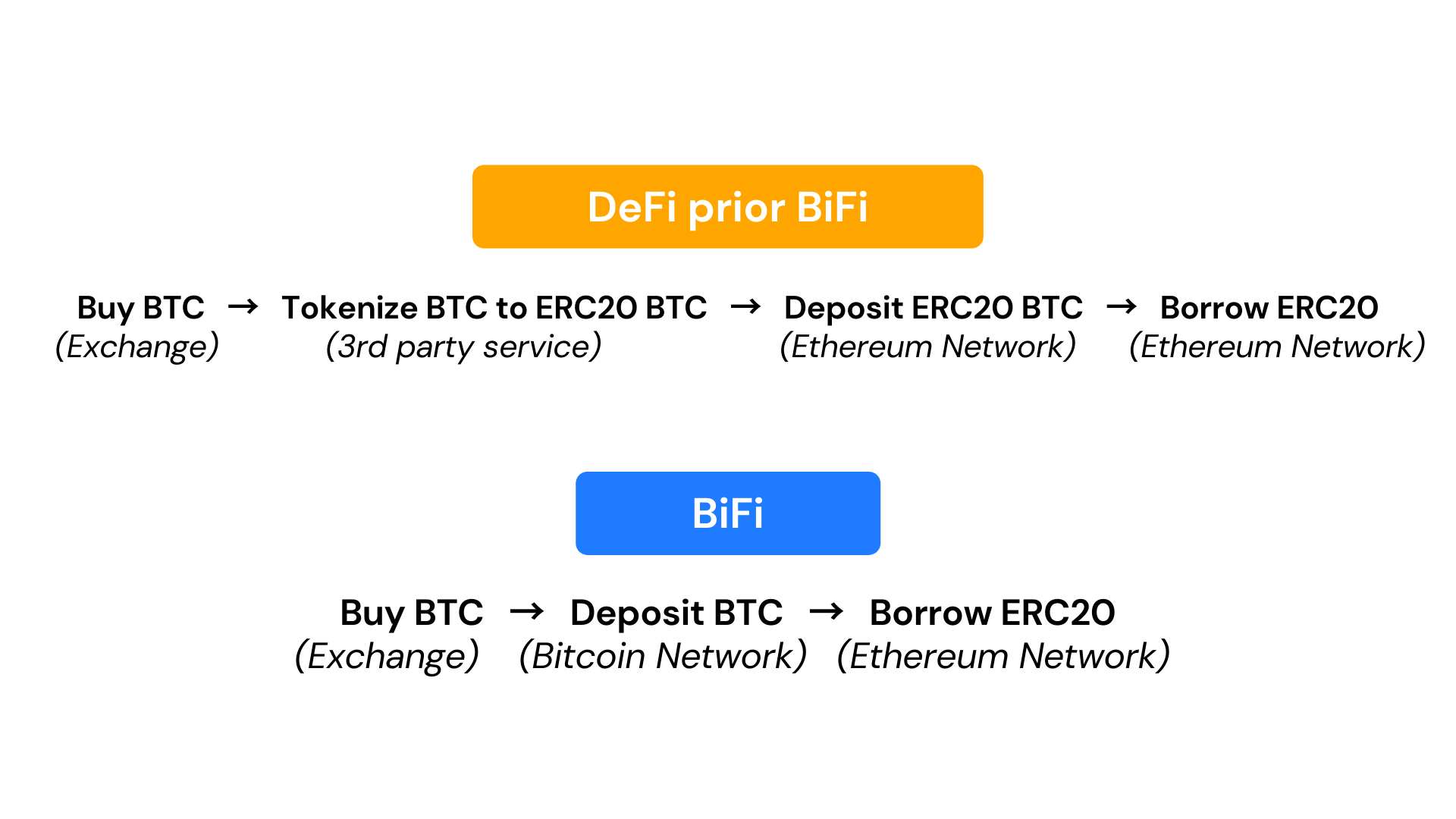

DeFi prior BiFi.

Prior BiFi, the world of DeFi was stuck in each of its own ecosystems. If you wanted to trade assets on Ethereum, you can only trade assets that exist within Ethereum (ex. ERC20 assets on Ethereum). Lending and borrowing ERC20 assets with non-ERC20 assets were not possible.

The biggest problem challenging DeFi: Bitcoin

Bitcoin (BTC) is the oldest and most-widely held asset. Bitcoiners could only engage in DeFi lending protocols using tokenized BTC on Ethereum (such as wBTC, renBTC, or hBTC). These tokens need to be minted on third party services to be used as a form of “BTC” in DeFi services. In the case of wBTC, a trusted custodian and merchant are required to authorize and mint wBTC. All these tokenized BTC only account for about 1% of the total BTC market.

This is the only way Bitcoiners could participate in DeFi — until today.

Enter BiFi — DeFi 2.0

BiFi is “like Compound or Aave, but with real, native Bitcoin. Deposit BTC, Borrow ERC-20, and vice versa.”

BiFi is the world’s first DeFi lending that works across native chains. They connect Bitcoin and Ethereum networks directly. Once native BTC has been deposited, it can be used to borrow other assets on Ethereum network — for the first time ever.

Here’s a better visualization:

Designed with a security-first mindset, BiFi allows anyone in the world to lend and borrow digital assets from one native chain to another without a third-party chain intervening. Anyone with a MetaMask wallet can earn interest on their digital assets and BiFi token rewards in return.

So how does it work?

BiFi supports lending native BTC and borrowing ERC20 assets on Ethereum, and vice versa. So if you borrow native BTC with ERC20 assets as collateral, native BTC will be deposited to your wallet!

🔍 Learn How to Lend & Borrow BTC on BiFi

⚠️ Currently, you can only register ‘My BTC Address’ that start with 1 or bc1. BiFi will add more Bitcoin wallets as soon they complete each testing.

- Available Exchange Wallets: Bithumb, Binance, CoinOne, etc.

- Unavailable Exchange Wallets: Upbit, Coinbase, etc.

Security

Transfer of data is essential to Bitcoin-Ethereum connectivity. Transactions must be transferred from one chain to another correctly. If a user deposits 10 BTC on BiFi, the same exact data must be transferred to Ethereum network. This Computational Integrity of blockchain transactions ensures transparency and security.

“Integrity is doing the right thing, even when no one’s watching.” C.S.Lewis

Computational Integrity in blockchains reports the correct the output of a certain computation, so that anyone at any time can verify that the computation is correct. This is how existing solutions with their own chains maintain their computational integrity. Additionally, the participation of a large number of nodes is needed to successfully implement this method. Often times, depending on the consensus of a chain, it may be inexpensive or fast.

BIFROST maintains computational integrity of publicly trustworthy blockchains rather than creating a new chain again. BiFi build cryptographic proofs to verify the accuracy of transactions that occurred on Bitcoin network and verify it on-chain on Ethereum smart contracts. It may be more expensive to perform on-chain verifications, but it’s the most secure way given the method of computational integrity.

BIFROST uses fraud proofs to verify that the actions of the Relayer are correct. This is also a method used in Optimistic Rollup of Ethereum chains on Layer 2.

Previously, existing solutions create a proof within Layer 2 and verify transactions on-chain. By creating cryptographic proofs and verifying them on-chain, BIFROST holds the promise to enhance the security of our protocol with stringent computational integrity requirements.

BTC Extension Smart Contract Security Audit by Certik

Looking Ahead

Bitcoin and Ethereum networks are just tips of the iceberg.

BiFi will soon reveal a multichain wallet to support native-chain features. It is their ultimate vision to share their multichain technology that works across cross-EVM and non-EVM networks through the BIFROST Multichain Dev Suite.

📰 INFO

https://medium.com/bifrost/introducing-native-btc-lending-a74e6f5c496a