pSTAKE’s Governance Token Introduction

TL;DR

- pSTAKE is excited to introduce its governance token — $PSTAKE

- $PSTAKE is an ERC-20 token that will primarily be used for the governance of the pSTAKE protocol

- To align interests of the users of pSTAKE and the long term growth of the protocol, $PSTAKE token holders will also receive a portion of the protocol fees once governance staking goes live

- $PSTAKE, in addition to being the governance token of the protocol, will also align incentives of its various stakeholders

- $PSTAKE will accrue value with an increase in the economic activity of the protocol

With pSTAKE uncapped launch supporting liquid staking for ATOM planned for later this month, they are excited to introduce pSTAKE’s governance token — $PSTAKE. A detailed token launch and distribution blog will follow in an upcoming update.

$PSTAKE is an ERC-20 token that provides its holders with a two fold benefit, including:

- Voting rights

- Direct benefit from the economic activity in the pSTAKE ecosystem via fee sharing

$PSTAKE is the governance and fee sharing token of the pSTAKE protocol. $PSTAKE holders can participate in the protocol’s governance to ensure pSTAKE’s long term success while receiving a share of the fees generated by the application.

Currently, pSTAKE issues 1:1 pegged ERC-20 liquid staking representative tokens on the Ethereum network, with a long-term aim of building a multi-chain protocol that will enable liquid staking across multiple networks including the Persistence Core-1 chain.

At its core, $PSTAKE aligns stakeholder incentives in pSTAKE’s liquid staking ecosystem.

These stakeholders are:

- Users (stkTOKEN holders)

- pBridge Validators

- Safelisted Validators (validators who receive delegations via the pSTAKE protocol)

- pSTAKE governance participants

In this article, they will explore the roles of the various stakeholders and then clarify how the $PSTAKE token accrues value from pSTAKE’s interconnected system.

pSTAKE Users

pSTAKE users, in this context, are the holders of stkTOKENs. stkTOKEN holders can use their staked representative tokens as collateral on borrowing platforms, supply liquidity on DEXs, and engage in various other activities to generate additional yield on their staked assets.

stkTOKEN holders will be incentivised to perform certain activities which will help to accelerate growth of the pSTAKE ecosystem, such as bootstrapping and providing sustained liquidity on DEXs.

$PSTAKE will effectively align the incentives of pSTAKE users with stakers of the supported network by distributing a majority of the pSTAKE supply (~50%) to stkTOKEN holders over time.

The pSTAKE team is also actively working on designing a mechanism to allow representative token holders (or stkTOKEN holders) to participate in governance of the underlying chain. For example, stkATOM holders should have the ability to vote on Cosmos Hub governance proposals. We plan to implement this functionality in the near future.

pSTAKE currently supports liquid staking for ATOM (the native token of the Cosmos Hub), with plans to support liquid staking for multiple assets — from both within and outside the Cosmos ecosystem. This includes ETH, XPRT, LUNA, and many other assets.

pBridge Validators

One of the most important components of pSTAKE is the pBridge built by the Persistence team. The pBridge enables assets to flow from one blockchain to another. The current pBridge implementation supports minting of pegged tokens on the Ethereum blockchain for the projects utilising Tendermint PBFT consensus built using the Cosmos SDK.

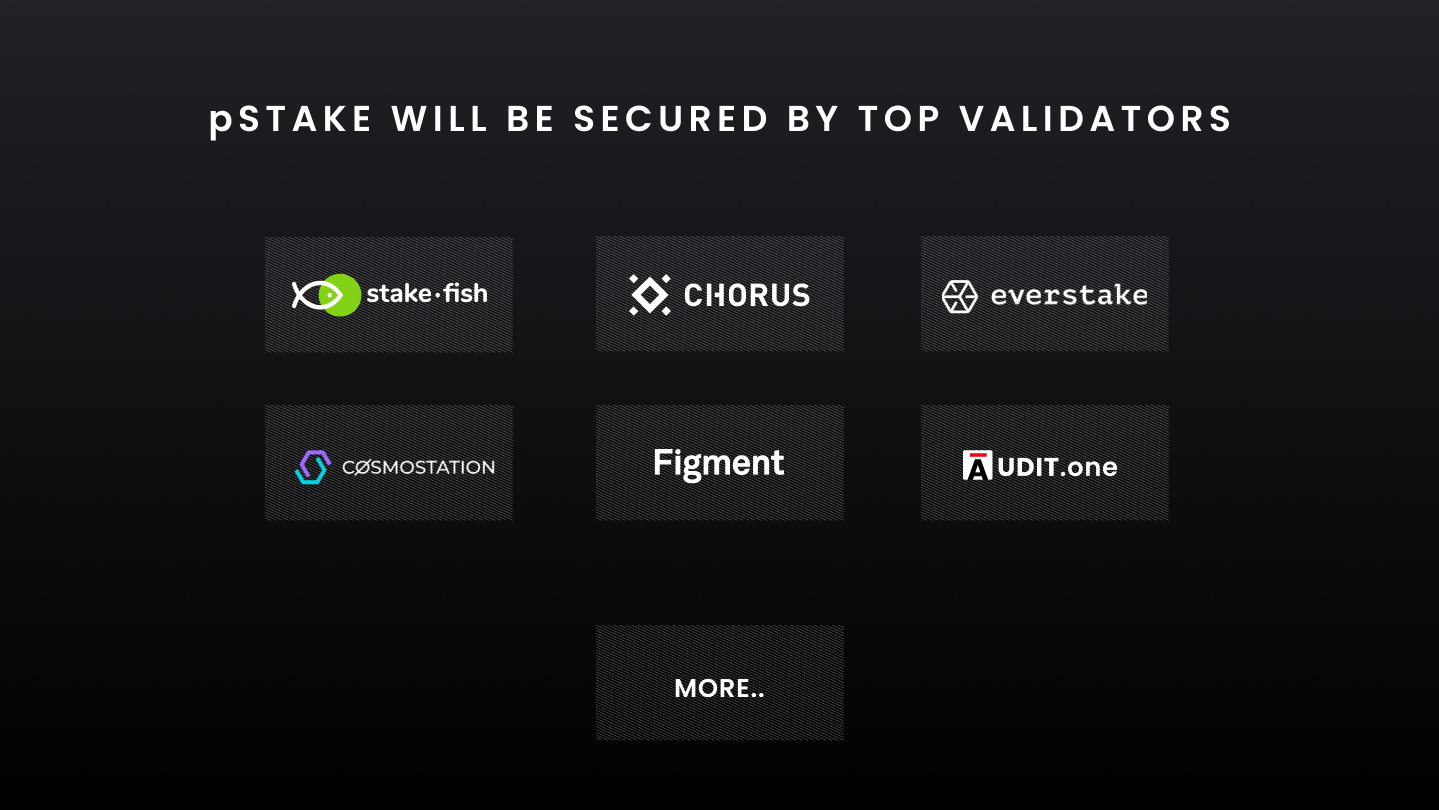

pBridge is an MPC-based bridge that will be secured by some of the leading PoS validators. In order to bootstrap pSTAKE and ensure that the security of pBridge is not compromised, a set of highly reputed, industry-leading validators have been currently onboarded onto the bridge, with a goal of increasing the validator set over time. To minimise security risks, we have thoroughly vetted the current set of validators.

At the time of uncapped launch, the active validators securing the pBridge would be:

In order to align incentives of the bridge validators with that of the pSTAKE protocol, the validators are incentivised with delegations of the native tokens staked via pSTAKE. Currently, all pBridge validators receive an equal amount of ATOM delegations.

As support for multiple assets is introduced on pSTAKE (such as XPRT, BAND, LUNA, etc.), the power of setting protocol parameters that might potentially affect the underlying chain’s security will be gradually shifted to the users. Therefore, to align the interests of the users with the long term growth of the protocol, ~50% of $PSTAKE’s total genesis supply will be distributed to pSTAKE’s stakeholders.

Safelisted Validators

Safelisted Validators are the validators that receive delegations via pSTAKE. Currently, the Safelisted Validators are the same as the pBridge validators, all of whom are listed above. As pSTAKE’s TVL increases, more validators will be safelisted to receive delegations via pSTAKE to further decentralise the underlying network.

Safelisted Validators will be encouraged to use pSTAKE to stake the rewards they earn as commissions to maximise their skin in the game while also contributing to the growth of the pSTAKE ecosystem.

pSTAKE Governance Participants

The pSTAKE team is in the process of implementing native governance staking, which will allow pSTAKE users to stake the $PSTAKE tokens earned and vote on governance proposals that modify parameters such as:

- Minting fees

- Staking service fees

- Safelist Validator onboarding parameters

- Voting to onboard validators

The $PSTAKE token will accrue value as the protocol generates revenue. A portion of the revenue that pSTAKE generates will be distributed to $PSTAKE and $XPRT stakers.

This will align the incentives of $PSTAKE holders and stkTOKEN holders, thus helping to preserve the security of the underlying blockchain.

$PSTAKE Value Accrual

$PSTAKE will accrue value with an increase in the protocol’s economic activity.

$PSTAKE stakers will also benefit in proportion to the increase in the protocol’s revenues.

The sources of revenue generation are as follows:

- Minting Fees: For minting pTOKENS against user’s deposits

- Service Fees: A portion of the staking rewards earned by stkTOKEN holders

Revenue growth for pSTAKE can be accelerated by the following factors:

- Expanding support to new assets would result in new sources of revenue both in minting fees and service fees

- Sustained growth in TVL for stkTOKENs on pSTAKE is expected to generate significantly higher revenues. Sustaining this increased revenue will be heavily dependent on the staking rewards (or block rewards) of the underlying blockchain network

- Increased utility of stkTOKENs

Details around the launch of $PSTAKE and distribution will be shared at a later stage

About pSTAKE

pSTAKE is a liquid staking solution that unlocks the potential of staked PoS assets (e.g. ATOM). PoS token holders can deposit their tokens on the pSTAKE application to mint 1:1 pegged ERC-20 wrapped unstaked tokens, which are represented as pTOKENs (e.g. pATOM) that can then be transferred to other wallets or smart contracts on the Ethereum network to generate additional yield.

📰 INFO

https://medium.com/pstakefinance/introducing-pstake-e4e6494169c7