InsurAce New Chain Deployment with Avalanche

Following InsurAce Ethereum mainnet launch in April, BSC launch in June and Polygon launch in September, they are proud to announce that they are launching their Avalanche mainnet. This is a major step towards their multi-chain insurance v2.0 where they expand to more public chain ecosystems and bring their insurance products and services to a wider audience in the DeFi space.

InsurAce.io is now the first insurance protocol to deploy on these four ecosystems.

InsurAce aim to be the leading insurance protocol on the Avalanche ecosystem and contribute to the safety of projects and the protection of Avalanche users.

By launching on Avalanche they will be joining their partners Sushiswap, as well as some great DeFi projects like Alliance Block, Arrow DFMs, BENQI, BiFrost, Chainlink, Curate, CyberFi, DCTDao, DeFi Yield Protocol (DYP), E-Money, Frax, Frontier, Hummingbot, ImmuneFi, Knit Finance, Marginswap, MyCointainer, Orion Protocol, Poolz, Prosper, Reef, Ren, Router Protocol, Tether, TrueUSD, Union, and Yield.

Given their previous experience launching our Ethereum, BSC and Polygon mainnets and all of their developments in the past few weeks, they are very confident in this deployment. However, there are a few new additions to their app that you should check out. These include:

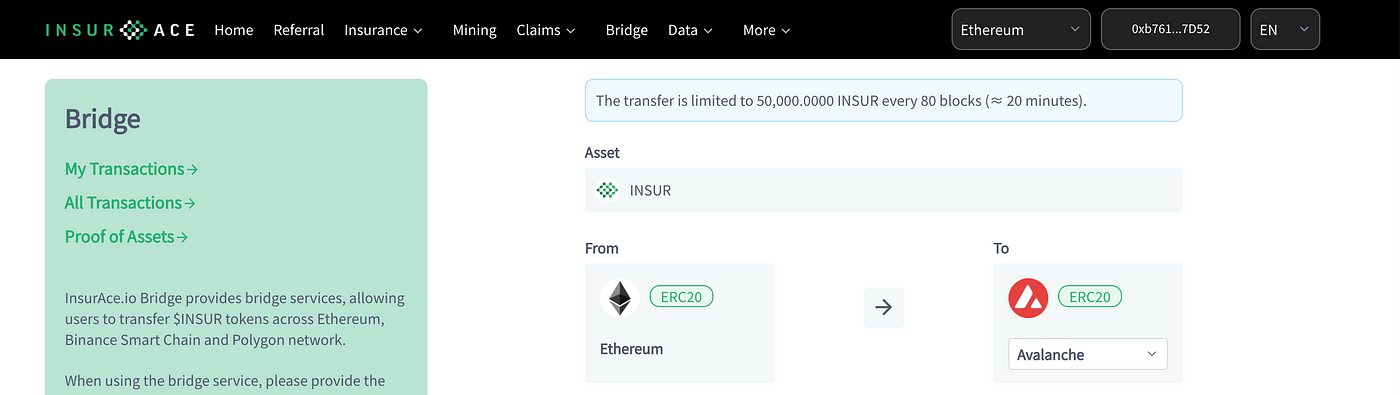

> Cross-chain bridge for $INSUR to Avalanche using their proprietary ETH-BSC-Polygon-Avalanche bridge;

> The trading pair is launched on Pangolin Exchange

> New staking pool setups for Avalanche, with high yields for early stakers

> New protocol listing: Benqi and Pangolin

The official deployment date is Wednesday 6th October at 9am EST, however users may notice some AVAX activity on our app before then as they conduct live testing on the network. Upon this official deployment, users will be able to stake assets via their underwriting mining to generate rewards, and their insurance services will go live.

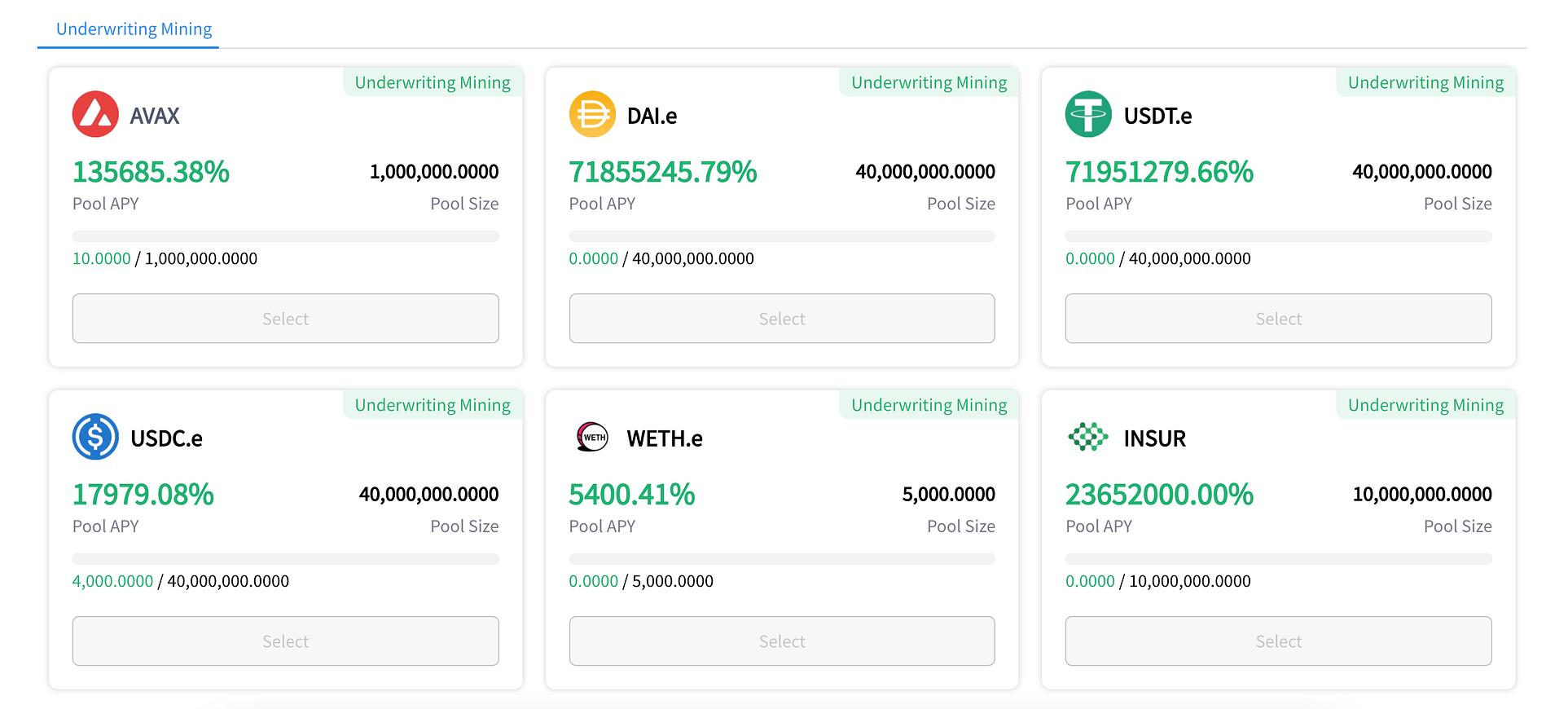

The Avalanche underwriting mining pools will have a dynamic return APY to help generate the desired TVL. Initial returns can be up to 800% APY. This figure will change as the pool fills up.

Users will be able to stake AVAX, DAI.e, USDT.e, USDC.e, WETH.e, and INSUR tokens.

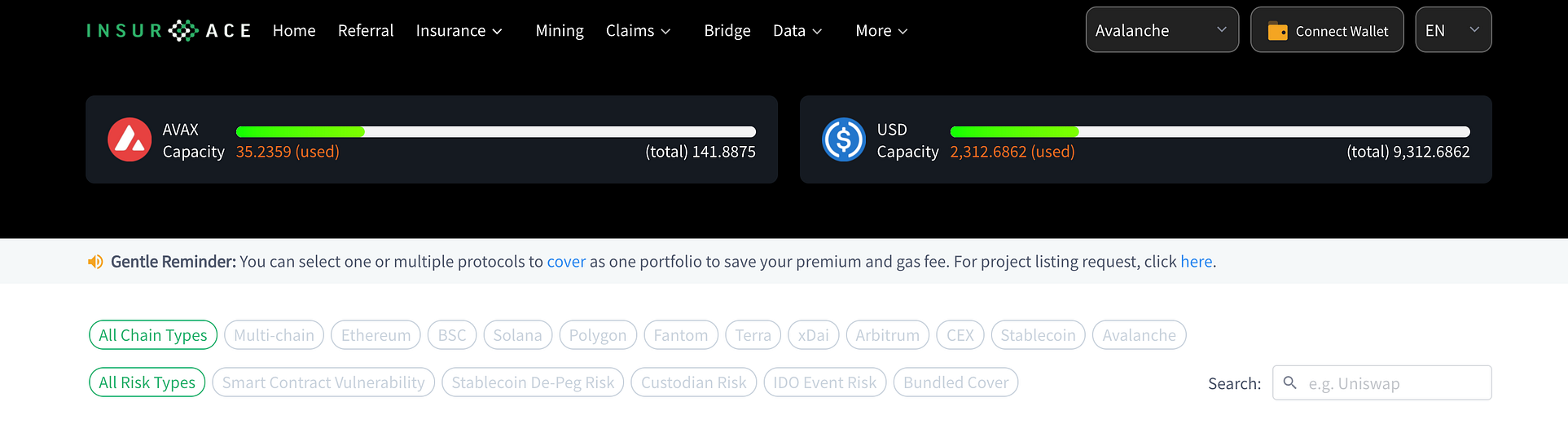

Insurance customers wishing to use the avalanche network to purchase cover can now do so using AVAX, DAI.e, USDT.e, and USDC.e.

InsurAce are in talks with several native Avalanche protocols like Pangolin and Benqi to provide insurance services to their users. Announcements on these developments will be made in the coming weeks.

“The AVA Labs team and wider Avalanche community have been extremely active in recent months, helping to grow this tremendous ecosystem where some leading DeFi projects have decided to build. It is their absolute pleasure to be able to deploy onto Avalanche and offer their insurance services to Avalanche users globally.” Oliver Xie, Founder, InsurAce.io

As InsurAce continue to build and grow, they are forever grateful for the support of their Community.

The InsurAce.io Team

$INSUR token on Avalanche

With the deployment to Avalanche, the $INSUR token has been created there as well.

N.B. this is not the issuance of new tokens and does not affect the total circulation of $INSUR, which remains to be 100,000,000 in total.

The $INSUR token on Avalanche can be found here.

Cross-chain Bridge for Avalanche

When they launched to BSC in June, they also launched their proprietary cross-chain bridge solution embedded in their dApp. The bridge works as a gateway to securely transfer the $INSUR tokens among different chains. Now they have also added Avalanche into this bridge as well, with which $INSUR tokens can be transferred among Ethereum, BSC, Polygon and Avalanche easily. To find out how to use the bridge, please refer to this user guide.

To check the proof of assets among different chains, please check this page.

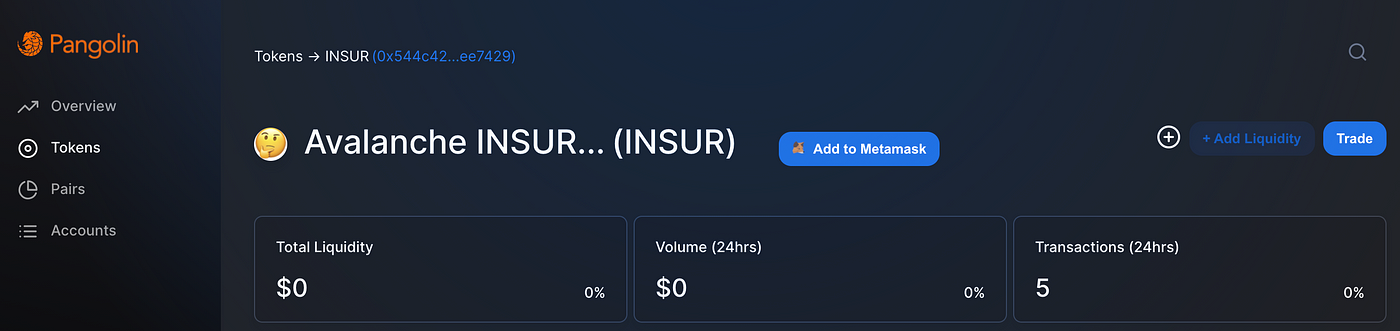

Launch Trading Pairs on Pangolin

With $INSUR tokens bridged to Avalanche, they have also launched the trading pairs of INSUR-USDC.e on Pangolin, the leading DEX on Avalanche. You will be able to trade $INSUR tokens in this pool with much lower gas fees compared to Uniswap on Ethereum.

The trading pair can be retrieved by this link:

InsurAce encourage their users to add more liquidity to this pool, and they will also work with Pangolin to provide LP incentives subsequently.

Please find the Pangolin analytics page for $INSUR here.

Staking Setups

Similar to their staking programs on Ethereum, BSC and Polygon, there will be an array of staking pools created for insurance underwriting. The pools include: AVAX, DAI, USDC, USDT, WETH and INSUR, and the mechanism behind the staking is the same as on the other chains.

Please note these percentages are from before pools were launched and do not represent the actual APYs. For up to date APY’s please go to https://app.insurace.io/Staking/StakingPools?chain=AVALANCHE

The details of the staking pools are illustrated as below:

- Staking Pools

There will be 6 pools created, including AVAX, USDC, USDT, DAI, WETH and INSUR with different weights for each pool.

- Staking Cap

Since the staking cap has been lifted greatly and the staking limit per wallet has also been removed on Ethereum, BSC and Polygon, it has been ported to Avalanche as well. Users can consider as no staking limit on Avalanche, which provides more flexibility to participants.

- Reward and APY

The rewards for the staking will be $INSUR tokens calculated at a per-block level according to the per-block reward configured. The rewards can be unlocked any time, but are subject to per-block linear vesting over 7 days.

Subsequently, when the insurance service is bootstrapped, they will add premium sharing into the reward system to provide higher yields in a more sustainable way. The APY has been set at 30% when the pools are full, but of course, the early stakers will always enjoy a much higher APY. This APY will be subject to the change of the $INSUR token prices and may be adjusted accordingly.

- Stake and Unstake

Users can stake and unstake their asset any time, but unstaking will be subject to a 15 day (configurable) lock-up period until it will be fully withdrawable, which is to ensure the sufficiency and liquidity of the capital pool in the event of potential claim payout, a commonly adopted practise in insurance protocols. However, stakers will still be entitled to rewards during this 15-days lock-up period.

- Risk Reminders

Assets invested and staked in DeFi protocols may carry certain risks. To learn about these risks, please click here.

Offer of Insurance Services

Staking is the initial phase to build liquidity, and insurance will come in second based on the capital pool by staking.

- Start of Insurance Service

At the time when mining is enabled, the insurance service will also be enabled as well, the insurance module will be enabled to accept insurance purchases. However, the capacity for covers will be very minimal since the TVL is just starting to increase.

- Initial Listed Protocols

All existing protocols listed on Ethereum, BSC and Polygon mainnets will be available on Avalanche. Two native Avalanche protocols — Benqi and Pangolin will be added at the launch. All risk types and protocols supported currently will be supported on Avalanche as well. Please refer to their insurance dApp for details.

- Purchase of Covers

Once the insurance functions are enabled, users will be able to purchase covers, view cover records and submit claims where triggered. For more operations under the Insurance menu, please refer to this user guide.

About Avalanche

Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low cost, and eco-friendly. Any smart contract-enabled application can outperform its competition by deploying on Avalanche. Don’t believe it? Try an app on Avalanche today.

AVAX

AVAX is the native token of Avalanche. It’s a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche. 1 nAVAX is equal to 0.000000001 AVAX.

About InsurAce.io

InsurAce.io Protocol is a Singapore-based DeFi Insurance protocol that has quickly become the second-largest protocol in DeFi insurance. The $INSUR token was released in February 2021, followed by a mainnet launch to the Ethereum Network in April 2021.

📰 INFO

https://blog.insurace.io/new-chain-deployment-avalanche-9c180e73d00f