Bella Protocol Formed an Alliance with Solv Protocol

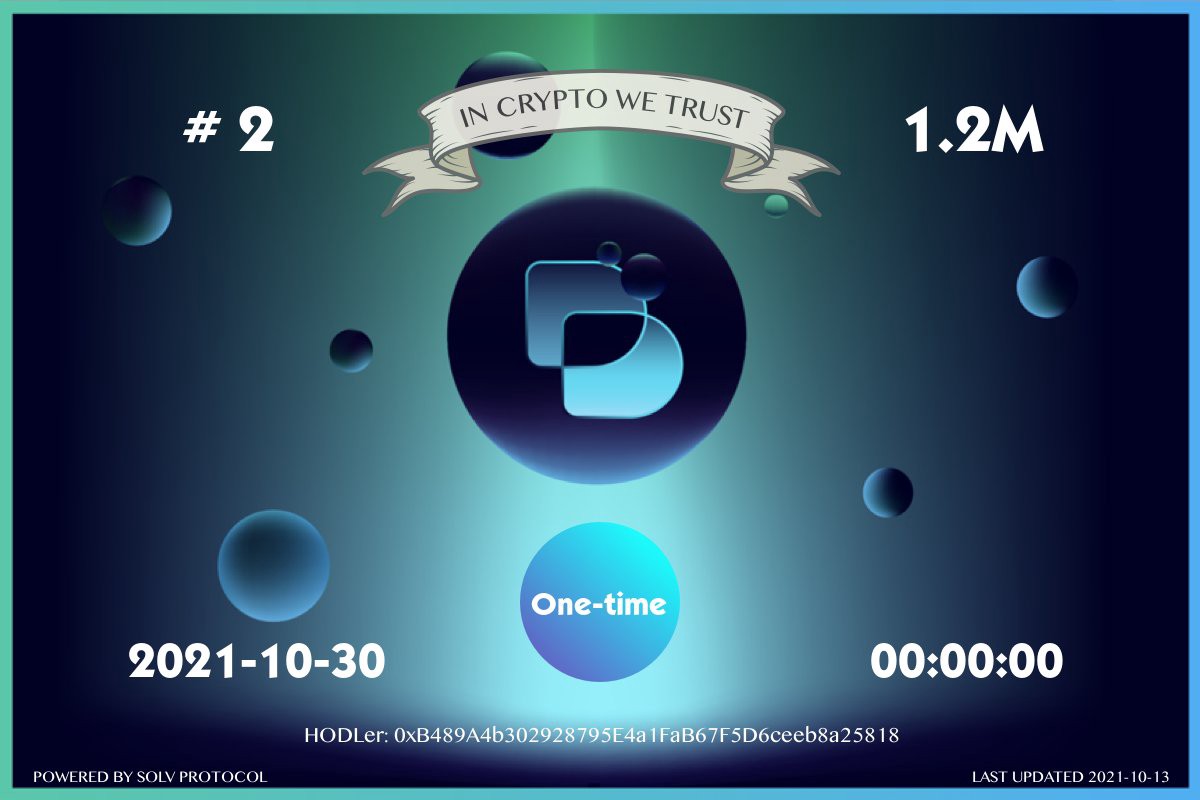

With the development of Decentralized Finance, explorations of bringing NFTs into more tangible scenarios of finance are conceiving the concept of “Financial NFTs.” Bella Protocol is thrilled to share with their community their new partnership with Solv Protocol, the pioneer of financial NFTs. Bella will issue Vouchers with BEL token allocations on the Solv Protocol platform as BEL’s first step into the financial NFTs.

What are Financial NFTs?

It seems that they could say financial NFTs are NFTs that are used in financial scenarios. But strictly speaking, Financial NFT means an upgraded version of NFTs with a brand-new token standard that could enable its ability to express the multi-dimensional attributes of assets in the form of computable NFTs. Financial NFTs are used to represent the contractual relationship between investors and the project team, and the transfer of Vouchers represents the transfer of investment portions.

Financial NFTs can be split into multiple derivatives/portions that can be transferred to other individuals. This feature enhances lock-up allocations by vastly improving the flexibility of their management. NFTs represented by locked-up allocations can be traded freely on the Solv Marketplace or on OpenSea. They can also be turned into collateral on NFTfi for liquidity before their release date as needed.

What is the Vesting Voucher created by Solv?

Vesting Vouchers are Financial NFTs where tokens are locked up in smart contracts on the blockchain. The coding and release schedule of the smart contracts in the NFT guarantees uniform acceptance of the tokens.

A Voucher for allocations is a Financial NFT representing project allocations:

- Hold Vouchers to claim future token flows on the interface of Solv Vouchers

- Trade allocations just like any other NFTs

- Enable even earlier price/value discovery prior to any IDOs or listings

- Lock-up circulating tokens as Vouchers for liquidity management

- Deposit Vouchers as the mortgage on NFT lending platform for loans

The Vesting Voucher of BEL represents BEL’s locked-up token allocations, with the locked BEL tokens scheduled for gradual release. Vouchers for allocations are used to represent the contractual relationship between investors and the project team, the transfer of Vouchers represents the transfer of investment portions. In addition, with the abilities of splitting and merging, Vouchers bring much more flexibility to portion trading. Check here to learn more about Solv Protocol and Voucher.

About Bella

Bella is a suite of open finance products, including automated yield farming tools, BEL Locker, and Flex Savings. We believe everyone deserves equal access to premium financial products and services with elegant design and a smooth user experience.

📰 INFO