Bridging ETH from Ethereum to Polygon; how do blockchain bridges vary?

Ethrereum blockchain, Polygon Network, Binance Smart Chain, Polkadot… there are literally thousands of blockchain networks in operation right now. Whilst this sounds great as they all have their own unique offers, the problem is that they’ve been existing in isolation with a complete lack of interoperability.

What is the validator bridge model?

The traditional bridging model essentially uses very specific types of smart contracts to lock up tokens on the first network and then mints or unlocks tokens on the destination network (that is the blockchain the person is bridging to). That means that when a token is transferred — let’s say from blockchain A to blockchain B — the underlying protocol burns the token on A and then mints an equivalent token on blockchain B.

This process has to be done with on-chain validation. The validators check that everything that is transacting has happened correctly. This means ensuring, for example, that people don’t create tokens out of thin air or accidentally burn tokens that aren’t meant to be burnt. The process is incredibly computationally expensive, which results in a high cost on congested networks such as Ethereum where each computational cycle must be validated by proof of work. When using a validator-driven bridge such as Polygon Bridge V2 to transfer assets from the Ethereum network to the Polygon network, costs of anywhere between $400 and $600 are not unheard of. It is also very slow, again, due to the validation process.

What is Narni’s liquidity bridging model?

Using Narni’s liquidity bridging model, anyone can seamlessly move their assets across chains. Bridging is incredibly quick and incurs extremely low fees in comparison to validator-driven bridges.

Umbria has developed a new style of cross-chain bridge that removes a lot of the encumbrances of the validator-driven model. This new style of bridge – called a liquidity bridge — enables assets to be transferred approximately 10 times cheaper and 10 times faster than equivalent validator-driven bridges.

Since we launched Narni, we’ve seen quite a lot of adoption from the Zed Run community because obviously a lot of people are trying to get their Eth into the Zed Run platform.

Bridging ETH from Ethereum to Polygon Network

The basic principle of the Narni bridge is to replace the on-chain validation protocol with a liquidity pool protocol. When someone wants to migrate Ethereum between two networks there’s a liquidity pool on each network. A user sends their funds into the liquidity pool on the starting network and the bridge sends their funds back to them from the liquidity pool on the destination network. A small fee is paid by the user migrating their assets, of which a percentage is given to liquidity providers of the bridge on the destination network.

That’s the revenue model for those that are providing liquidity.

Liquidity provision and no impermanent loss

The really good news for anyone providing liquidity to both sides of the bridge is that there’s no impermanent loss on their assets. When you provide liquidity on Uniswap, SushiSwap or similar you always provide liquidity as a pair of two different tokens (a liquidity pair). The values of each token in a pair are married based on the constant product formula. This causes impermanent loss meaning that when one asset rises in value, the liquidity provider loses some of the upside.

However, with the Narni bridge that problem doesn’t exist because the liquidity provider is only providing one asset at a time as liquidity. This means that when the price of the asset goes to the moon 🚀 they reap all the benefits of that compared to somewhere like Uniswap where they’d lose half of the upside.

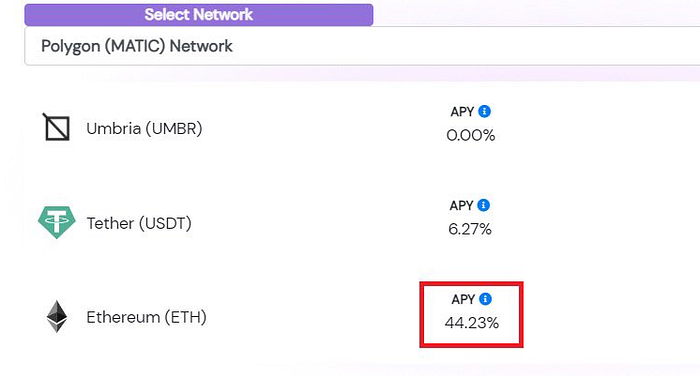

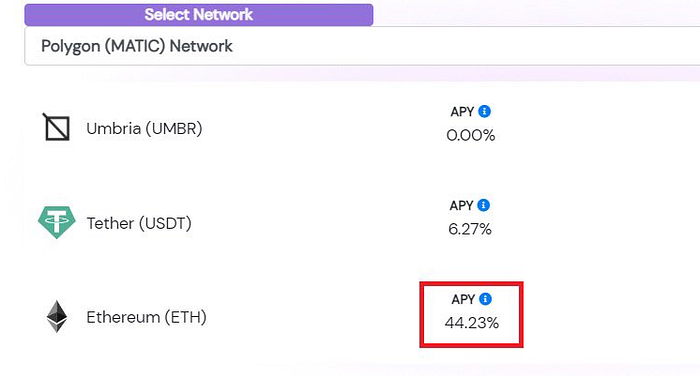

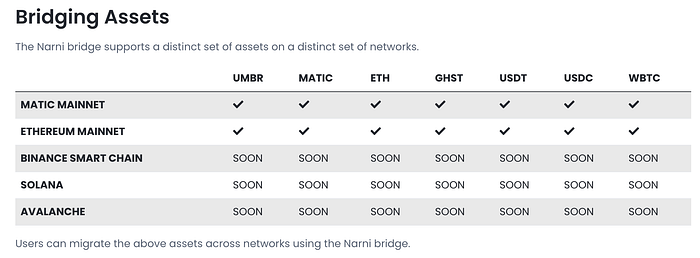

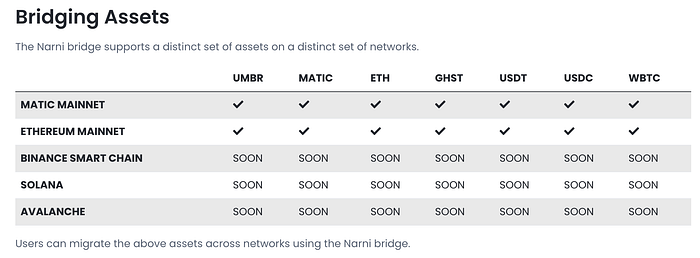

These are the assets that people can currently bridge and provide liquidity for:

See a demo of the Narni Cross-Chain Liquidity Bridge in this interview with SEANvsALL.

For more information about the bridge see the Umbria documentation page: bridge.umbria.network/docs and for feedback, questions and the very latest news about the Narni Bridge please head to our Discord channel

About Umbria Network

Umbria is a decentralised protocol (Defi) which enables the creation of tokenised money markets. These money markets will enable users to accrue interest.

SOURCE: https://umbrianetwork.medium.com/?p=42d342a249dd