Amara Finance aims to be the top lending protocol within the Polkadot ecosystem, and the go-to hub for interconnectivity and lending.

You can read here, their previous IDO announcement.

When is the Amara IDO?

The IDO will be on January 17th and it will last for 6 hours. The timeframe to participate will be from 13.00 to 19.00 UTC.

What’s the token of the IDO?

Amara’s finance token is $MARA and it will be used on their upcoming lending/borrowing platform. You’ll be able to lock your MARA to have a share over the income of the platform and boost your borrow and mining rewards.

What’s the total amount to be raised and what will be the token price?

The total raise will be $300,000 and it will be splitted between the basic and the unlimited pool on Eclipse. There are 600,000 MARA tokens to be distributed at the price of $0.5 per MARA token.

How will my MARA tokens be distributed?

The first batch of your allocated tokens (20%) will be given when Amara launches its platform in late February. Over the course of 5 months after launch, you’ll be able to claim an additional 16% each month.

How to participate in Solarbeam’s launchpad platform, Eclipse

Eligibility

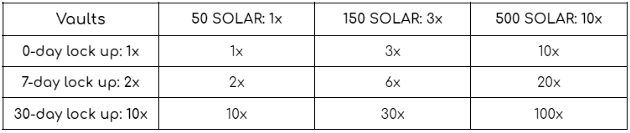

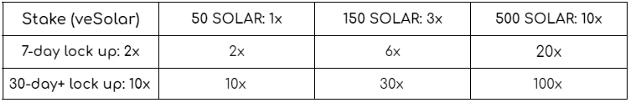

In order to be eligible for participation in Amara’s IDO you will need to lock some of your Solar in either the vaults or on our new staking feature, veSolar. A minimum of 50 Solar is required to be eligible. There is no time limit on when to lock your Solar, you can even lock them during the IDO.

Multiplier

Based on the amount and the duration of your Solar lock, you’ll have a corresponding multiplier.

Depending on which of the two IDO pools you will participate in (basic or unlimited), the multiplier acts in a different way:

By participating in the basic pool, your multiplier indicates the maximum amount of $ value you are eligible to commit.

The maximum commitment in the basic pool is $100 x your multiplier.

Eg. Let’s say that you locked 50 Solar for one month in either the vaults or veSolar. Your multiplier is 10x. The maximum amount that you can commit in the basic pool is $1000 worth of Solar/Movr LP ($100 x 10 = $1000).

By participating in the unlimited pool, your multiplier boosts your allocation.

There is no limit in the amount that you can commit in the unlimited pool. There is also a 1% tax that is used for burns and buybacks.

Someone with a 100x multiplier will get 100 times more allocation from someone with a 1x multiplier in the unlimited pool, even if they committed the same amount of $.

Commitment

On the day of the IDO you will be able to make your commitment in one of the two pools. To commit you’ll need to deposit Solar/Movr LP in one of the two available pools on Eclipse.

You can find a guide on how to add liquidity and get Solar/Movr LP, here

Overflow

Eclipse is using the overflow method, allowing commitments even if the target raise amount of the pool is already fulfilled, leading to a possible oversubscription of the pools.

Eg. Target raise amount of the basic pool is $150,000. The total amount of commitments though, are $1,500,000. That means that there is a 10x overflow on the basic pool (10 times oversubscribed).

Allocation

In Eclipse there isn’t a guaranteed allocation. At the end of the IDO, your allocation of the MARA tokens will be calculated based on the amount you committed and the overflow of the pool. Any spare Solar/Movr LP will be refunded at the end of the IDO.

Eg. Let’s say that you committed $1000 in the basic pool. The overflow of the basic pool at the end of the IDO is 10x. You will get $100 of MARA tokens as allocation (1/10th) and the spare $900 worth of Solar/Movr lp will get refunded to you immediately after the end of the IDO.

📰 INFO

https://medium.com/solarbeam/upcoming-ido-amara-finance-ef202b873f16