Solace is LIVE on Polygon!

Solace launched on Polygon! Solace is excited to get one step closer to offering affordable protection options for investments on the Polygon ecosystem. This article will explain:

What is Solace?

Solace is the only crypto protection protocol that offers simple, intelligent, and transparent protection tools for people who want to explore crypto without compromising safety. Through the current and upcoming tools, users can get coverage for their crypto positions with ease.

It’s Simple: Solace breaks the pattern of overcomplexity in crypto insurance. Buying cover for products takes just a few clicks, with only a few inputs. File a claim and get paid within a week. We make every part of the process simple.

It’s Intelligent: Solace analyzes a user’s investment portfolio and determines what risks they’re exposed to. Using quantitative and qualitative measures for the risk assessment process, Solace quotes a price for the coverage. Even as a user changes their portfolio positions, Solace will monitor changes and adjust the rate for coverage accordingly.

It’s Transparent: Solace is the only crypto protection protocol to publish it’s pricing, risk data and risk models to GitHub and decentralized storage using IPFS. Risk managers are invited to participate in the governance process by joining the DAO, contributing to risk surveys, or by creating their own risk products.

$SOLACE Tokenomics

$SOLACE is the governance token that you can bond, stake and lock for rewards.

Staking and Locking

Users that stake $SOLACE earn a proportion to the yearly 10M distributed $SOLACE tokens. Moreover, locking tokens can earn a multiplier on both staking rewards (up to 2.5x) and voting power (up to 4x). The longer you lock your tokens, the higher the multiplier.

The design is intentional in two ways.

- We want to reward long-term investors and stakers.

- We want to have this distrubtion system to work for years to come.

By creating the current distribution mechanism and multiplier system, we’re ensuring these two goals come to fruition. Learn more about staking in our latest article.

Bonding

Bonding (now live with V2) is a way for users to get $SOLACE at a discounted price from market value. Before v2, bonds vested over 5 days. Now with the upgrade, bonds vest, linearly unlocking over a 7 day period. Moreover, you now have the opportunity to autostake and lock the tokens over the vesting period to immediately start earning rewards and voting rights.

How to Get $SOLACE

There are two options to get $SOLACE in Polygon:

The first and best way is to purchase bonds on Polygon, where you get $SOLACE at a discount in exchange for another asset. Currently we offer bonds for ETH, MATIC, DAI, USDC, USDT, WBTC, and FRAX.

This option ensures that you can get $SOLACE under the market value (especially if you buy bonds early), and it ensures more underwriting capital in the underwriting pool. This is crucial.

The more underwriting capital, the more risk we can pool, and the more affordable coverage becomes. If you believe in what Solace is building for the future of crypto protection, increasing the underwriting pool through bonding is the best way to strengthen and grow the protocol.

The second way to purchase $SOLACE is to buy on Ethereum mainnet either via bonds or on Sushiswap, and then bridging the tokens via a bridge. After giving first bonders a week to buy $SOLACE, we will offer a liquidity pool on Polygon for liquidity mining incentives.

How to bond $SOLACE

If you want to purchase bonds and help fund the underwriting pool, follow these steps:

- Go to the Solace website and connect your wallet.

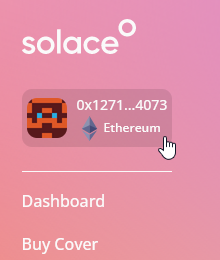

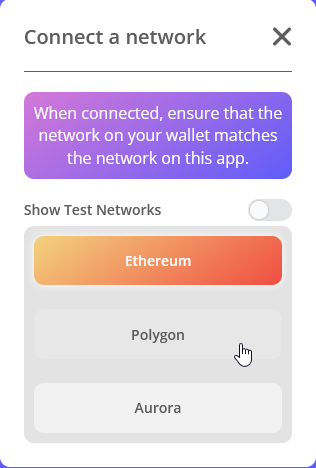

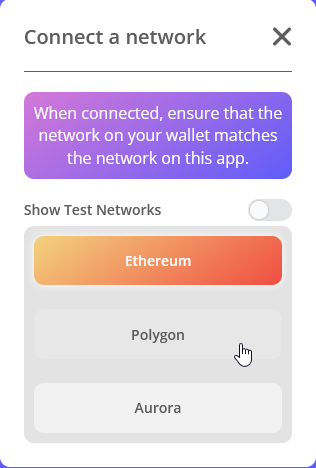

- Make sure you’re connected to the Aurora network. Do this by clicking on the network shown in the top left.

On the top right of the page, click on the network.

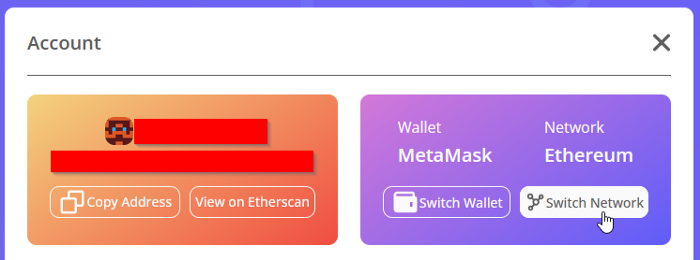

Select Switch Nework.

Select Polygon.

3. Go to the Bonds page and determine what token you’d like to exchange. Select Bond on the token.

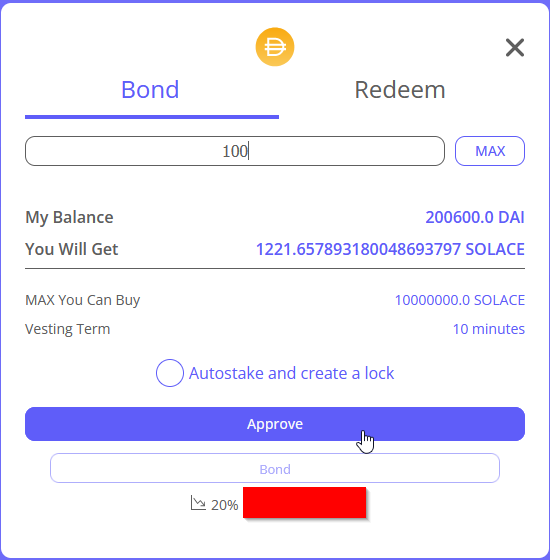

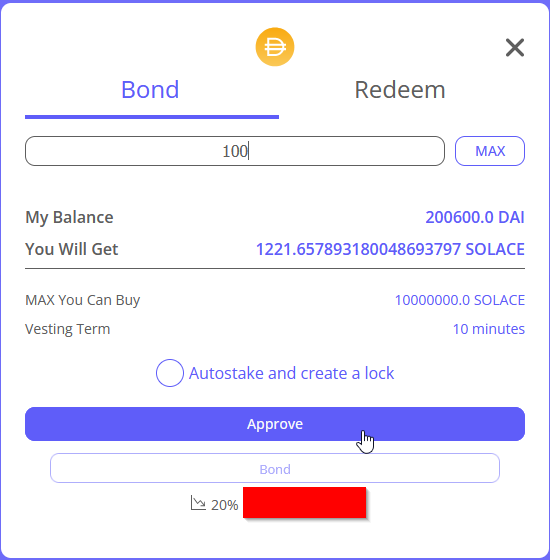

4. Input the amount of tokens you want to exchange for $SOLACE. Then, Approve the token.

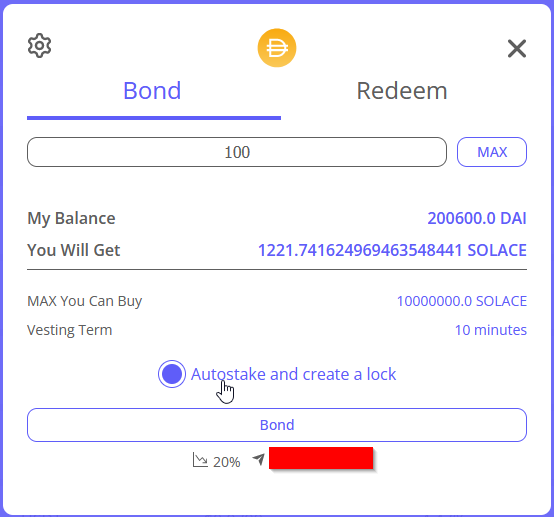

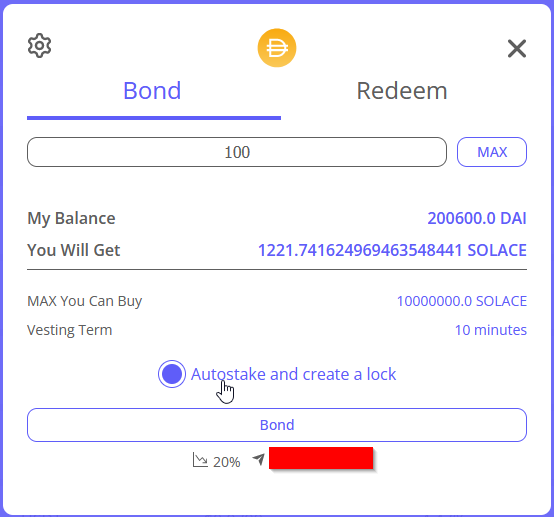

5. Once you approve, you now have a choice to do two things: Autostake and lock, or just bond. Choose your preference.

In the example above, I’m autostaking and locking the 1221 $SOLACE coming from the new bond.

6. Click Bond and confirm the transaction in your wallet.

Congrats! You’ve successfully purchased $SOLACE on the Aurora network!

About Polygon

Polygon is the leading platform for Ethereum scaling and infrastructure development. Its growing suite of products offers developers easy access to all major scaling and infrastructure solutions: L2 solutions (ZK Rollups and Optimistic Rollups), sidechains, hybrid solutions, stand-alone and enterprise chains, data availability solutions, and more. Polygon’s scaling solutions have seen widespread adoption with 7000+ applications hosted, 1B+ total transactions processed, ~100M+ unique user addresses, and $5B+ in assets secured.

SOURCE: https://nima1007.medium.com/solace-is-live-on-polygon-d1ce31afee2f