Unipilot will launch on Polygon

Unipilot, soon you’ll be able to optimize your Polygon liquidity on Uniswap for higher returns while enjoying low gas costs and faster transactions.

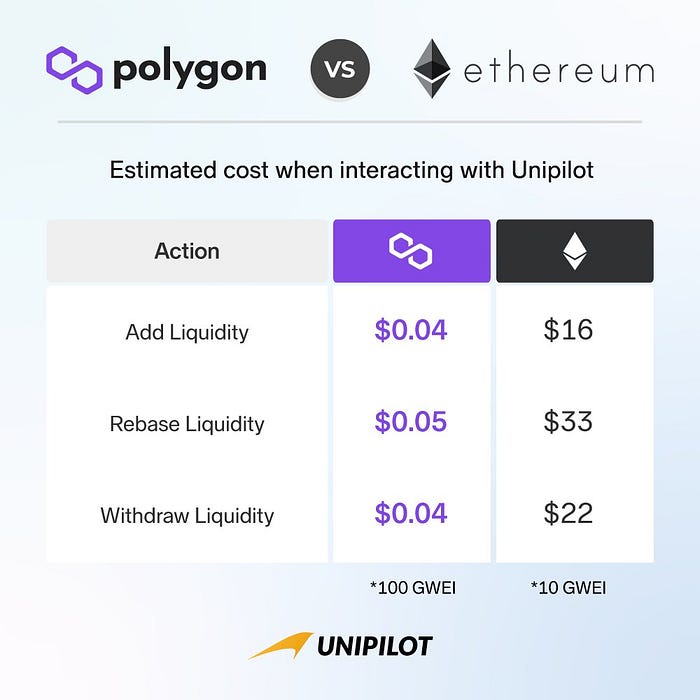

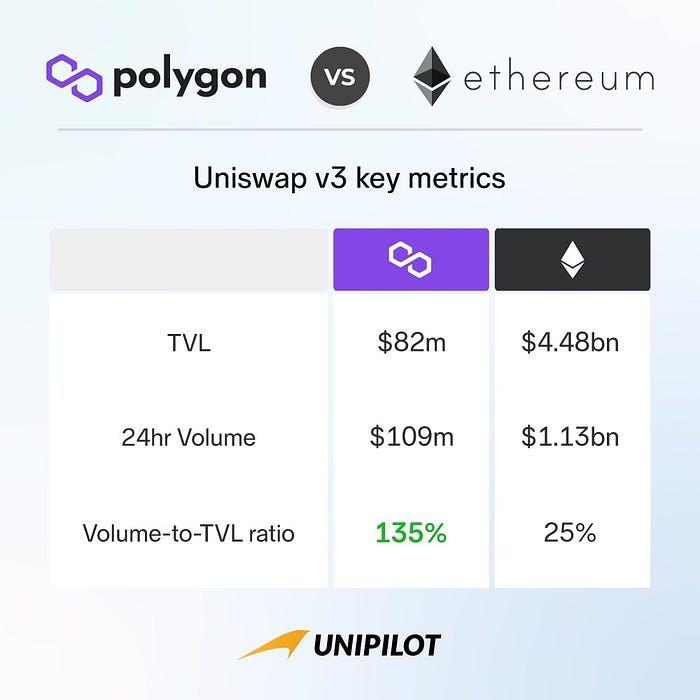

And they can now reveal that Unipilot will launch on Polygon on 15th October. As you can see from the infographics belows, its users stand to benefit from the low gas costs and higher volume-to-TVL ratio on Polygon compared to Ethereum.

Polygon’s volume-to-TVL ratio on Uniswap v3 is more than 5x higher than Ethereum’s, indicating potential for lucrative returns for liquidity providers

Unipilot’s Polygon dApp also introduces:

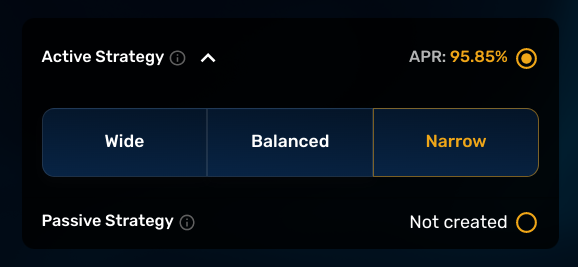

- Concentration preferences.

This allows you to select the preferred degree of concentration for your liquidity.

- Narrow: Earn high liquidity fees with potential for more impermanent loss.

- Balanced: A good balance between earning high liquidity fees and minimizing impermanent loss.

- Wide: Moderate fees but less impermanent loss.

2. Rebalance Tolerances.

Normally, when the price moves out of the range in which liquidity is provided, the liquidity becomes single sided and you need to swap assets to rebalance the position. With our new Tolerance feature, rebalances will be triggered before liquidity is fully single sided in order to reduce impermanent loss.

Note: This feature will not be live at launch but will be added in the coming weeks.

The red lines show the ‘Tolerance’ range. When the price moves out of this area, the position will be rebalanced.

3. Improved stats page

Their new stats page shows you all relevant info for various vaults at a glance, so you don’t have to click between vaults to find what you’re looking for.

Which vaults are available?

The following vaults will be live as Active pairs at launch.

- WETH/USDC 0.05%

- MATIC/USDC 0.05%

- WBTC/WETH 0.05%

Additional vaults will be added over time, and users can still ofcourse add any pair as a Community (aka Passive) vault.

FAQ

Will there be a PILOT token on Polygon?

For now, for simplicity and to avoid splitting liquidity across two networks, the PILOT token will remain on the Ethereum network only.

What about staking rewards?

Revenue earned by Unipilot on the Polygon network will be shared with stakers as WETH on the Ethereum network. Therefore, if you have already staked PILOT, you don’t have to do anything to earn your share of revenues from Polygon! Great, huh?

How do I add the Polygon network to my wallet?

Check this guide here.

How do I access the dApp?

The link is exactly the same, simply change the network in the dropdown menu from Ethereum to Polygon.

Do I need MATIC tokens?

Yes, while gas fees on the Ethereum network are paid for using ETH, gas fees on the Polygon network are paid for using MATIC tokens. To obtain MATIC, bridge assets over to Polygon using the official Polygon Bridge and then swap assets on Uniswap after switching to the Polygon network.

About Unipilot

Unipilot is a Uniswap v3 liquidity manager which keeps liquidity in an optimal range so you can earn higher returns and save on gas. PILOT stakers earn their share of protocol revenue paid in ETH.

SOURCE:

https://unipilot.medium.com/fasten-your-seatbelts-were-heading-to-polygon-a51c4b719e91