Tulip Protocol Partnership with Orca

The first yield aggregation platform built on Solana with auto-compounding vault strategies, Tulip Protocol, announced its partnership with Orca.

This partnership of Tulip Protocol with the most user-friendly cryptocurrency exchange on the Solana blockchain, Orca, is to build concentrated liquidity vault strategies.

Tulip Protocol sees Wave 1 of the Whirlpools Builders Program as an interesting opportunity to grow its product line across the Solana DeFi ecosystem. They are proud to be a part of Orca’s mission to assist developers that create unique products.

A New Farm

Tulip Protocol has collaborated with Orca to develop focused liquidity vault techniques that minimize divergence loss and reward auto-compounding.

The vault employs a hybrid auto-compounding and rebalancing technique that allows user deposits to be classified into a limited number of tick ranges. This combines the compounding of liquidity provision rewards and the control of price/tick ranges within a pre-defined era.

In their backend, they’ve also included a new tool called “Autoswap,” which is powered by Jupiter Aggregator. This enables users to deposit uneven assets into the LP, and our backend will automatically exchange them to balance out before generating the LP, eliminating the need to browse into an AMM. Users will enjoy a one-click method to enjoy long-term yield with this vault.

How does this Work?

If the pair’s actual price reaches a threshold inside the specified price/tick range, the vault eliminates the liquidity until the next epoch. This enables the approach to handle Impermanent Loss, an issue for concentrated liquidity pools, particularly when one of the paired assets is volatile.

It is important to understand the different types of concentrated liquidity strategy vaults and how they are manage.

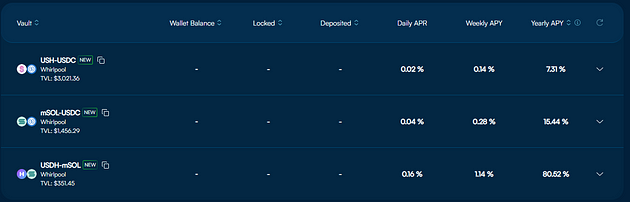

Vaults are Classified into Three Types: stable, pseudo-stable, and non-stable, each with its own set of concerns.

- Pure stable vaults: both paired assets are stablecoins. This category includes pairs like USH/USDC, USDH/USDC, USDT/USDC, UXD/USDC, etc. Pure stable vaults are typically managed using a strict strategy, which rebalances the position once the current tick index changes from the tick index that was active when the position created.

- Pseudo stable vaults: theoretically trade/pegged at price ratios similar to stable swaps, but paired assets aren’t price stable. This category includes pairs like SOL/stSOL, SOL/mSOL, etc. Pseudo stable vaults are usually managed using a midpoint strategy, which rebalances the position when the tick index changes by more than 50% from the tick index which was active when the position was created.

- Non-stable vaults: only one asset is stable, or neither paired assets are price stable. This category includes pairs like SOL/USDC, SOL/DUST, etc. Non stable vaults are typically manage using a variable strategy, which rebalances the position when the current tick index changes by X or more from the tick index which was active when the position created.

About Tulip Protocol

Tulip Protocol, the first yield aggregation platform, built on Solana with auto-compounding vault strategies.

About Orca

Orca is the easiest way to exchange cryptocurrency on the Solana blockchain. Users can exchange tokens with minimal transaction fees. And lower latency than any DEX on Ethereum, all while knowing that you’re getting a fair price. Additionally, users may provide liquidity to a trading pool to earn a share of trading fees.

SOURCE

https://medium.com/tulipprotocol/tulip-whirlpool-vaults-concentrated-liquidity-farming-bbb947ac1e57