Vertex Edge: Bridging Chains, Unifying Liquidity, and Enhancing EVM Alignment

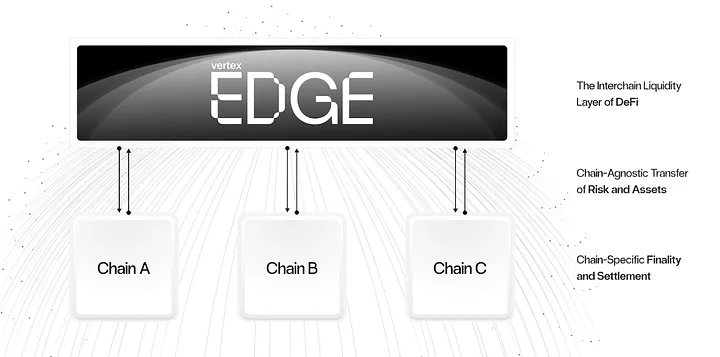

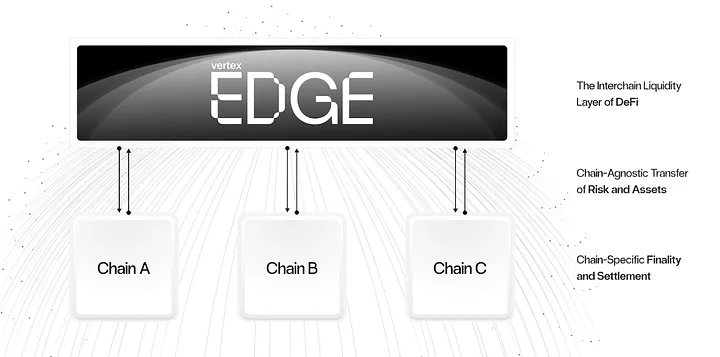

In an era where decentralized finance (DeFi) is rapidly evolving, the quest for efficient, seamless liquidity across various blockchain networks has become a top priority for traders, developers, and ecosystem participants alike. Vertex Edge steps onto the scene as a pioneering solution, poised to transform the landscape of cross-chain trading with its innovative Synchronous Orderbook Liquidity layer.

This article delves deeper into the intricacies of Vertex Edge, highlighting its advantages for base layer networks, and how it aligns with the Ethereum Virtual Machine (EVM) protocols to offer a unified, efficient trading environment.

Introduction to Vertex Edge: A Leap in DeFi Liquidity Management

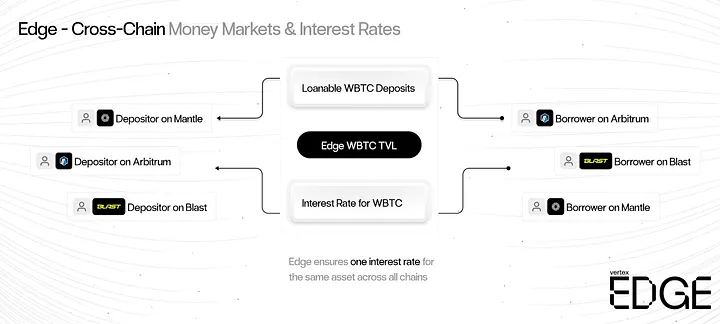

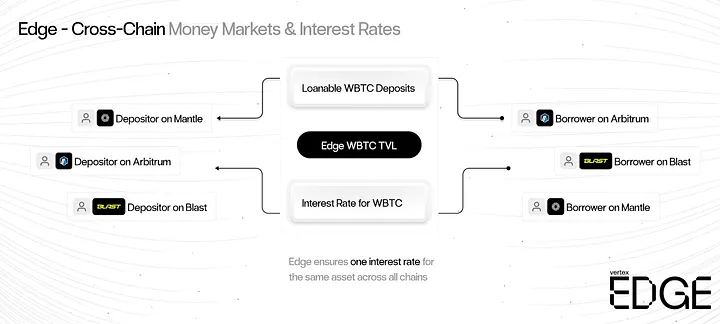

Vertex Edge emerges as a significant advancement in DeFi, introducing a synchronous orderbook model that integrates liquidity across multiple blockchains. This model not only enhances market depth and reduces slippage but also offers consistent lending and borrowing opportunities alongside spot and derivatives trading with improved efficiency and lower latency. At the heart of Vertex Edge is its alignment with EVM chains and the app layer, ensuring that on-chain activity benefits the host chain without being siphoned off to an alternative layer.

EVM Protocol & App Layer Alignment: A Core Advantage

The core innovation of Vertex Edge lies in its ability to seamlessly integrate with EVM protocols, ensuring that all trades settle on-chain within the host chain’s ecosystem. This approach maintains the integrity and value accrual of the host chain, addressing the common conflict between general-purpose chains and DEXs built on sovereign app chains. Vertex Edge’s design circumvents the need for a distinct execution environment, thereby preserving on-chain settlement’s benefits and fostering a symbiotic relationship between the protocol and app layers.

Key Advantages for Base Layer Networks

Vertex Edge brings a host of benefits to supported base layer networks, driving increased blockspace demand, enhancing on-chain liquidity, and reducing development and integration costs. By facilitating batched settlement natively on-chain, Vertex Edge generates net increases in blockspace demand, illustrating a positive-sum effect on local blockspace demand for any chain it supports. Furthermore, it creates a healthier liquidity ecosystem by enabling direct cross-chain liquidity access for users of a given base layer, thus retaining on-chain capital and fostering a cycle of growth and liquidity.

Increased Blockspace Demand

The innovative settlement model of Vertex Edge, which allows for batched transactions on-chain, boosts blockspace demand. This model is evident in the gas consumption patterns of Vertex contracts on Arbitrum, showcasing the positive impact on blockspace demand through high gas spending apps.

Better On-Chain Liquidity

Vertex Edge’s ability to pool liquidity across chains without splintering it enhances the overall liquidity profile of the supported ecosystems. This model benefits users by providing direct access to cross-chain liquidity, thereby reducing the need for capital outflows in search of better liquidity.

Reduced Development / Integration Costs

Launching DEXs on new L2 ecosystems can be resource-intensive. Vertex Edge offers a cost-effective solution by leveraging its existing powerful orderbook DEX infrastructure and deep liquidity pools, significantly lowering the barriers to entry for new chains and reducing the overall development and integration costs.

Summary: Vertex Edge as a Catalyst for Unified DeFi Ecosystems

Vertex Edge stands at the forefront of a new paradigm in cross-chain DeFi trading, offering a suite of benefits that extend beyond liquidity management. Its alignment with EVM protocols and the app layer, combined with the tangible advantages it offers to base layer networks, positions Vertex Edge as a pivotal force in the evolution of decentralized trading. By bridging the gaps between chains, Vertex Edge not only enhances the efficiency and liquidity of DeFi ecosystems but also paves the way for a more interconnected, unified, and prosperous blockchain landscape.