Router Protocol launches Crosschain (XCLP) Testnet

Router Protocol is happy to announce the launch of Router’s ‘almost-mainnet’ version of a testnet. This is a significant upgrade on the testnet v1 that we launched in late Q1. Router’s XCLP (Crosschain Liquidity Protocol) delivers seamless liquidity migration across chains, coupled with smart-order routing for efficient execution against customizable parameters. Prior to the imminent launch of Router Protocol’s mainnet, the team has decided to make its new XCLP testnet available to the entire community, in response to persistent demands for accessing the testnet. Until now, this testnet was accessible only to a small number of users. By making the testnet available to the community at large, the Router team aims to achieve the following objectives:

- Give users a chance to become acquainted with the platform. Since the new XCLP testnet has almost the same interface and functionalities as the imminent mainnet, the community will be able to play around with the platform in a safe environment with testnet funds.

- By allowing for an open feedback mechanism, the Router team looks forward to hearing from the community regarding bugs, UI improvements, or any other suggestions in general. Router will be carefully monitoring feedback channels and will incorporate feedback into the mainnet launch.

Previous XCLP Testnet

Prior to the current version of the XCLP testnet, Router team initially launched a testnet in March 2021. The previous XCLP testnet allowed users to transfer stablecoin assets between the testnets of Ethereum (Kovan), Matic, BSC, and Huobi. Support for Avalanche FUJI testnet was also added later. By facilitating cross-chain transfers in under a minute, the testnet demonstrated Router’s potential for ultra-fast cross-chain transfers and gained significant community traction and trust.

What’s New in the Current Testnet?

Revamped UI

The existing UI has been replaced with a new and hopefully, more intuitive UI. Some significant additions in the new UI include:

- Cost estimations (network fee & bridge fee) and price impact. Users can analyze these metrics before choosing to proceed with the transaction.

i) Network Fees: Blockchain Network fees (Currently Ethereum/Polygon) that must be paid to do the transaction.

ii) Bridge Fees: Any fees which the Router Bridge may charge for facilitating the transaction.

iii) Price Impact: Large orders which are getting fulfilled by the AMM can impact the price of the liquidity pool, that impact is indicated in this field.

2.) A dynamic transaction tracker that allows users to monitor the status of their transactions while they are being processed. The UI tracker for transaction status gets updated in real-time and makes the cross-chain experience a lot more intuitive.

3.) Popup error messages to make it easier for the user to analyze and resolve minor issues.

Cross-chain Swaps

The new XCLP testnet supports cross-chain transfers and cross-chain swaps, as opposed to the previous XCLP testnet, which only supported cross-chain transfers. Router is launching with support for transactions between Ethereum and Polygon, and other chains will follow soon. For tokens with liquidity reserves on both sides of the bridge, transfers/swaps are almost instantaneous and require very low fees. For some tokens that do not have sufficient native ‘on-bridge’ liquidity on one or both chains, transfers/swaps might take a bit longer and cost more — due to the underlying AMM transaction fee and gas costs involved in swaps. For now, XCLP uses Uniswap AMM on Ethereum and Dfyn AMM on Polygon. In due course, Router will be integrating and aggregate various AMMs across chains to ensure a seamless crosschain transfer or swap experience for users.

Pathfinder API for Best Price Discovery

Router uses a proprietary Pathfinder API that enables XCLP to find the best price across multiple pools on the source/target chain AMM contract. Currently, the pathfinder algorithm only finds the optimal route on individual AMMs. However, as Router integrates more and more AMM contracts on the source and target chain, the pathfinder algorithm will dynamically find the best route across liquidity pools available on all AMM contracts.

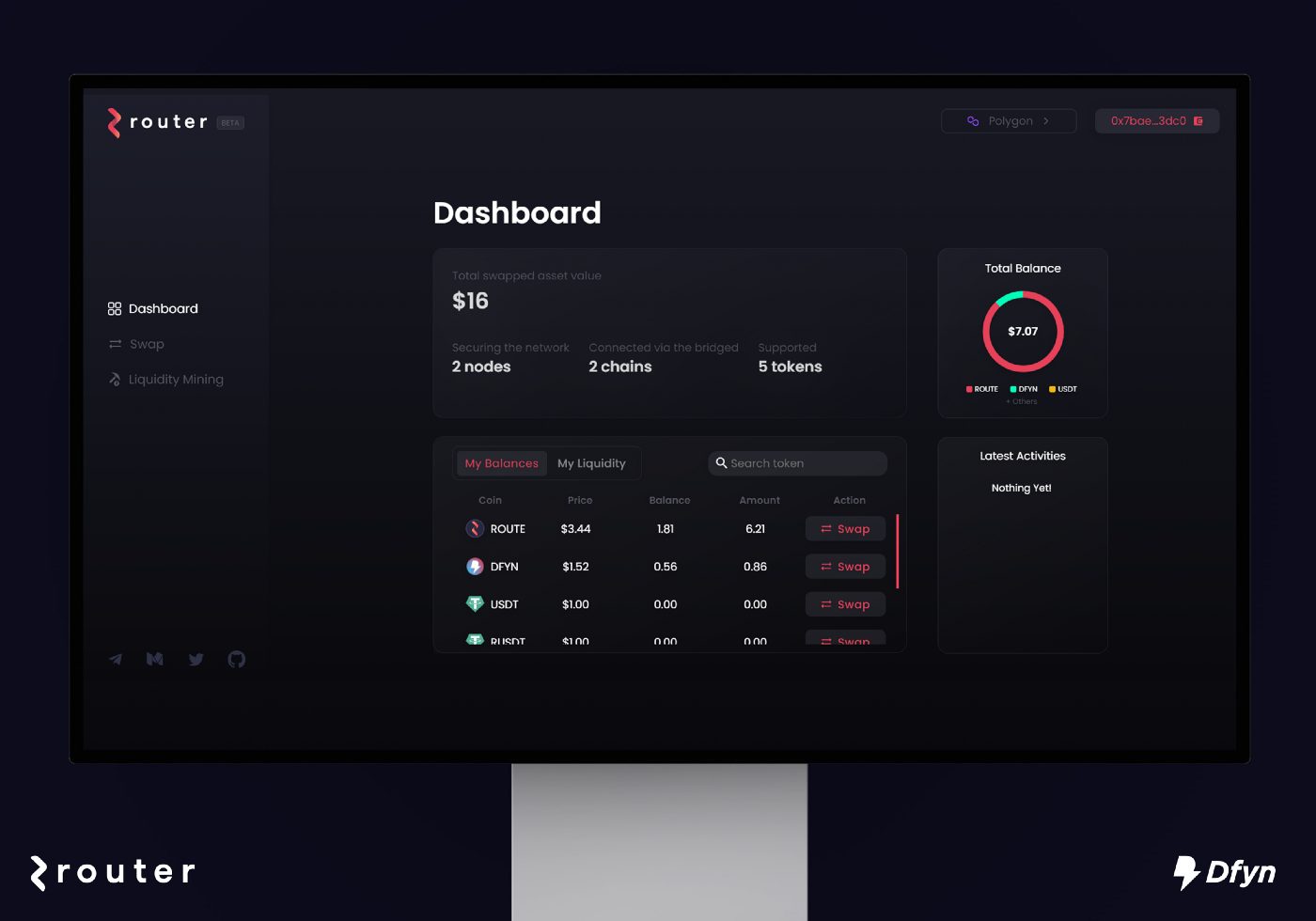

Dynamic Dashboard

One of the major changes in the new testnet is the introduction of a dashboard that allows users to check their token balances and liquidity positions. In addition to these statistics, the users can also see the list of their latest activities on Router’s interface directly from the dashboard.

Support for More Tokens

In this testnet, Router have added support for two more tokens — ROUTE and DFYN. The testnet also supports rUSDT, which is a representative token that users receive when they stake their USDT tokens on Router’s bridge contract. The complete list of canonical tokens supported by Router’s new testnet is given below:

- ROUTE

- DFYN

- DAI

- Tether USD (USDT)

- USDC

- ETH

Support for More Wallet Providers

Router team has added support for multiple new web3 wallets including Fortmatic, Torus, Bitski, and Portis. Users can also use any other wallet that is compatible with WalletConnect.

Liquidity Mining

Router have come up with a liquidity mining program to incentivize users to stake their liquidity on the bridge. On the testnet, users can stake their USDT to get rUSDT on either the Polygon side of the bridge or the Ethereum side of the bridge. Users will be able to pool their rUSDT with USDT on Dfyn and participate in rUSDT/USDT farm to earn liquidity mining rewards.

A new category of farms will launch on Dfyn called Router Farms where various different pairs supported by Router Protocol will be farmed.

Note: Currently, the rewards are not live on the testnet, and this page has been included only for demonstration purposes.

Access the Testnet & Provide Feedback

To access the Testnet, please follow the testnet link

- Testnet Link: https://testnet.routerprotocol.com

- Please consider providing Feedback here once you have played around with the Testnet for some time ( Router will be rewarding users who provide quality feedback).

Testnet Faucet

Router also have a faucet where you can get all the testnet coins you need to play around with the demo. Just go to faucet.routerprotocol.com, enter your account address and select how many testnet tokens you want on Kovan (Ethereum testnet) and/or Matic Mumbai testnet. Once you submit the request, you will instantly receive the testnet tokens. The users are requested not to make excessive requests for tokens as it will exhaust all the available funds.

For paying gas fees on the testnet, the users will need MATIC tokens on the Mumbai testnet and ETH tokens on Kovan. For MATIC tokens, users can visit this link and for ETH tokens, users can post their address on this link.

Pro tip: Make sure you have native gas on your destination chain, whether it be ETH or Matic. Both can be availed from the testnet faucet link above.

Mainnet Launch

The community can expect some minor changes in the XCLP mainnet from the current testnet:

- The integration of UST, MATIC, and ETH tokens. (The list is being finalized).

- In addition to USDT, users will be able to stake their USDC, DAI, UST, ROUTE, DFYN, ETH, and MATIC tokens to get their corresponding representation tokens (for example, rDFYN for DFYN).

- Launch of special farms to reward holders of these representative tokens — rTokens such as rUSDT, rETH, etc obtained by staking the native asset on Router can then be added to farms on DFYN for earning yield.

The beta version of the Router mainnet is already being tested internally. Soon, Router will be carrying out a whitelisting process to enable incentivized testing of the beta mainnet. Following rigorous testing of the mainnet, the beta version of the XCLP mainnet will be released for the public.

If you absolutely cannot wait to try out Router mainnet — please fill this form and Router will soon start rolling out early access in batches to Router Protocol’s beta mainnet.

About Router Protocol

Router Protocol is building a suite of cross-chain liquidity infra primitives that aims to seamlessly provide bridging infrastructure between current and emerging Layer 1 and Layer 2 blockchain solutions.

📰 INFO