DeltaPrime Savings Accounts on Yield Yak

DeltaPrime Savings Accounts on Yield Yak are high-performing ‘real yield’ pools which have the ability to super-charge the Avalanche and Arbitrum DeFi ecosystems.

DeltaPrime Savings Accounts on Yield Yak, allow users to benefit from Yield Yak’s familiar method of tracking historical returns vs project. No fees for depositing via Yield Yak.

The DeltaPrime Savings Pools across both the Avalanche and Arbitrum ecosystems, making the pools available to all Yield Yak users directly within the platform. Savings Pools offer high yields on blue chip assets on both blockchains, requiring single-sided deposits and avoiding impermanent loss. DeltaPrime Savings Accounts on Yield Yak

The increased exposure of Savings Pools should increase liquidity in DeltaPrime, allowing users to utilize various integrated protocols within their accounts and pay lower borrowing fees when the supply on the Savings side increases.

The Savings Pools are attractive to depositors as they offer high yields across a range of blue chip assets on both blockchains, and only require single-sided deposits so are not exposed to impermanent loss.

Why should I deposit with Yield Yak?

The Savings Pools on Yield Yak are simple proxies to DeltaPrime, and charge no fees for their use whatsoever, including no deposit, withdrawal or performance fees. This means that it is equivalent to depositing directly on DeltaPrime, but with some added benefits:

- APY calculations based on actual and recent performance

- Whilst DeltaPrime uses a forward looking calculation for their APR, Yield Yak bases APY calculations on returns realised from deposits to the pools.

- Advanced reporting available through Yield Yak Analytics

- This allows you to track and monitor things such as the TVL and APY of the pools over time, rather than just the current status.

- Simplified portfolio and position management

- If you have existing deposits with Yield Yak then you can now use and manage your positions in the DeltaPrime Savings Pools all from the same place, rather than having to switch between platforms.

- No fees whatsoever are charged

- Yield Yak usually charges a small performance fee on the yield in most pools, however the DeltaPrime Savings Pools have no deposit, withdrawal or performance fees at all.

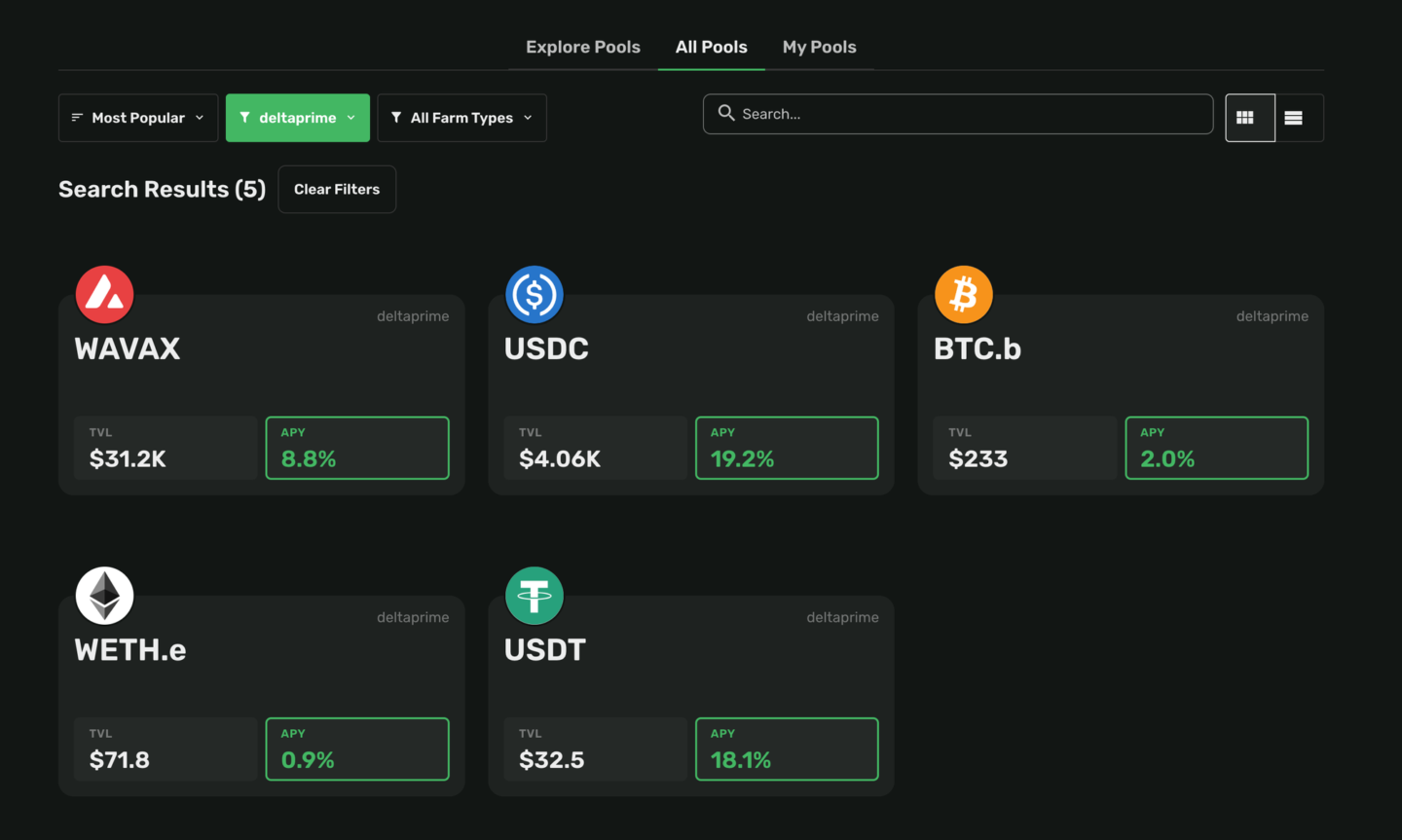

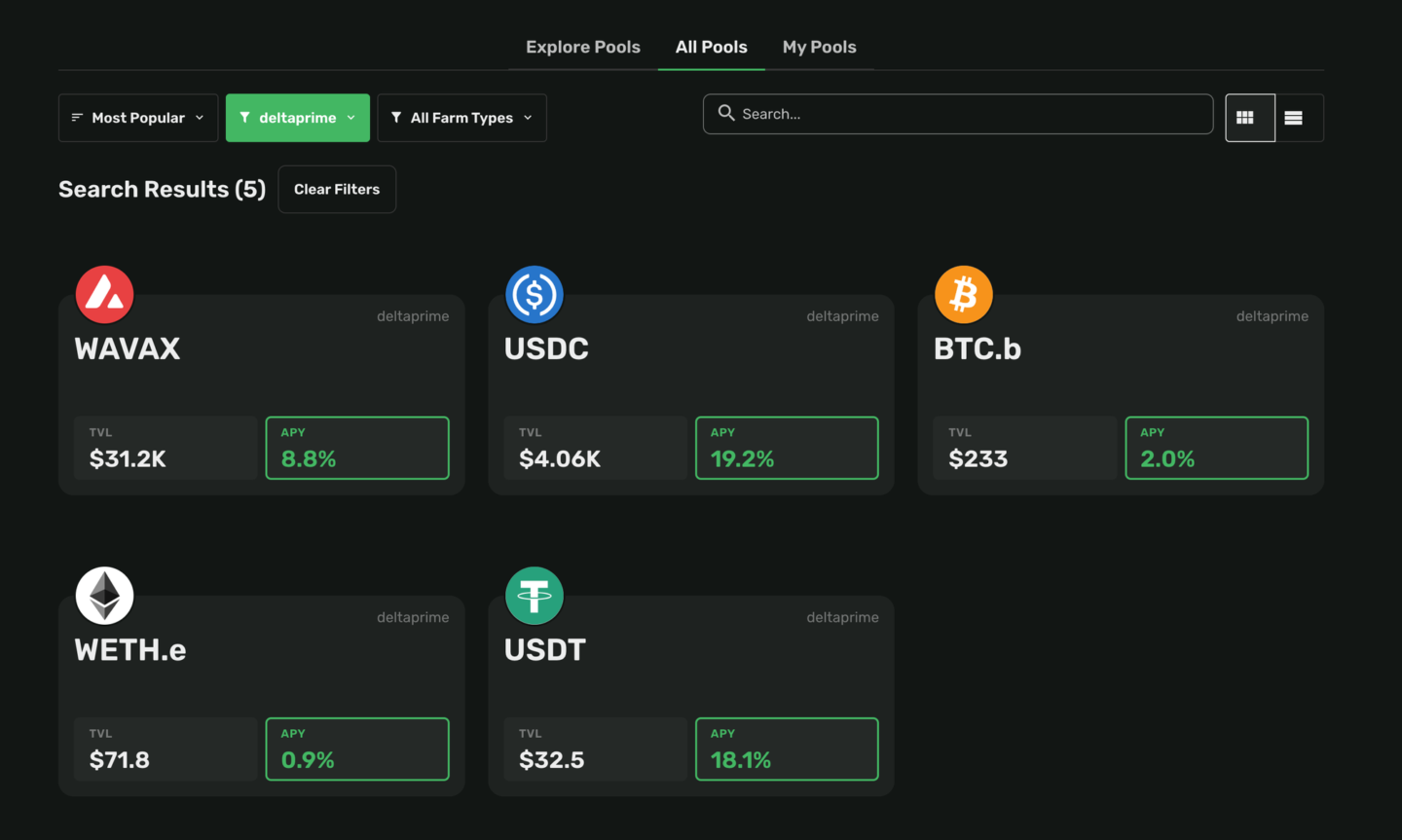

Yield Yak now has the following pools available on Avalanche:

- WAVAX

- USDC

- USDT

- BTC.b

- WETH.e

Arbitrum:

- WETH

- USDC

- DAI

- ARB

- WBTC

About DeltaPrime

Providing secure undercollateralized loans, redistributing assets with a focus on maximum capital efficiency. Being built on the strong foundation of the Avalanche network, Prime users are ensured of fast and reliable transactions for their most important investments.

About Yieldyak

Yield Yak provides tools for DeFi users on Avalanche. Discover a huge selection of auto compounding pools and make your life easier.