DeFi Yield Protocol Enhances DYP Token Liquidity on Avalanche with KyberDMM

DeFi Yield Protocol has chosen the highly capital-efficient KyberDMM DEX to boost DYP token liquidity on Avalanche, with $300,000 in $DYP and $KNC liquidity mining rewards.

KyberDMM (Kyber Dynamic Market Maker) is an innovative and capital efficient DEX protocol that enhances liquidity with amplified pools, and optimizes returns for liquidity providers with dynamic fees.

On top of the main ‘Rainmaker’ liquidity mining campaign on the Avalanche network (~$5.8M in rewards), the Kyber community and KyberDAO have been voting on promising projects on Avalanche such as DeFi Yield Protocol to run joint liquidity mining campaigns together. The aim is to increase the number and liquidity of key token pools on KyberDMM as well as incentivize liquidity providers with attractive yield.

Rainmaker Liquidity Mining: DeFi Yield Protocol

They are excited to run a joint liquidity mining campaign with DeFi Yield Protocol, a unique multi-chain platform that offers solutions for yield farming, staking, NFTs, and enabling users to leverage its advanced trading tools. The protocol employs an anti-manipulation feature that aims to maintain stability, fair access to liquidity, and provide a secure and simplified DeFi platform for users of all sizes.

The core feature of the DYP is the decentralized tool dashboard, providing advanced features, such as Decentralized Score, Unique Community Trust Vote System, DYP Locker, Yield Farm Data, and LaunchPad, allowing investors to make informed decisions that maximize yields and reduce risks.

$DYP Token: $DYP is a requirement for entering the DeFi Yield Protocol ecosystem and serves as the fuel for all products such as but not limited to transaction fees, staking and yield farming.

KyberDMM DEX allows $DYP liquidity providers to maximize the use of their capital via:

- Amplified Liquidity Pools: Extremely high capital efficiency; less tokens required to achieve better liquidity and rates compared to AMMs.

- Dynamic Fees: React to market conditions and optimize returns for LPs.

- Better Reliability & Security: Audited by ChainSecurity and insured up to $20M by Unslashed Finance.

From ~5th October at 23:00 EDT (11:00 GMT +8), liquidity providers can add any amount of liquidity to the DYP-WAVAX pool on KyberDMM on Avalanche to unlock their share of the ~$300,000 in $DYP and $KNC liquidity mining rewards over the next two months (split into two phases).

Important Details

- Total Reward: ~$300,000 in DYP and KNC. Farm will start with DYP rewards first in Phase 1, with KNC rewards coming at a later date.

- Campaign Duration: ~ 2 months

- Vesting: No Vesting

- DYP token address (Avalanche): 0x961C8c0B1aaD0c0b10a51FeF6a867E3091BCef17

- CoinGecko: https://www.coingecko.com/en/coins/defi-yield-protocol

Phase 1

- Start block: 5229000 ~5th October at 23:00 EDT (11:00 GMT +8)

- End block: 8018000

- Reward: $DYP

- Note: Only DYP Token rewards are available for now. KNC tokens are NOT available on the Avalanche network at this time. We are working closely with the Avalanche Foundation and other bridges to support KNC soon. Please pay attention to the upcoming KNC announcements.

Phase 2

- Start block: TBD

- Reward: Remaining $DYP + $KNC

How to Farm $DYP (and $KNC later on)

- Visit KyberDMM DEX

- Make sure you are on the Avalanche network.

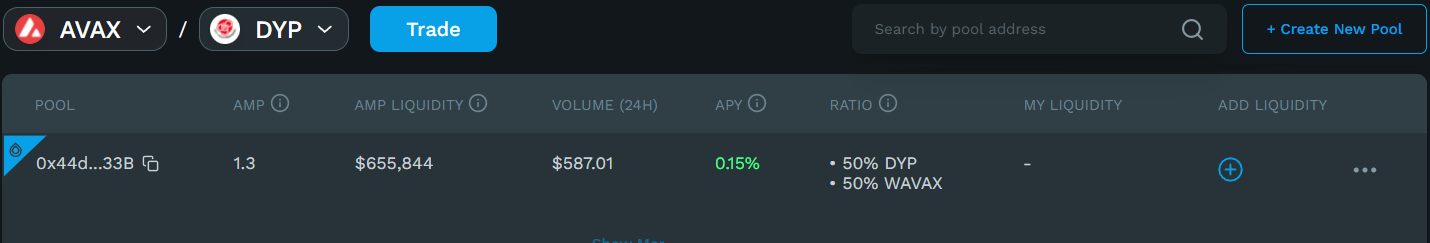

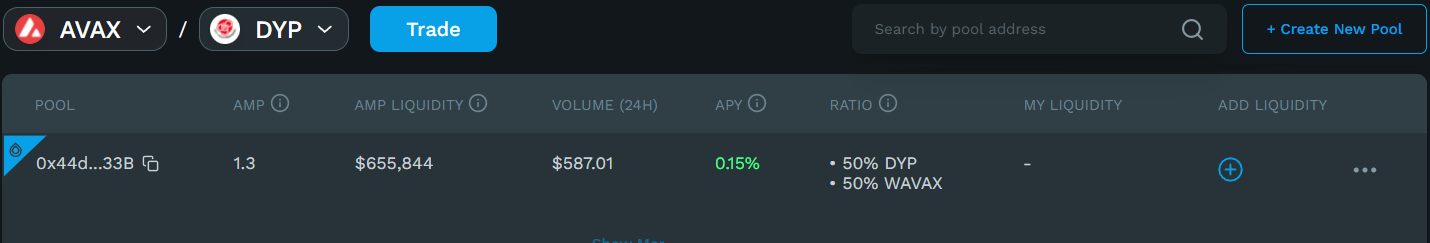

- Visit the Pools page and add liquidity for the eligible DYP-WAVAX pool, which has a raindrop 💧 icon (adding AVAX instead of WAVAX is fine; it’d auto-convert). You will receive LP tokens representing your pool share.

4. Go to the Farm page and stake your LP tokens on the DYP-WAVAX farm. You will start receiving $DYP rewards, which can be harvested and claimed anytime as there is no vesting period.

Besides adding liquidity for and farming $DYP, you are also able to trade the token on KyberDMM DEX by navigating to the Swap page.